Capri Holdings Results Presentation Deck

Gross profit

Total operating expenses

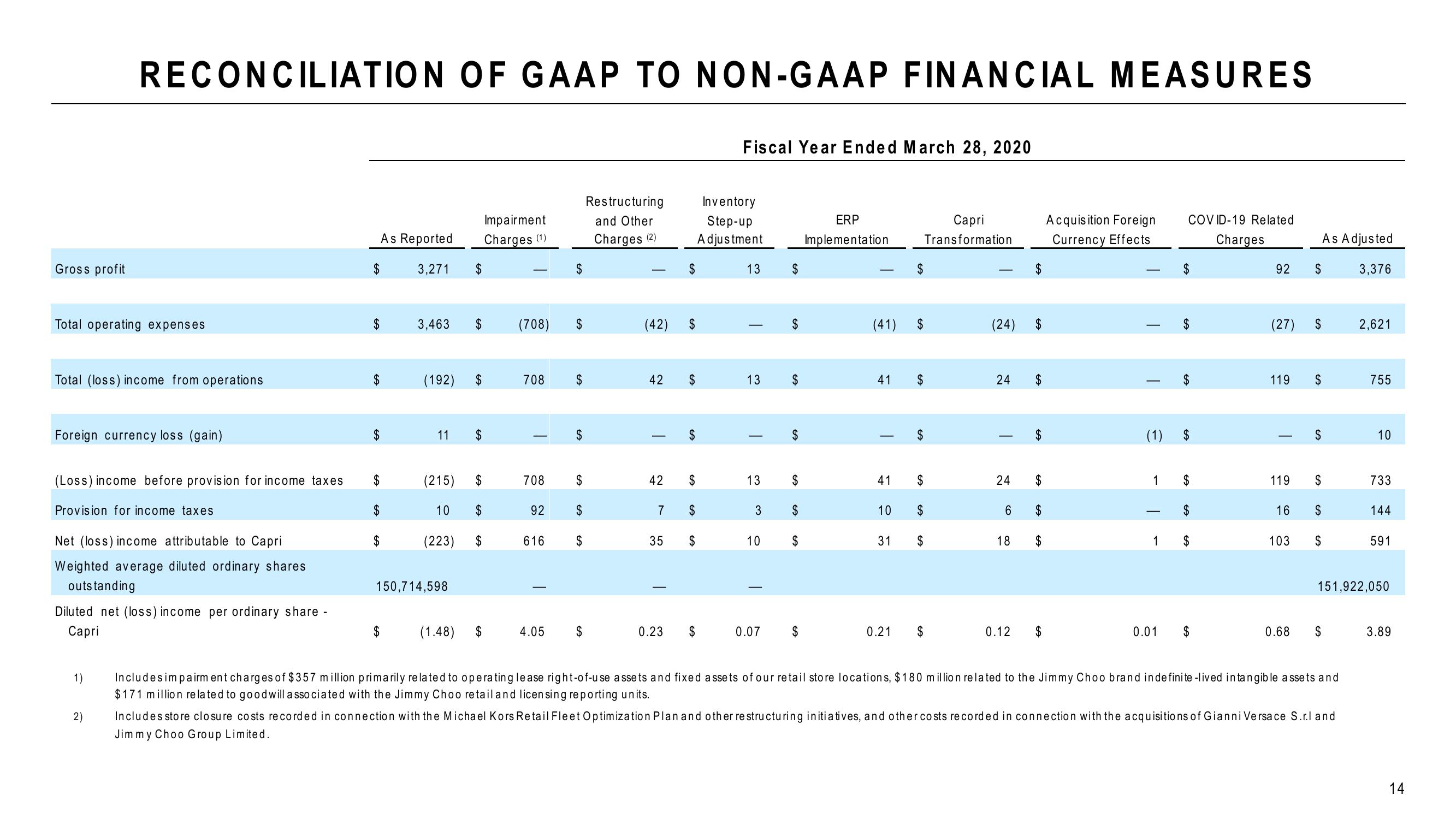

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

Total (loss) income from operations

Foreign currency loss (gain)

(Loss) income before provision for income taxes

Provision for income taxes

Net (loss) income attributable to Capri

Weighted average diluted ordinary shares

outstanding

Diluted net (loss) income per ordinary share -

Capri

1)

2)

$

As Reported

3,271

$

$

3.463 $

(192)

11

(215)

10

(223)

150,714,598

(1.48)

$

FA

$

$

$

$

Impairment

Charges (1)

(708) $

708

I

708

92

616

$

4.05

$

$

$

$

$

$

Restructuring

and Other

Charges (2)

(42) $

42 $

I

$

7

35

42 $

0.23

$

GA

GA

$

$

$

Fiscal Year Ended March 28, 2020

Inventory

Step-up

Adjustment

13

13

|

3

10

$

0.07

$

13 $

$

$

$

$

$

ERP

Implementation

(41) $

41

41

10

31

$

Capri

Transformation

$

$

$

0.21 $

(24) $

24 $

T

24

$

6

18

EA

$

$

$

GA

$

0.12 $

Acquisition Foreign

Currency Effects

T

(1)

COV ID-19 Related

Charges

$

0.01

SA

GA

1 $

FA

FA

1 $

$

92

(27) $

119

T

As Adjusted

3,376

119

$

GA

$

16 $

103 $

0.68 $

Includes impairment charges of $357 million primarily related to operating lease right-of-use assets and fixed assets of our retail store locations, $180 million related to the Jimmy Choo brand in definite -lived in tangible assets and

$171 million related to good will associated with the Jimmy Choo retail and licensing reporting units.

2,621

Includes store closure costs recorded in connection with the Michael Kors Retail Fleet Optimization Plan and other restructuring initiatives, and other costs recorded in connection with the acquisitions of Gianni Versace S.r.l and

Jimmy Choo Group Limited.

755

10

733

151,922,050

144

591

3.89

14View entire presentation