Wix Results Presentation Deck

For Q4 guidance, we expect the following:

Revenue in the range of $116 to $117 million, an increase of 38% to 39%

year over year

●

Given our strong performance in Q3, we are raising our full year guidance for

2017:

●

●

Collections in the range of $126 to $127 million, representing year over

year growth of 29% to 30%

- 12-

Increasing the range of revenue from $421 to $423 million to a range of

$423 to $424 million, which is an increase of 46% year over year

Increasing the collections range from $473 to $477 million to $478 to $479

million, representing annual growth of 40%. If we report collections

within or above this range, it will mark the third consecutive year

of 40% year over year collections growth

Given the continued leverage we are realizing in our model, we are raising

our expected free cash flow from a range of $67 to $68 million to $68 to

$69 million, which represents 88% to 91% growth over last year

We are updating our operating expense expectations for the full year 2017 as

follows:

We continue to expect non-GAAP S&M expense as a percent of

collections to be approximately 40% to 41% for the full year, as we

previously guided

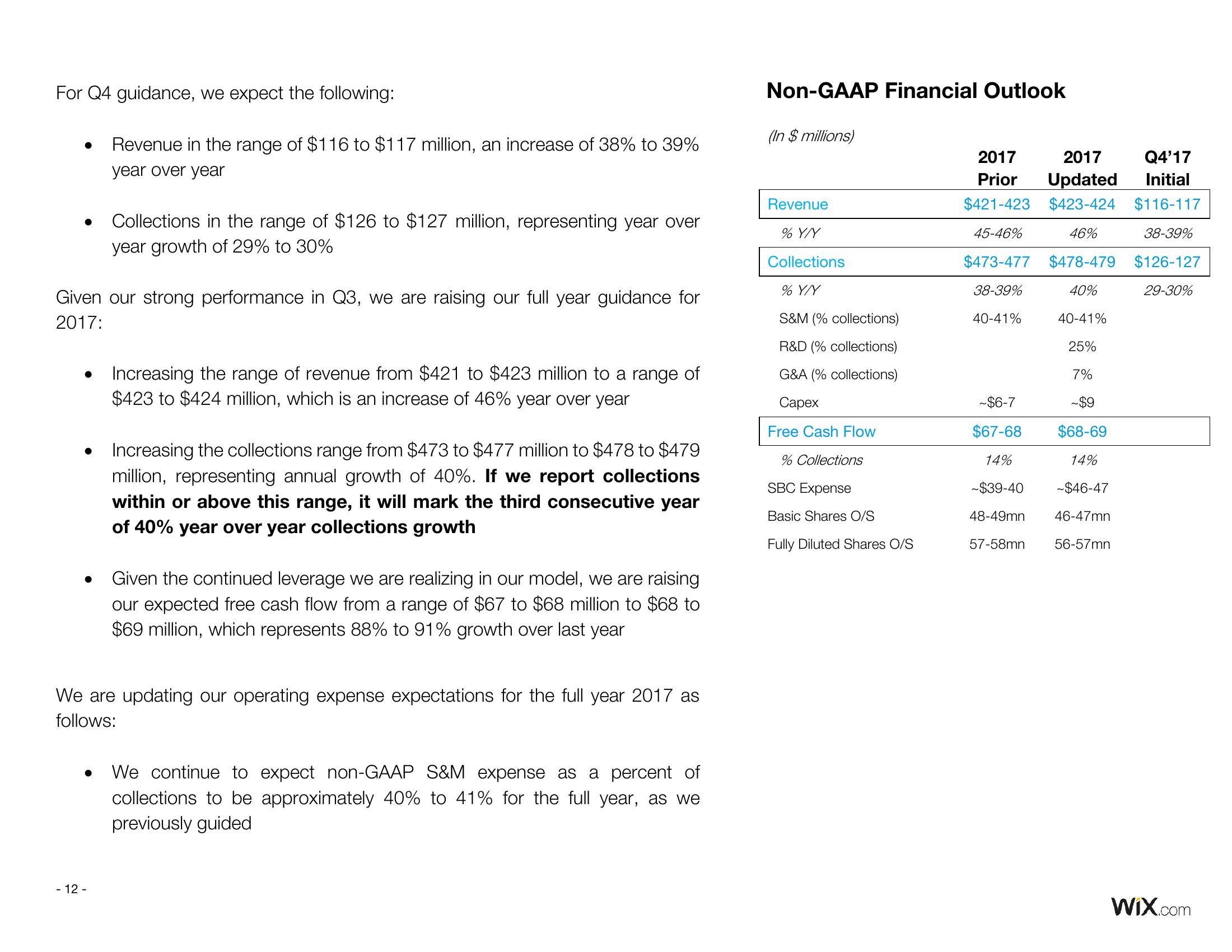

Non-GAAP Financial Outlook

(In $ millions)

Revenue

% Y/Y

Collections

% Y/Y

S&M (% collections)

R&D (% collections)

G&A (% collections)

Capex

Free Cash Flow

% Collections

SBC Expense

Basic Shares O/S

Fully Diluted Shares O/S

Q4'17

2017

Updated Initial

2017

Prior

$421-423 $423-424 $116-117

45-46%

46%

38-39%

$473-477 $478-479 $126-127

38-39%

40%

29-30%

40-41% 40-41%

~$6-7

$67-68

14%

25%

7%

~$9

$68-69

14%

~$39-40 ~$46-47

48-49mn

46-47mn

57-58mn

56-57mn

Wix.comView entire presentation