J.P.Morgan Results Presentation Deck

Consumer & Community Banking ¹

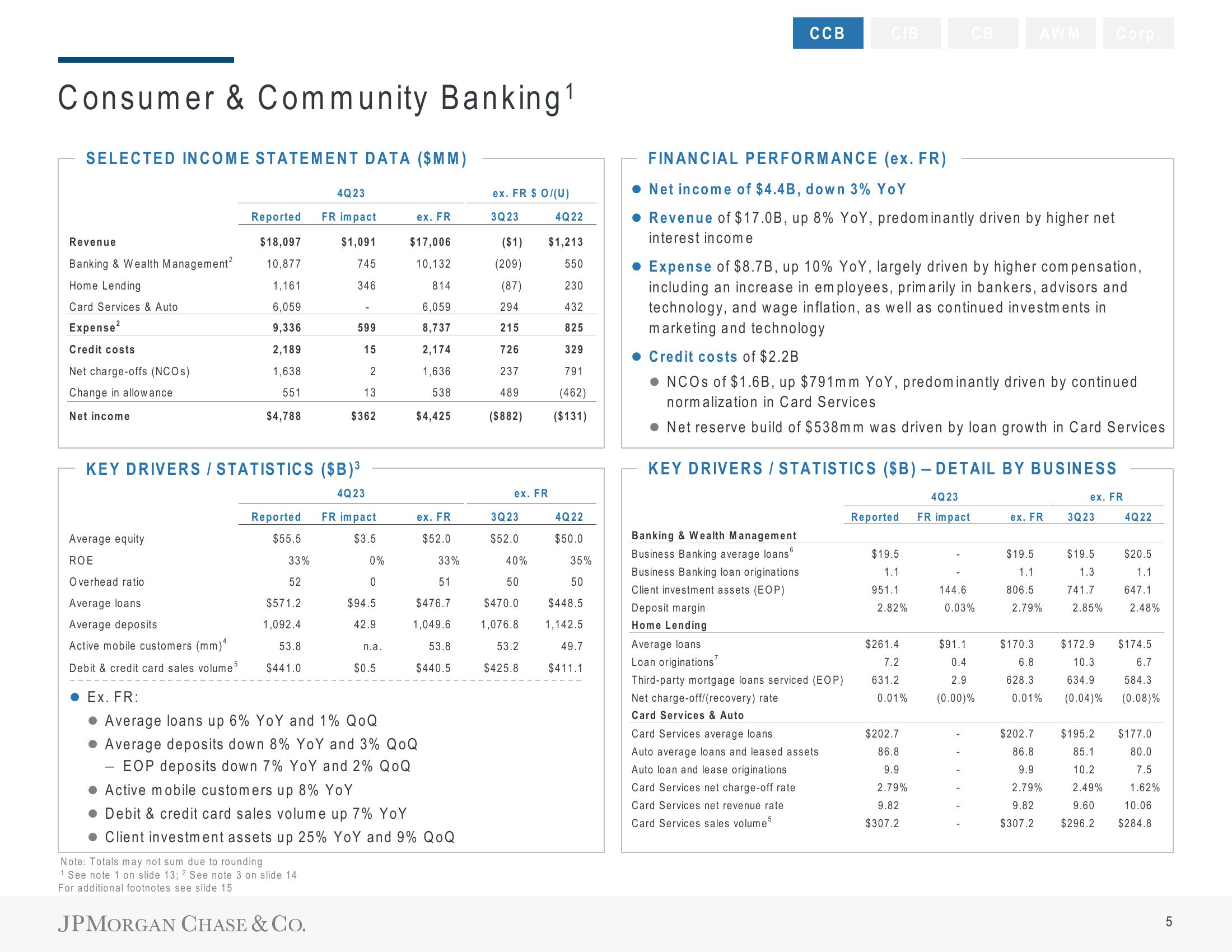

SELECTED INCOME STATEMENT DATA ($MM)

Revenue

Banking & Wealth Management²

Home Lending

Card Services & Auto

Expense²

Credit costs

Net charge-offs (NCOs)

Change in allowance

Net income

Average equity

ROE

Reported

$18,097

10,877

1,161

6,059

9,336

2,189

1,638

551

$4,788

Overhead ratio

Average loans

Average deposits

Active mobile customers (mm)4

Debit & credit card sales volume 5

KEY DRIVERS / STATISTICS ($B)³

4Q23

Reported

$55.5

33%

52

$571.2

1,092.4

53.8

$441.0

4Q23

FR impact

$1,091

745

346

Note: Totals may not sum due to rounding

1 See note 1 on slide 13; 2 See note 3 on slide 14

For additional footnotes see slide 15

599

15

2

13

$362

JPMORGAN CHASE & CO.

FR impact

$3.5

0%

0

$94.5

42.9

n.a.

$0.5

ex. FR

$17,006

10,132

814

6,059

8,737

2,174

1,636

538

$4,425

ex. FR

$52.0

33%

Ex. FR:

Average loans up 6% YoY nd 1% QOQ

Average deposits down 8% YoY and 3% QOQ

-EOP deposits down 7% YoY and 2% QOQ

Active mobile customers up 8% YoY

Debit & credit card sales volume up 7% YoY

Client investment assets up 25% YoY and 9% QOQ

51

$476.7

1,049.6

53.8

$440.5

ex. FR $ 0/(U)

3Q23

($1)

(209)

(87)

4Q22

$1,213

550

230

294

432

215

825

726

329

237

791

489

(462)

($882) ($131)

ex. FR

3Q23

$52.0

40%

50

4Q22

$50.0

35%

50

$470.0 $448.5

1,076.8 1,142.5

53.2

49.7

$411.1

$425.8

CCB

CIB

FINANCIAL PERFORMANCE (ex. FR)

Net income of $4.4B, down 3% YoY

• Revenue of $17.0B, up 8% YoY, predominantly driven by higher net

interest income

Banking & Wealth Management

Business Banking average loans

Business Banking loan originations

Client investment assets (EOP)

Deposit margin

Home Lending

Average loans

Loan originations

Expense of $8.7B, up 10% YoY, largely driven by higher compensation,

including an increase in employees, primarily in bankers, advisors and

technology, and wage inflation, as well as continued investments in

marketing and technology

Credit costs of $2.2B

NCOs of $1.6B, up $791mm YoY, predominantly driven by continued

normalization in Card Services

Net reserve build of $538mm was driven by loan growth in Card Services

Third-party mortgage loans serviced (EOP)

Net charge-off/(recovery) rate

Card Services & Auto

Card Services average loans

Auto average loans and leased assets

Auto loan and lease originations

Card Services net charge-off rate

Card Services net revenue rate

Card Services sales volume 5

KEY DRIVERS / STATISTICS ($B)- DETAIL BY BUSINESS

4Q23

FR impact

Reported

$19.5

1.1

951.1

2.82%

CB

$261.4

7.2

631.2

0.01%

$202.7

86.8

9.9

2.79%

AWM Corp.

9.82

$307.2

144.6

0.03%

$91.1

0.4

2.9

(0.00)%

ex. FR

$19.5

1.1

806.5

2.79%

$170.3

6.8

628.3

0.01%

$202.7

86.8

9.9

2.79%

9.82

$307.2

ex. FR

3Q23

$19.5

1.3

741.7

2.85%

4Q22

$20.5

1.1

647.1

2.48%

$172.9 $174.5

10.3

634.9

(0.04)%

6.7

584.3

(0.08)%

$195.2 $177.0

85.1

80.0

10.2

7.5

2.49%

1.62%

9.60 10.06

$296.2 $284.8

LO

5View entire presentation