TradeStation SPAC Presentation Deck

31

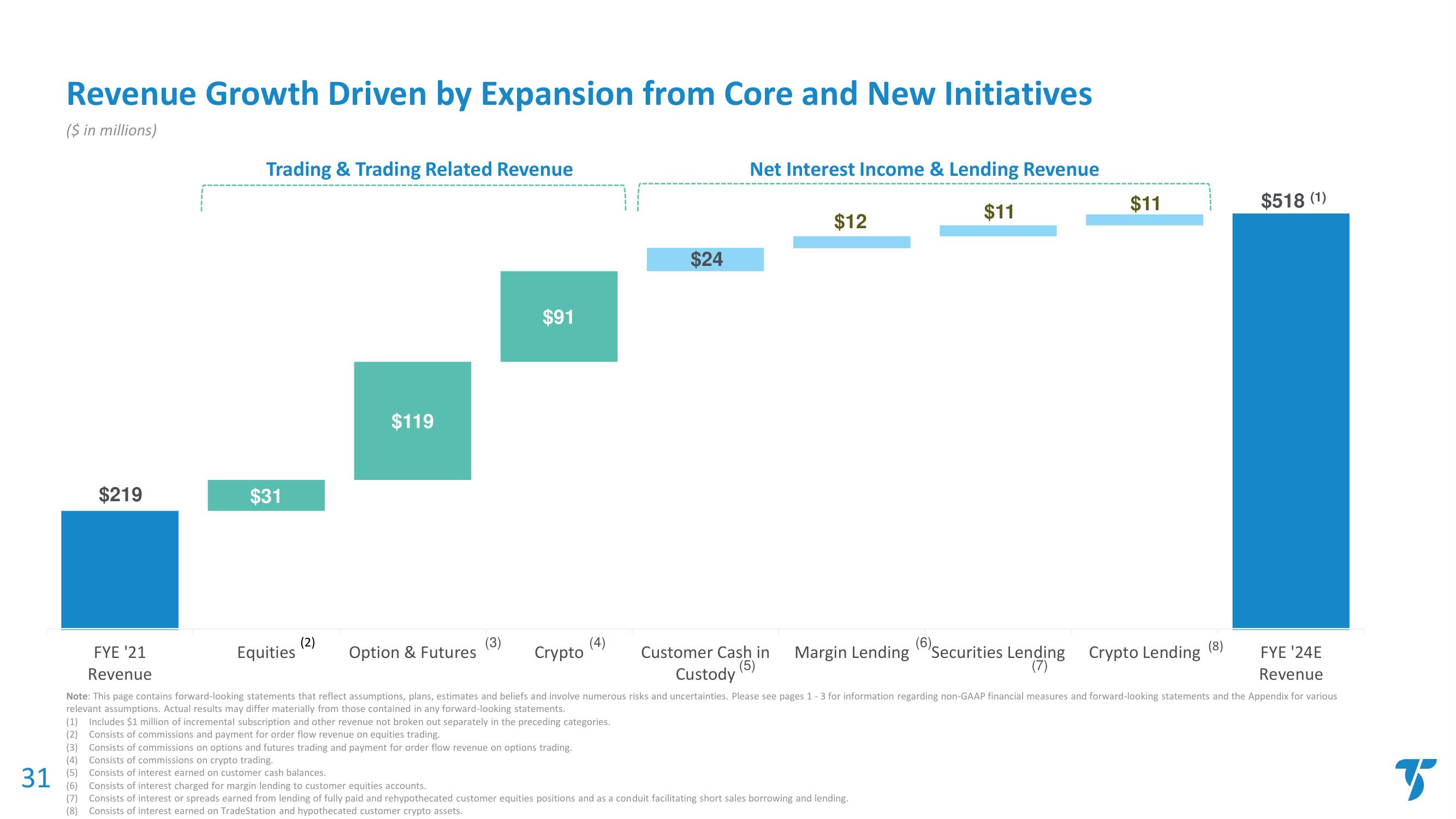

Revenue Growth Driven by Expansion from Core and New Initiatives

($ in millions)

(3)

(4)

(5)

$219

(6)

(7)

Trading & Trading Related Revenue

$31

(2)

Equities

$119

(3)

Option & Futures

$91

Crypto

(4)

Consists of commissions on options and futures trading and payment for order flow revenue on options trading.

Consists of commissions on crypto trading.

Consists of interest earned on customer cash balances.

$24

Net Interest Income & Lending Revenue

$11

$12

FYE '21

Revenue

Note: This page contains forward-looking statements that reflect assumptions, plans, estimates and beliefs and involve numerous risks and uncertainties. Please see pages 1-3 for information regarding non-GAAP financial measures and forward-looking statements and the Appendix for various

relevant assumptions. Actual results may differ materially from those contained in any forward-looking statements.

Customer Cash in Margin Lending

(5)

Custody

Crypto Lending

FYE '24E

Revenue

(1) Includes $1 million of incremental subscription and other revenue not broken out separately in the preceding categories.

(2) Consists of commissions and payment for order flow revenue on equities trading.

Consists of interest charged for margin lending to customer equities accounts.

Consists of interest or spreads earned from lending of fully paid and rehypothecated customer equities positions and as a conduit facilitating short sales borrowing and lending.

(8) Consists of interest earned on TradeStation and hypothecated customer crypto assets.

(6)

Securities Lending

(7)

$11

(8)

$518 (1)

BView entire presentation