Clover Health SPAC Presentation Deck

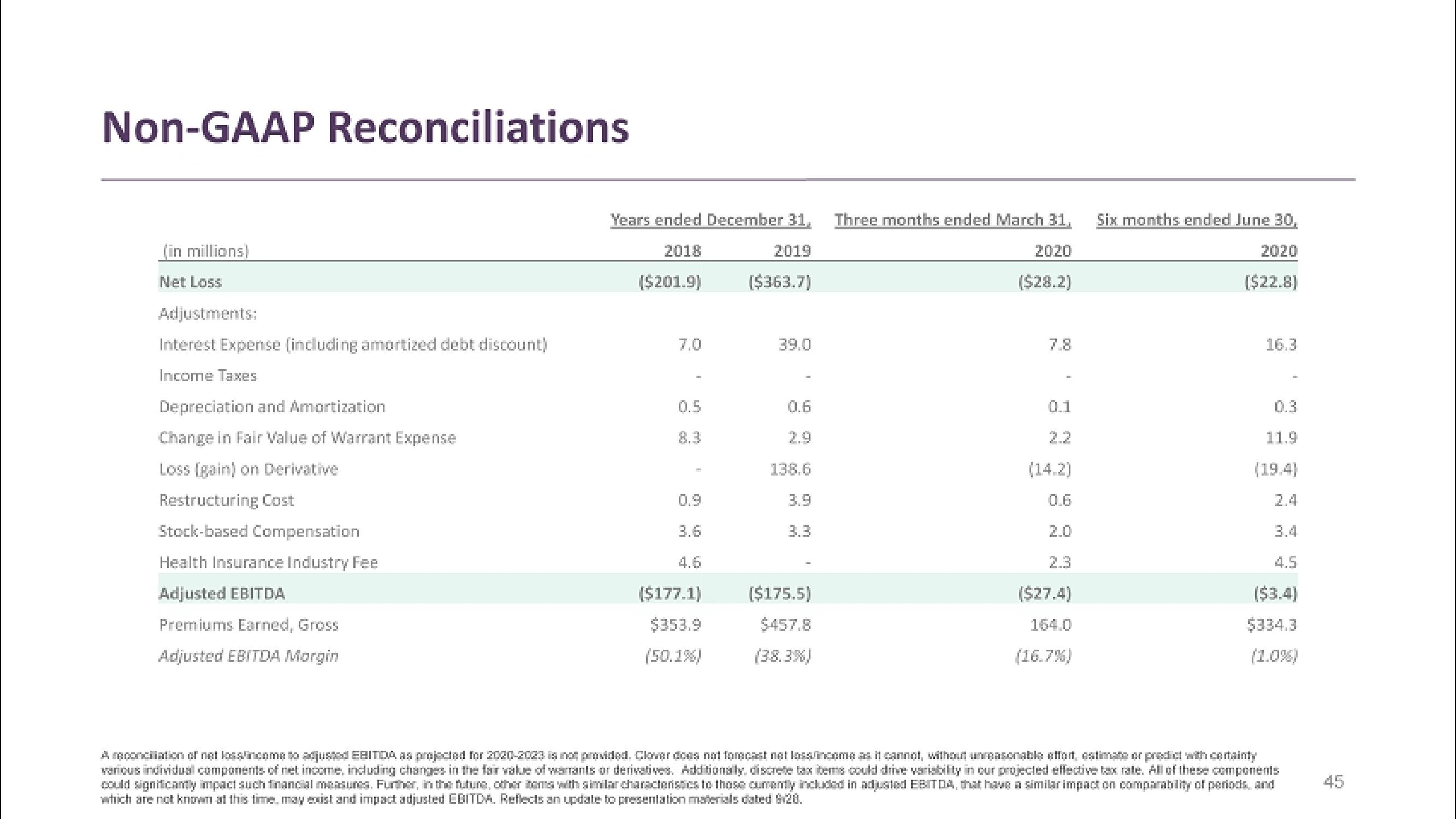

Non-GAAP Reconciliations

(in millions)

Net Loss

Adjustments:

Interest Expense (including amortized debt discount)

Income Taxes

Depreciation and Amortization

Change in Fair Value of Warrant Expense

Loss (gain) on Derivative

Restructuring Cost

Stock-based Compensation

Health Insurance Industry Fee

Adjusted EBITDA

Premiums Earned, Gross

Adjusted EBITDA Margin

Years ended December 31, Three months ended March 31, Six months ended June 30,

2018

2019

2020

2020

($201.9)

($363.7)

($28.2)

[$22.8]

0.5

3.6

($177.1)

$353.9

(50.1%)

39.0

0.6

138.6

3.9

3.3

($175.5)

$457.8

(38.3%)

7.8

0.1

($27.4)

164.0

(16.7%)

16.3

0.3

11.9

(19.4)

4.5

($3.4)

$334.3

A reconciliation of net loss/income to adjusted EBITDA, as projected for 2020-2023 is not provided. Clower does not forecast not loss income as it cannot, without unreasonable effort, estimate or predict with certainty

various individual components of net income, including changes in the fair value of warrants or derivatives. Additionally, discrete tax items could drive variability in our projected effective tax rate. All of these components

could significantly impact such financial measures. Further, in the future, other items with similar characteristics to those currently included in adjusted EBITDA, that have a similar impact on comparability of periods, and

which are not known at this time, may exist and impact adjusted EBITDA. Reflects an update to presentation materials dated 928.

45View entire presentation