Credit Suisse Investment Banking Pitch Book

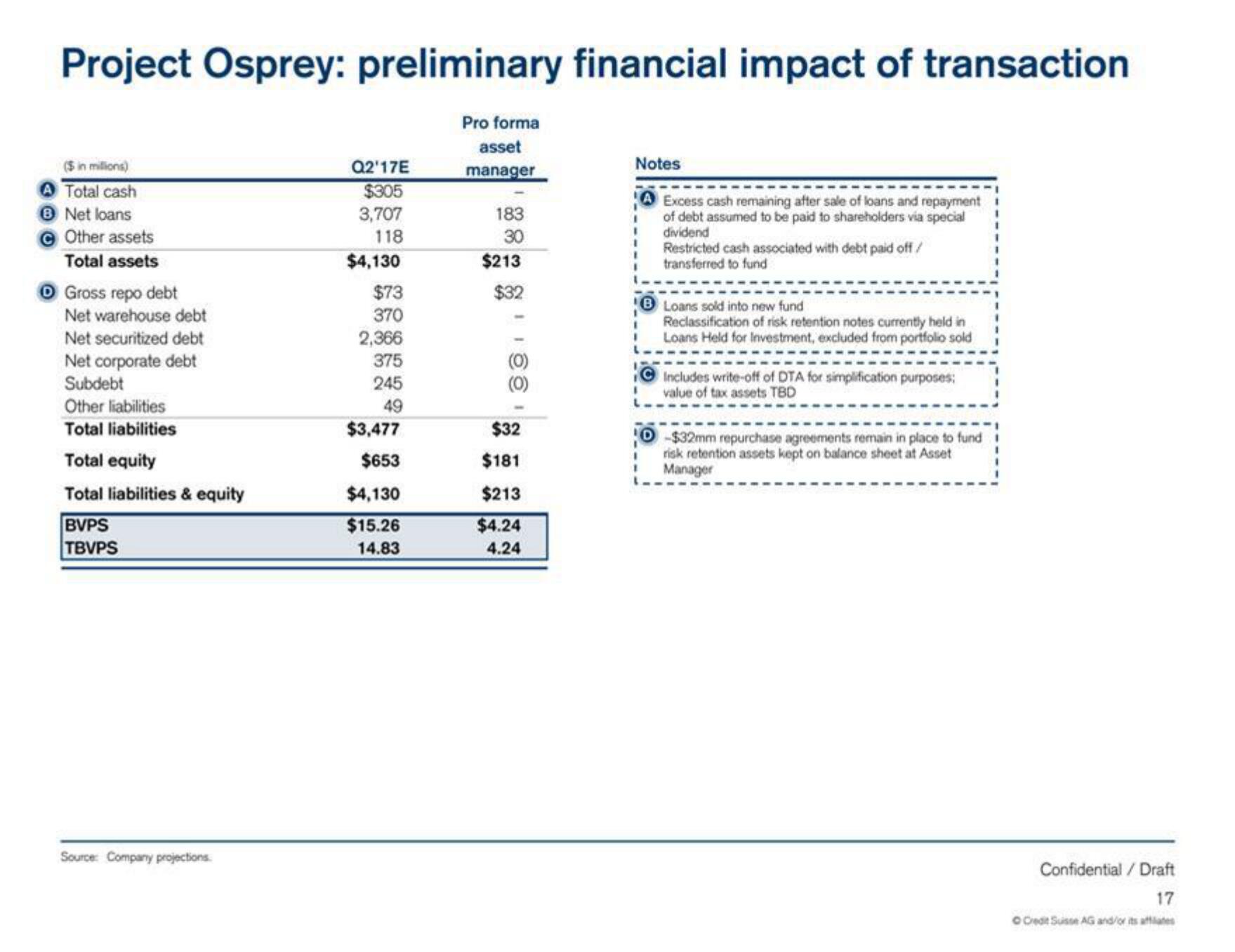

Project Osprey: preliminary financial impact of transaction

Pro forma

asset

manager

($ in millions)

A Total cash

B Net loans

Other assets

Total assets

Ⓒ Gross repo debt

Net warehouse debt

Net securitized debt

Net corporate debt

Subdebt

Other liabilities

Total liabilities

Total equity

Total liabilities & equity

BVPS

TBVPS

Source: Company projections

Q2'17E

$305

3,707

118

$4,130

$73

370

2,366

375

245

49

$3,477

$653

$4,130

$15.26

14.83

183

30

$213

$32

1100

$32

$181

$213

$4.24

4.24

Notes

Excess cash remaining after sale of loans and repayment

of debt assumed to be paid to shareholders via special

dividend

1

I

Restricted cash associated with debt paid off/

transferred to fund

Loans sold into new fund

Reclassification of risk retention notes currently held in

Loans Held for Investment, excluded from portfolio sold

Includes write-off of DTA for simplification purposes:

value of tax assets TBD

-$32mm repurchase agreements remain in place to fund

risk retention assets kept on balance sheet at Asset

Manager

Confidential / Draft

17

O Credit Suisse AG and/or its affiliatesView entire presentation