Q4 2020 Investor Presentation

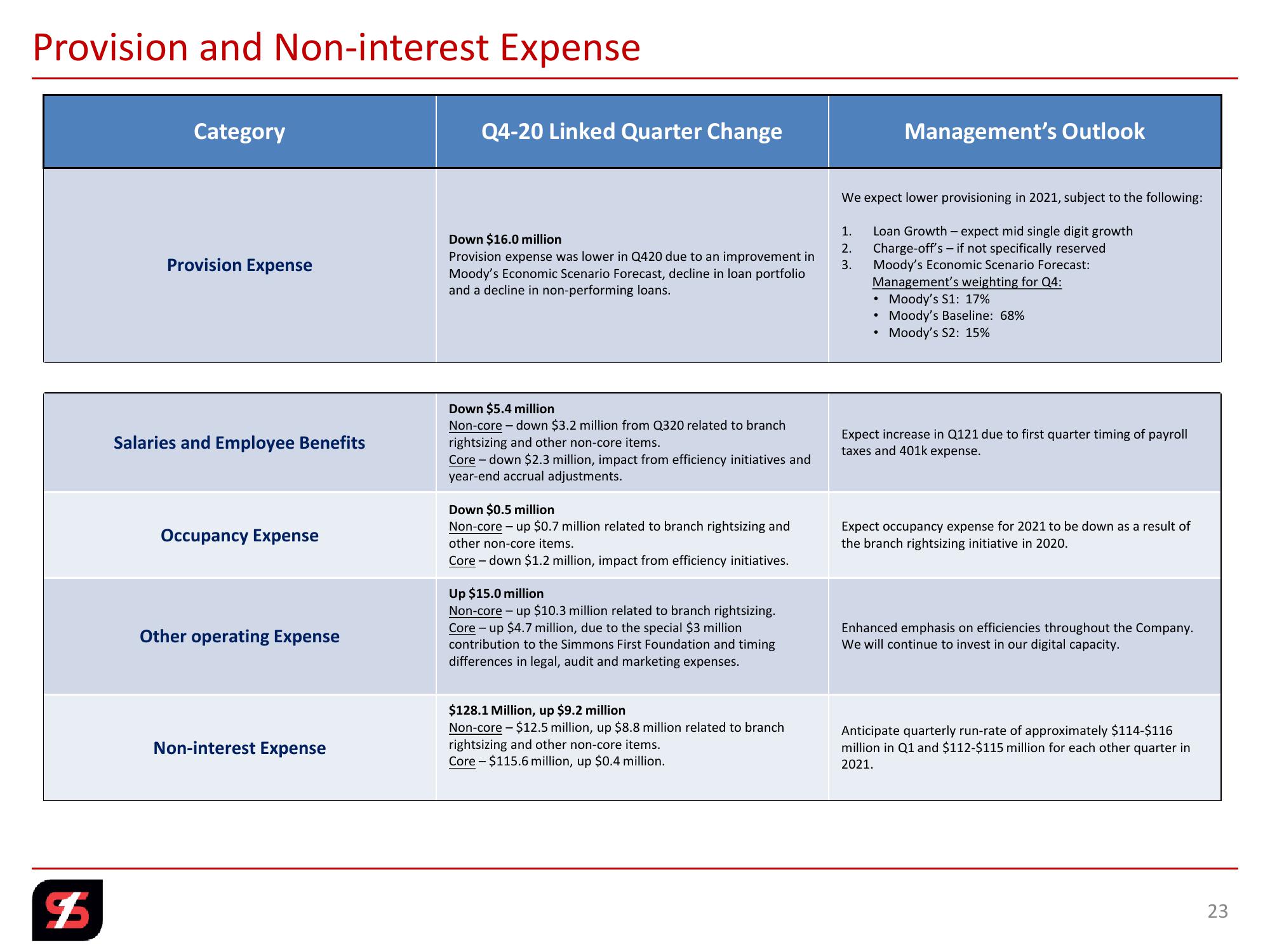

Provision and Non-interest Expense

Category

Q4-20 Linked Quarter Change

$

Provision Expense

Management's Outlook

We expect lower provisioning in 2021, subject to the following:

1.

Loan Growth-expect mid single digit growth

Down $16.0 million

2.

Charge-off's - if not specifically reserved

Provision expense was lower in Q420 due to an improvement in

Moody's Economic Scenario Forecast, decline in loan portfolio

and a decline in non-performing loans.

3.

Moody's Economic Scenario Forecast:

Management's weighting for Q4:

• Moody's S1: 17%

⚫ Moody's Baseline: 68%

.

Moody's S2: 15%

Salaries and Employee Benefits

Occupancy Expense

Other operating Expense

Non-interest Expense

Down $5.4 million

Non-core-down $3.2 million from Q320 related to branch

rightsizing and other non-core items.

Core down $2.3 million, impact from efficiency initiatives and

year-end accrual adjustments.

Down $0.5 million

Non-core-up $0.7 million related to branch rightsizing and

other non-core items.

Core - down $1.2 million, impact from efficiency initiatives.

Up $15.0 million

Non-core-up $10.3 million related to branch rightsizing.

Core up $4.7 million, due to the special $3 million

contribution to the Simmons First Foundation and timing

differences in legal, audit and marketing expenses.

$128.1 Million, up $9.2 million

Non-core $12.5 million, up $8.8 million related to branch

rightsizing and other non-core items.

Core - $115.6 million, up $0.4 million.

Expect increase in Q121 due to first quarter timing of payroll

taxes and 401k expense.

Expect occupancy expense for 2021 to be down as a result of

the branch rightsizing initiative in 2020.

Enhanced emphasis on efficiencies throughout the Company.

We will continue to invest in our digital capacity.

Anticipate quarterly run-rate of approximately $114-$116

million in Q1 and $112-$115 million for each other quarter in

2021.

23View entire presentation