LVMH Shareholder Engagement Presentation Deck

Strong financial structure

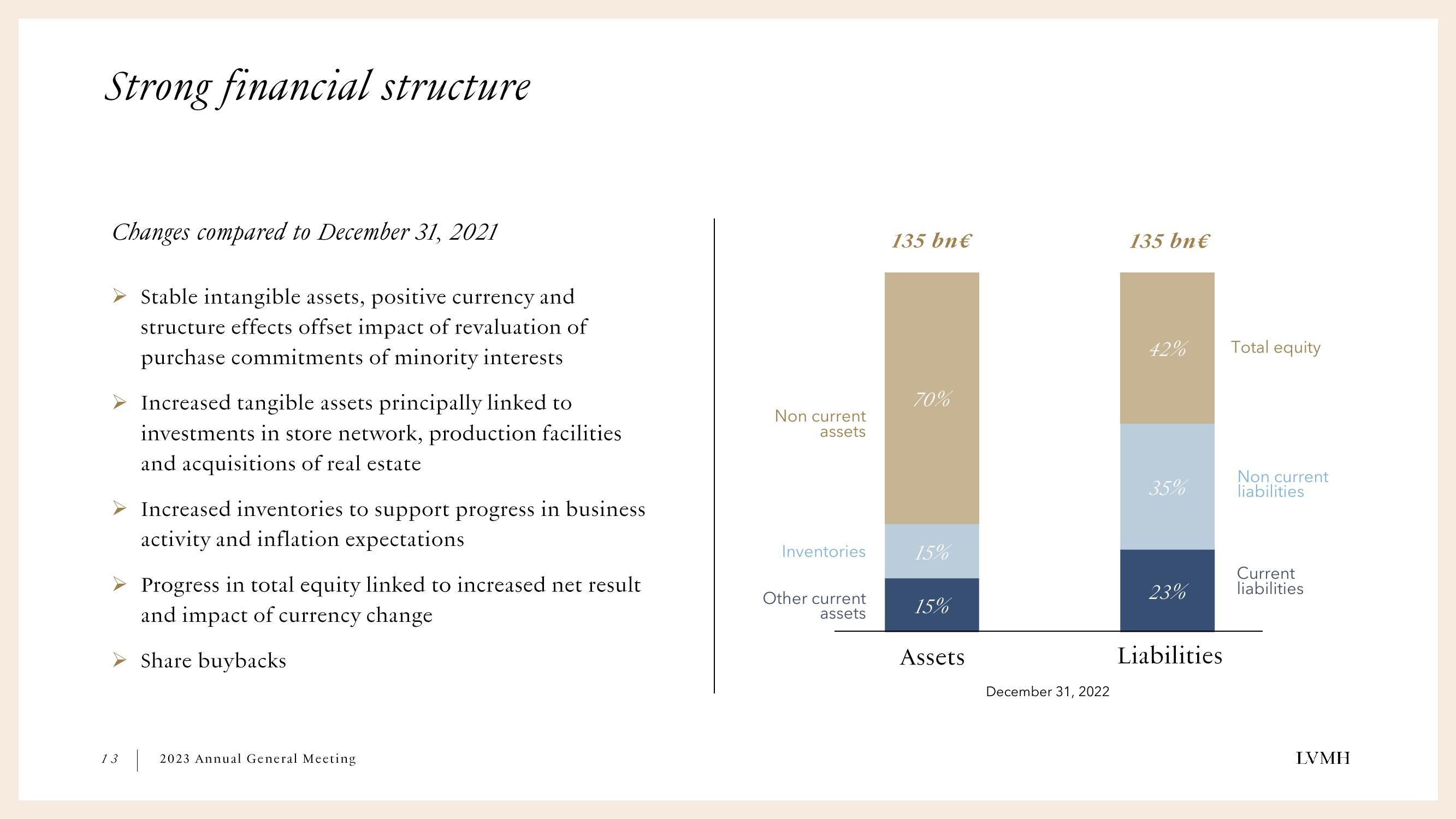

Changes compared to December 31, 2021

Stable intangible assets, positive currency and

structure effects offset impact of revaluation of

purchase commitments of minority interests

➤ Increased tangible assets principally linked to

investments in store network, production facilities

and acquisitions of real estate

Increased inventories to support progress in business

activity and inflation expectations

Progress in total equity linked to increased net result

and impact of currency change

Share buybacks

13 2023 Annual General Meeting

Non current

assets

Inventories

Other current

assets

135 bn€

70%

15%

15%

Assets

December 31, 2022

135 bn€

42%

35%

23%

Liabilities

Total equity

Non current

liabilities

Current

liabilities

LVMHView entire presentation