JD Sports Results Presentation Deck

JD

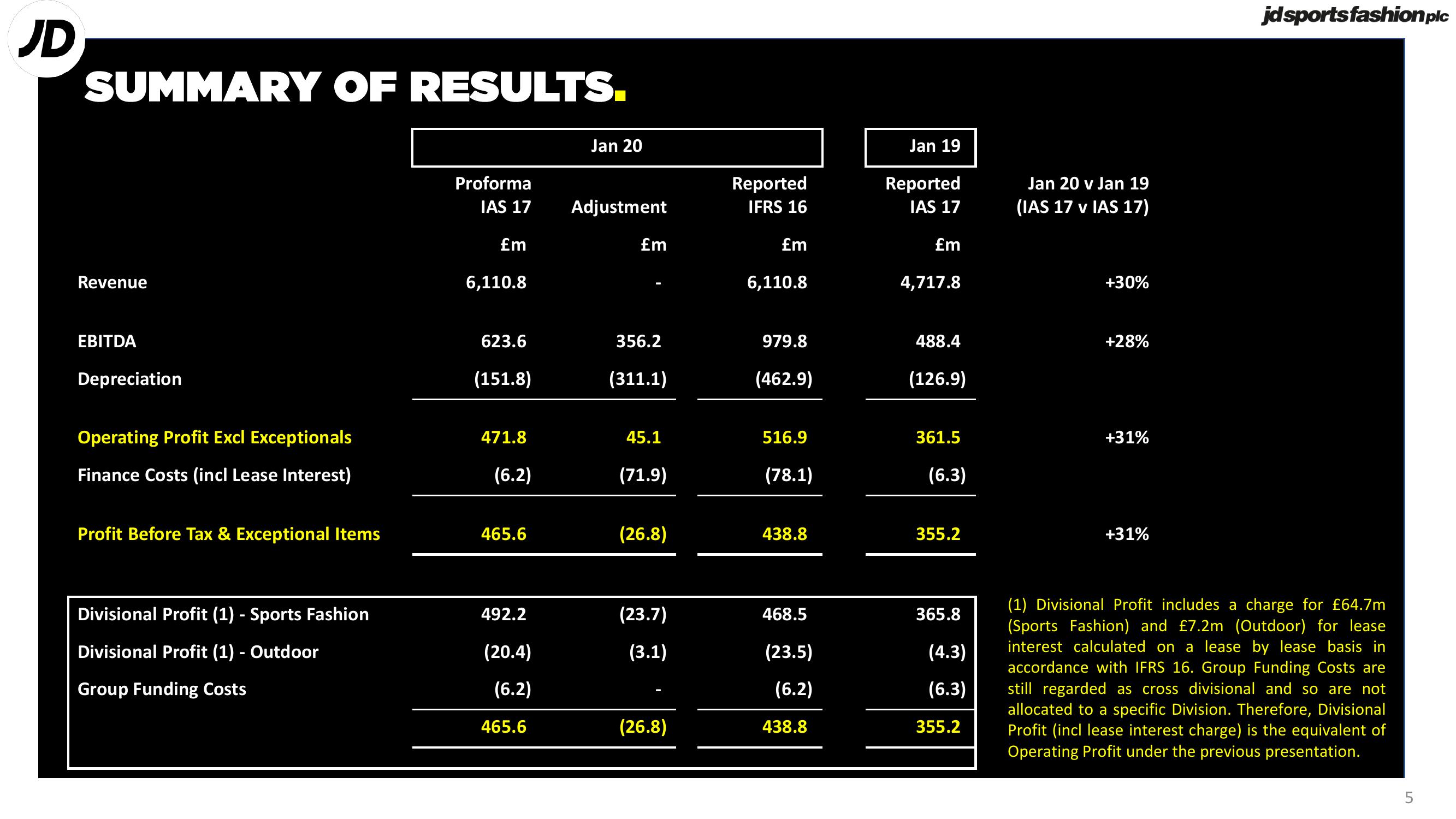

SUMMARY OF RESULTS.

Revenue

EBITDA

Depreciation

Operating Profit Excl Exceptionals

Finance Costs (incl Lease Interest)

Profit Before Tax & Exceptional Items

Divisional Profit (1) - Sports Fashion

Divisional Profit (1) - Outdoor

Group Funding Costs

Proforma

IAS 17

£m

6,110.8

623.6

(151.8)

471.8

(6.2)

465.6

492.2

(20.4)

(6.2)

465.6

Jan 20

Adjustment

£m

356.2

(311.1)

45.1

(71.9)

(26.8)

(23.7)

(3.1)

(26.8)

Reported

IFRS 16

£m

6,110.8

979.8

(462.9)

516.9

(78.1)

438.8

468.5

(23.5)

(6.2)

438.8

Jan 19

Reported

IAS 17

£m

4,717.8

488.4

(126.9)

361.5

(6.3)

355.2

365.8

(4.3)

(6.3)

355.2

Jan 20 v Jan 19

(IAS 17 v IAS 17)

+30%

+28%

+31%

+31%

jd sports fashion plc

(1) Divisional Profit includes a charge for £64.7m

(Sports Fashion) and £7.2m (Outdoor) for lease

interest calculated on a lease by lease basis in

accordance with IFRS 16. Group Funding Costs are

still regarded as cross divisional and so are not

allocated to a specific Division. Therefore, Divisional

Profit (incl lease interest charge) is the equivalent of

Operating Profit under the previous presentation.

5View entire presentation