Liberty Global Results Presentation Deck

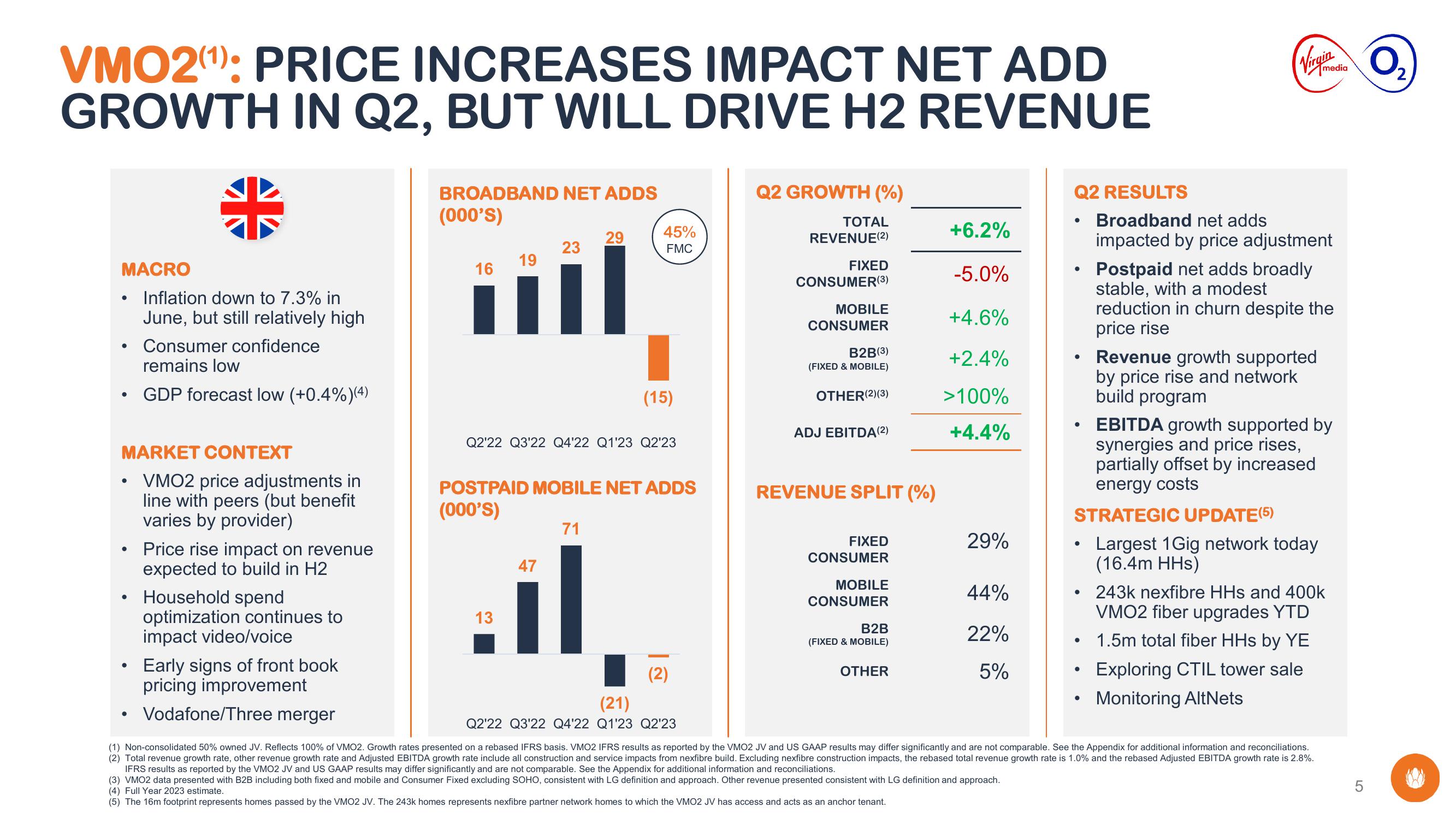

VMO2(¹): PRICE INCREASES IMPACT NET ADD

GROWTH IN Q2, BUT WILL DRIVE H2 REVENUE

MACRO

●

●

• Consumer confidence

remains low

GDP forecast low (+0.4%)(4)

●

小米

MARKET CONTEXT

VMO2 price adjustments in

line with peers (but benefit

varies by provider)

●

Inflation down to 7.3% in

June, but still relatively high

●

Price rise impact on revenue

expected to build in H2

Household spend

optimization continues to

impact video/voice

Early signs of front book

pricing improvement

BROADBAND NET ADDS

(000'S)

16

19

13

23

47

29

Q2'22 Q3'22 Q4'22 Q1'23 Q2'23

45%

FMC

POSTPAID MOBILE NET ADDS

(000'S)

71

(15)

(2)

(21)

Q2'22 Q3'22 Q4'22 Q1'23 Q2'23

Q2 GROWTH (%)

TOTAL

REVENUE (2)

FIXED

CONSUMER(3)

MOBILE

CONSUMER

B2B(3)

(FIXED & MOBILE)

OTHER(2)(3)

ADJ EBITDA (2)

REVENUE SPLIT (%)

FIXED

CONSUMER

MOBILE

CONSUMER

B2B

(FIXED & MOBILE)

OTHER

+6.2%

-5.0%

+4.6%

+2.4%

>100%

+4.4%

29%

44%

22%

5%

(3) VMO2 data presented with B2B including both fixed and mobile and Consumer Fixed excluding SOHO, consistent with LG definition and approach. Other revenue presented consistent with LG definition and approach.

(4) Full Year 2023 estimate.

(5) The 16m footprint represents homes passed by the VMO2 JV. The 243k homes represents nexfibre partner network homes to which the VMO2 JV has access and acts as an anchor tenant.

●

Q2 RESULTS

Broadband net adds

impacted by price adjustment

●

●

Virgin

●

EBITDA growth supported by

synergies and price rises,

partially offset by increased

energy costs

STRATEGIC UPDATE(5)

Largest 1Gig network today

(16.4m HHs)

●

Postpaid net adds broadly

stable, with a modest

reduction in churn despite the

price rise

Revenue growth supported

by price rise and network

build program

media

243k nexfibre HHs and 400k

VMO2 fiber upgrades YTD

1.5m total fiber HHs by YE

Exploring CTIL tower sale

Monitoring AltNets

Vodafone/Three merger

(1) Non-consolidated 50% owned JV. Reflects 100% of VMO2. Growth rates presented on a rebased IFRS basis. VMO2 IFRS results as reported by the VMO2 JV and US GAAP results may differ significantly and are not comparable. See the Appendix for additional information and reconciliations.

(2) Total revenue growth rate, other revenue growth rate and Adjusted EBITDA growth rate include all construction and service impacts from nexfibre build. Excluding nexfibre construction impacts, the rebased total revenue growth rate is 1.0% and the rebased Adjusted EBITDA growth rate is 2.8%.

IFRS results as reported by the VMO2 JV and US GAAP results may differ significantly and are not comparable. See the Appendix for additional information and reconciliations.

LO

5

0₂View entire presentation