UBS Results Presentation Deck

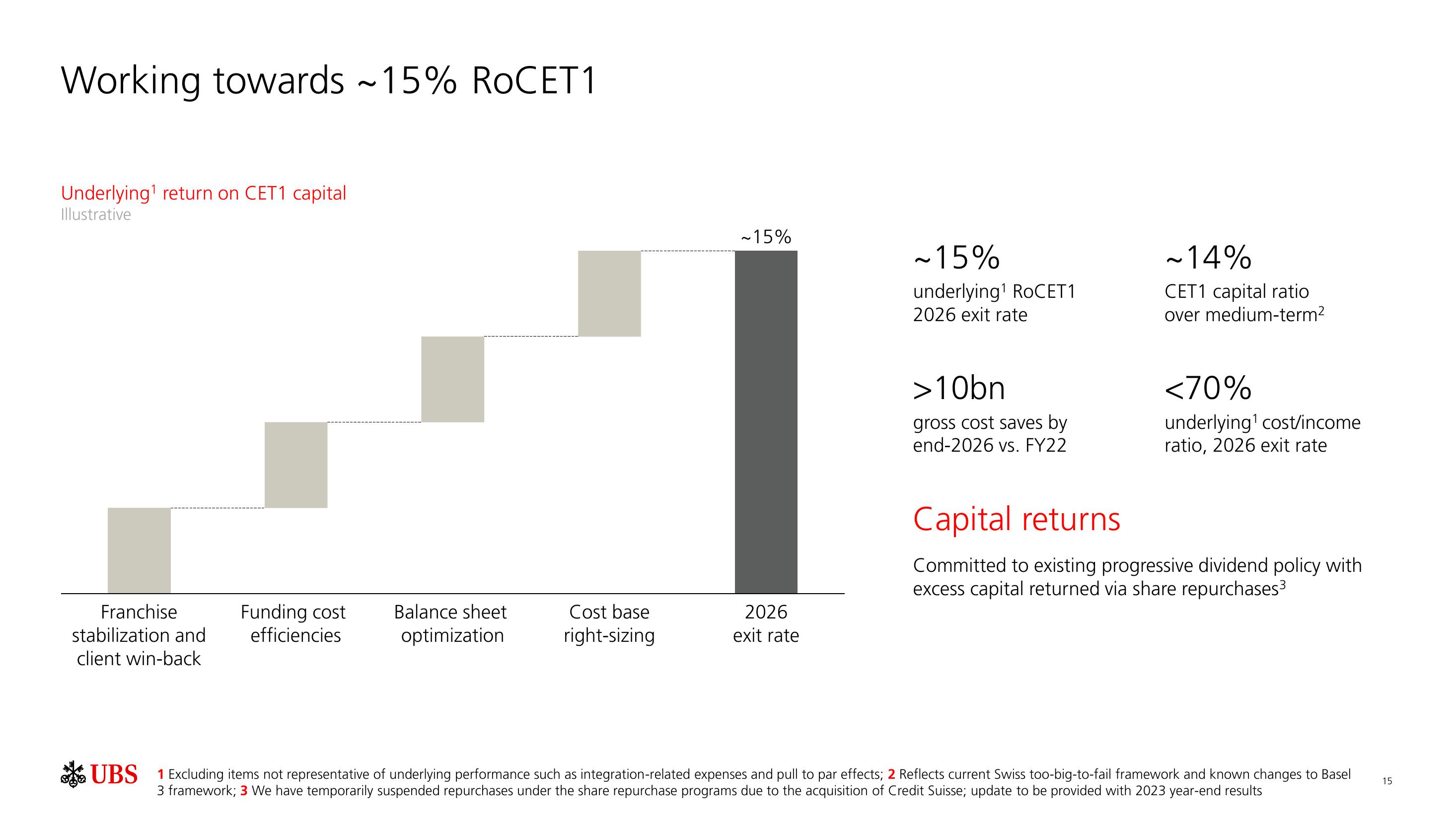

Working towards ~15% ROCET1

Underlying¹ return on CET1 capital

Illustrative

Franchise

stabilization and

client win-back

Funding cost

efficiencies

Balance sheet

optimization

Cost base

right-sizing

~15%

2026

exit rate

~15%

underlying¹ ROCET1

2026 exit rate

>10bn

gross cost saves by

end-2026 vs. FY22

~14%

CET1 capital ratio

over medium-term²

<70%

underlying¹ cost/income

ratio, 2026 exit rate

Capital returns

Committed to existing progressive dividend policy with

excess capital returned via share repurchases³

UBS 1 Excluding items not representative of underlying performance such as integration-related expenses and pull to par effects; 2 Reflects current Swiss too-big-to-fail framework and known changes to Basel

3 framework; 3 We have temporarily suspended repurchases under the share repurchase programs due to the acquisition of Credit Suisse; update to be provided with 2023 year-end results

15View entire presentation