Kering Investor Presentation Deck

DEVELOPING A COMPLEMENTARY ENSEMBLE OF ICONIC LUXURY HOUSES

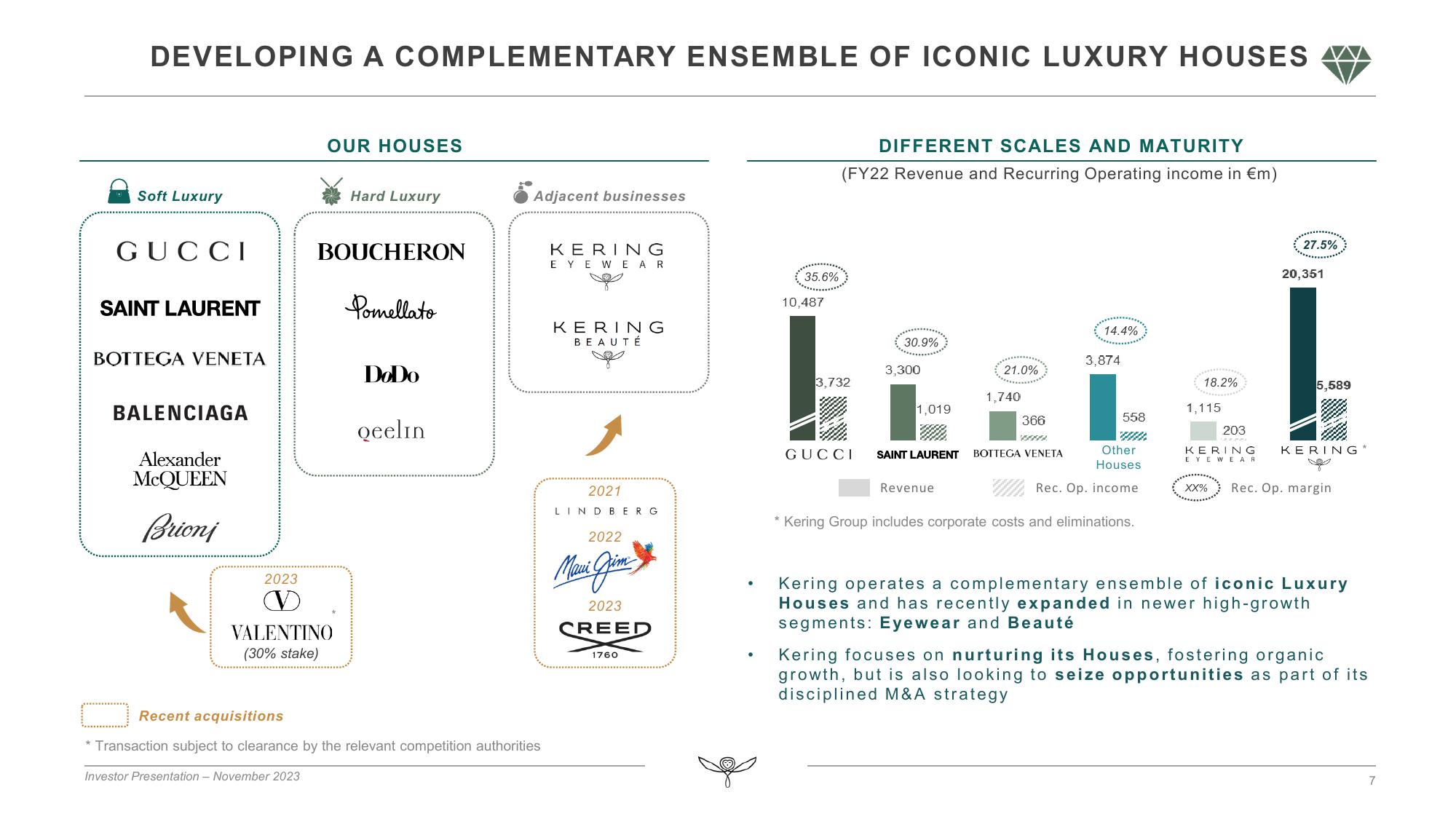

Soft Luxury

GUCCI

SAINT LAURENT

BOTTEGA VENETA

BALENCIAGA

Alexander

MCQUEEN

Brionj

2023

OUR HOUSES

VALENTINO

(30% stake)

Investor Presentation - November 2023

Hard Luxury

BOUCHERON

Pomellato

DoDo

Qeelin

Adjacent businesses

Recent acquisitions

* Transaction subject to clearance by the relevant competition authorities

KERING

EYEWEAR

KERING

BEAUTÉ

2021

LINDBERG

2022

Mani Grim

2023

CREED

1760

35.6%

10,487

DIFFERENT SCALES AND MATURITY

(FY22 Revenue and Recurring Operating income in €m)

3,732

GUCCI

30.9%

3,300

1,019

SAINT LAURENT

Revenue

21.0%

1,740

366

WWW.

14.4%

BOTTEGA VENETA

3,874

558

Other

Houses

Rec. Op. income

* Kering Group includes corporate costs and eliminations.

18.2%

1,115

203

KERING

EYEWEAR

XX%

27.5%

20,351

5,589

KERING

Rec. Op. margin

Kering operates a complementary ensemble of iconic Luxury

Houses and has recently expanded in newer high-growth

segments: Eyewear and Beauté

Kering focuses on nurturing its Houses, fostering organic

growth, but is also looking to seize opportunities as part of its

disciplined M&A strategy

7View entire presentation