Allego Investor Presentation Deck

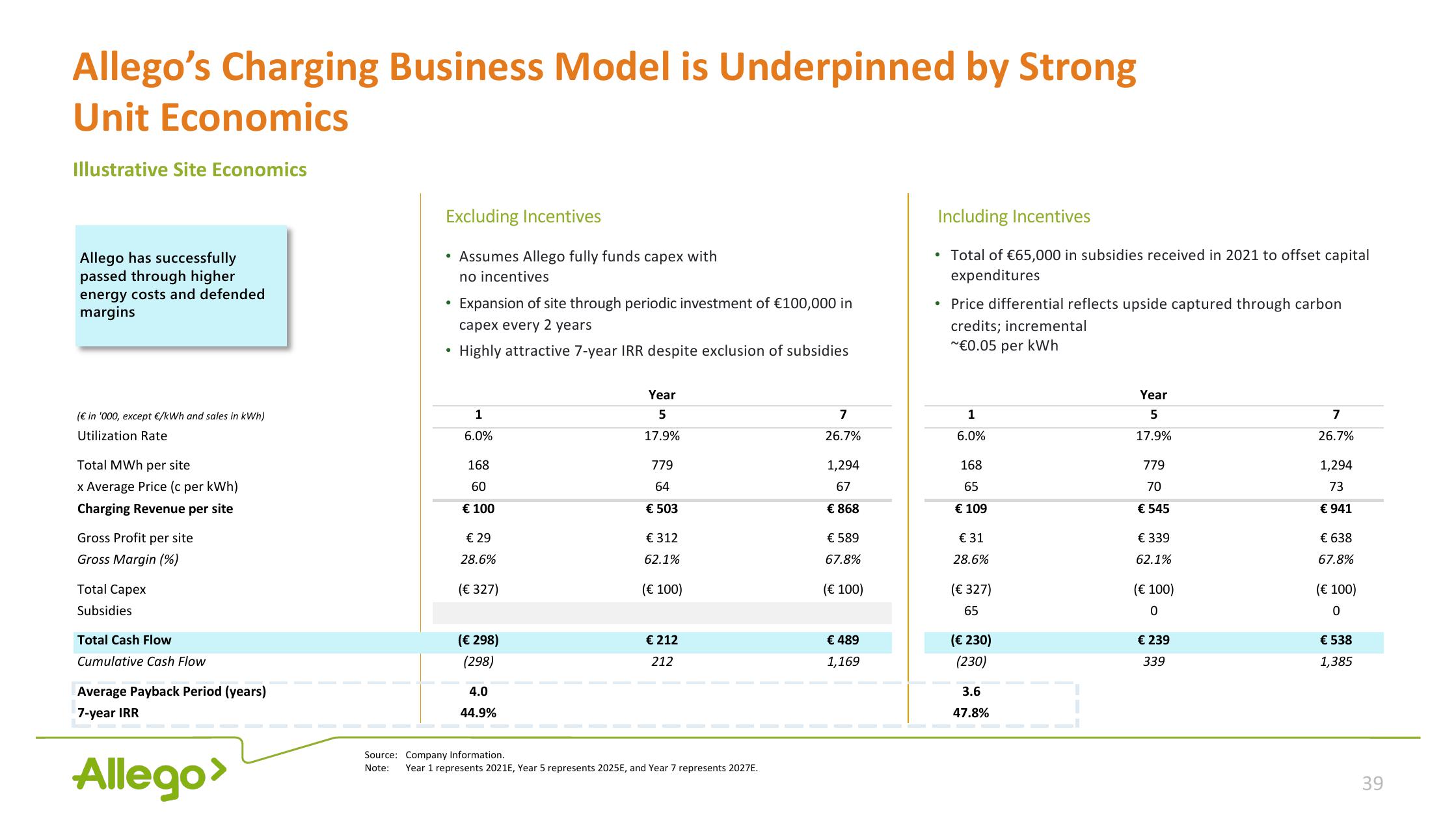

Allego's Charging Business Model is Underpinned by Strong

Unit Economics

Illustrative Site Economics

Allego has successfully

passed through higher

energy costs and defended

margins

(€ in '000, except €/kWh and sales in kWh)

Utilization Rate

Total MWh per site

x Average Price (c per kWh)

Charging Revenue per site

Gross Profit per site

Gross Margin (%)

Total Capex

Subsidies

Total Cash Flow

Cumulative Cash Flow

Average Payback Period (years)

7-year IRR

Allego>

Excluding Incentives

• Assumes Allego fully funds capex with

no incentives

●

●

Expansion of site through periodic investment of €100,000 in

capex every 2 years

Highly attractive 7-year IRR despite exclusion of subsidies

1

6.0%

168

60

€ 100

€ 29

28.6%

(€ 327)

(€ 298)

(298)

4.0

44.9%

Year

5

17.9%

779

64

€ 503

€ 312

62.1%

(€ 100)

€ 212

212

Source: Company Information.

Note: Year 1 represents 2021E, Year 5 represents 2025E, and Year 7 represents 2027E.

7

26.7%

1,294

67

€ 868

€ 589

67.8%

(€ 100)

€ 489

1,169

Including Incentives

• Total of €65,000 in subsidies received in 2021 to offset capital

expenditures

●

Price differential reflects upside captured through carbon

credits; incremental

~€0.05 per kWh

1

6.0%

168

65

€ 109

€ 31

28.6%

(€ 327)

65

(€ 230)

(230)

3.6

47.8%

Year

5

17.9%

779

70

€ 545

€ 339

62.1%

(€ 100)

0

€ 239

339

7

26.7%

1,294

73

€ 941

€ 638

67.8%

(€ 100)

0

€ 538

1,385

39View entire presentation