The Urgent Need for Change and The Superior Path Forward

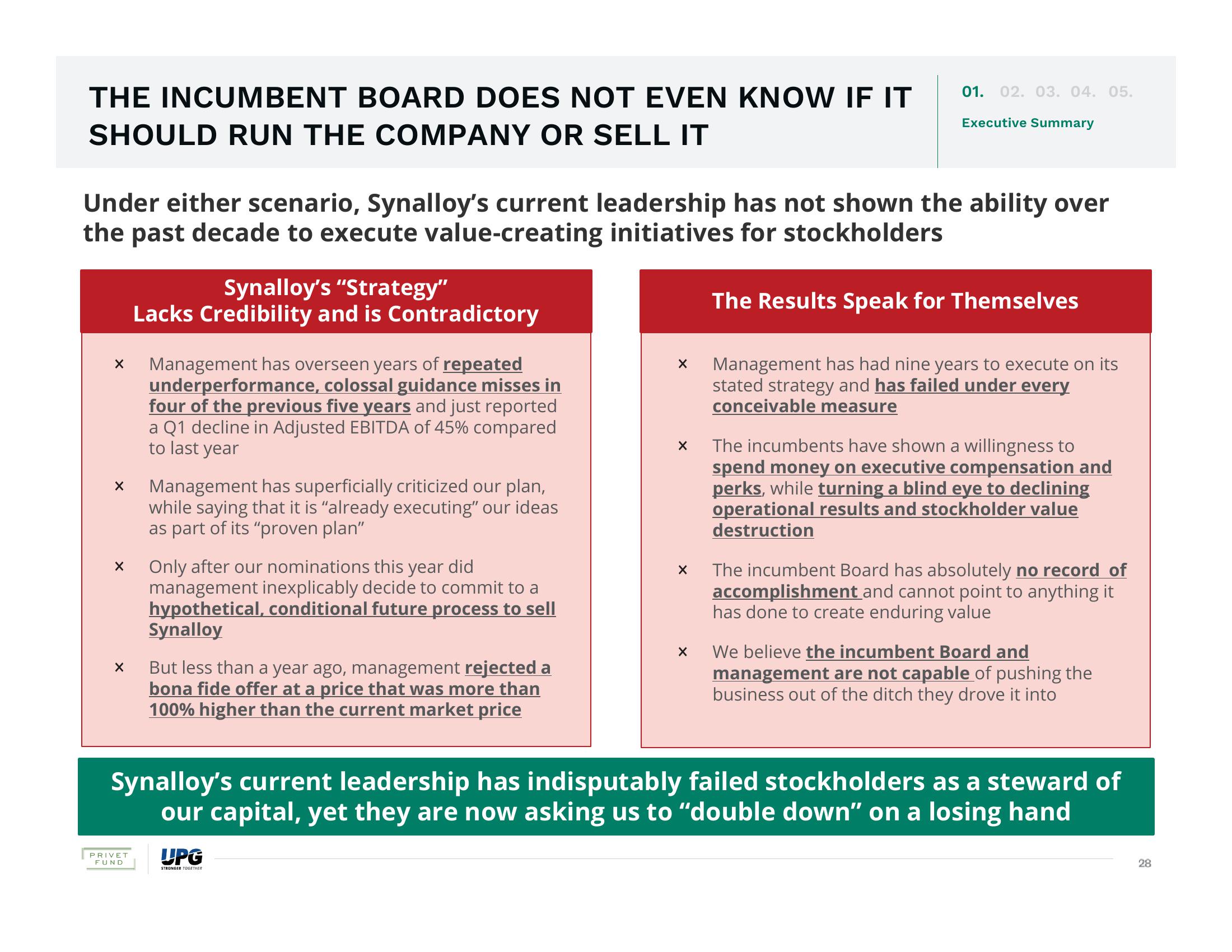

THE INCUMBENT BOARD DOES NOT EVEN KNOW IF IT

SHOULD RUN THE COMPANY OR SELL IT

X

Under either scenario, Synalloy's current leadership has not shown the ability over

the past decade to execute value-creating initiatives for stockholders

X

X

X

Synalloy's "Strategy"

Lacks Credibility and is Contradictory

PRIVET

FUND

Management has overseen years of repeated

underperformance, colossal guidance misses in

four of the previous five years and just reported

a Q1 decline in Adjusted EBITDA of 45% compared

to last year

Management has superficially criticized our plan,

while saying that it is "already executing" our ideas

as part of its "proven plan"

Only after our nominations this year did

management inexplicably decide to commit to a

hypothetical, conditional future process to sell

Synalloy

But less than a year ago, management rejected a

bona fide offer at a price that was more than

100% higher than the current market price

X

UPG

STRONGER TOGETHER

01. 02. 03. 04. 05.

Executive Summary

X

The Results Speak for Themselves

Management has had nine years to execute on its

stated strategy and has failed under every

conceivable measure

X The incumbents have shown a willingness to

spend money on executive compensation and

per while turning a blind eye to declini

operational results and stockholder value

destruction

X The incumbent Board has absolutely no record of

accomplishment and cannot point to anything it

has done to create enduring value

Synalloy's current leadership has indisputably failed stockholders as a steward of

our capital, yet they are now asking us to "double down" on a losing hand

We believe the incumbent Board and

management are not capable of pushing the

business out of the ditch they drove it into

28View entire presentation