J.P.Morgan Results Presentation Deck

Asset & Wealth Management¹

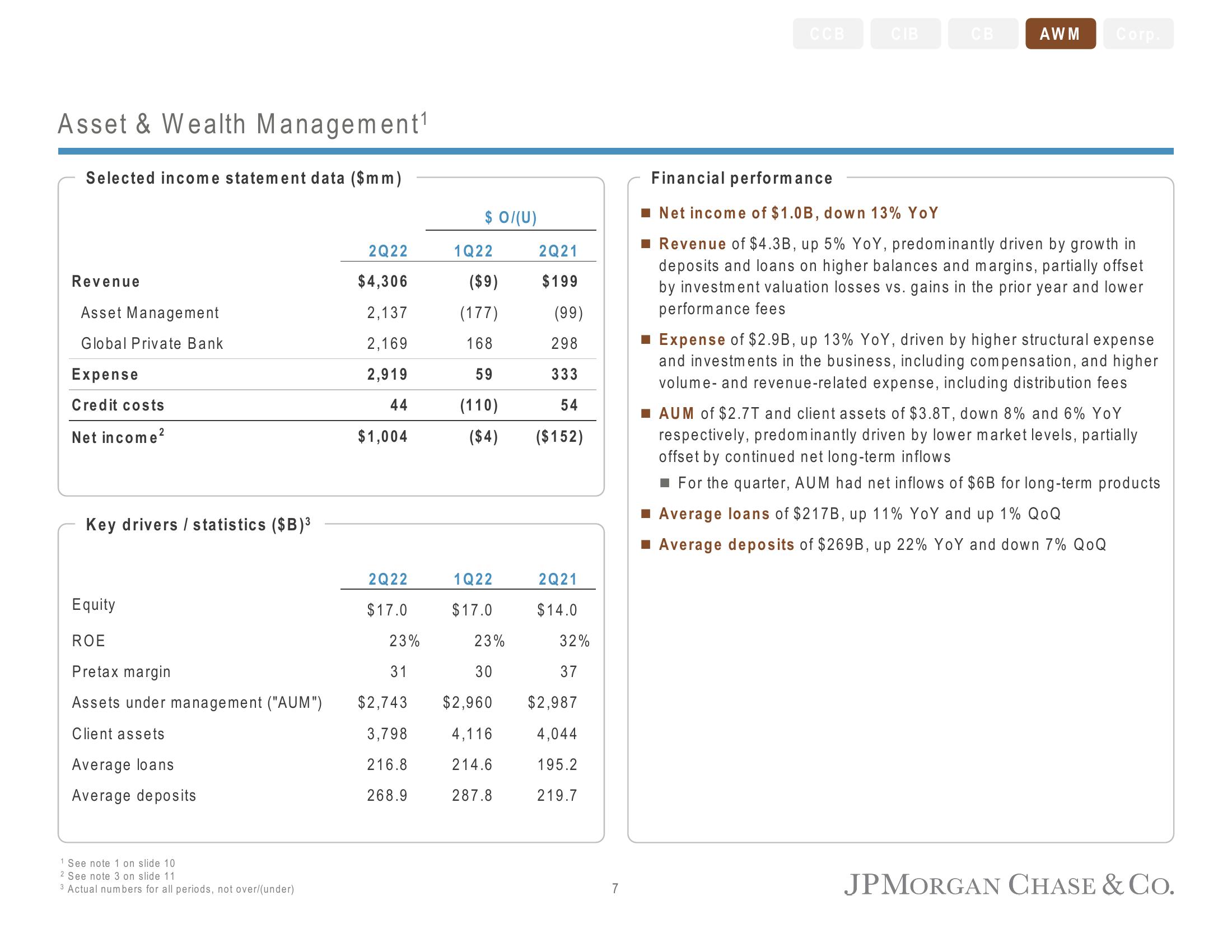

Selected income statement data ($mm)

Revenue

Asset Management

Global Private Bank

Expense

Credit costs

Net income²

Key drivers / statistics ($B)³

Equity

ROE

Pretax margin

Assets under management ("AUM")

Client assets

Average loans

Average deposits

1 See note 1 on slide 10

2 See note 3 on slide 11

3 Actual numbers for all periods, not over/(under)

2Q22

$4,306

2,137

2,169

2,919

44

$1,004

2Q22

$17.0

23%

31

$2,743

3,798

216.8

268.9

1Q22

($9)

(177)

168

298

59

333

(110)

54

($4) ($152)

1Q22

$17.0

O/(U)

23%

30

$2,960

4,116

214.6

287.8

2Q21

$199

(99)

2Q21

$14.0

32%

37

$2,987

4,044

195.2

219.7

7

CCB

CIB

CB

AWM Corp.

Financial performance

Net income of $1.0B, down 13% YoY

■ Revenue of $4.3B, up 5% YoY, predominantly driven by growth in

deposits and loans on higher balances and margins, partially offset

by investment valuation losses vs. gains in the prior year and lower

performance fees

■ Expense of $2.9B, up 13% YoY, driven by higher structural expense

and investments in the business, including compensation, and higher

volume- and revenue-related expense, including distribution fees

■AUM of $2.7T and client assets of $3.8T, down 8% and 6% YoY

respectively, predominantly driven by lower market levels, partially

offset by continued net long-term inflows

■ For the quarter, AUM had net inflows of $6B for long-term products

■ Average loans of $217B, up 11% YoY and up 1% QOQ

■ Average deposits of $269B, up 22% YoY and down 7% QOQ

JPMORGAN CHASE & Co.View entire presentation