Moelis & Company Investment Banking Pitch Book

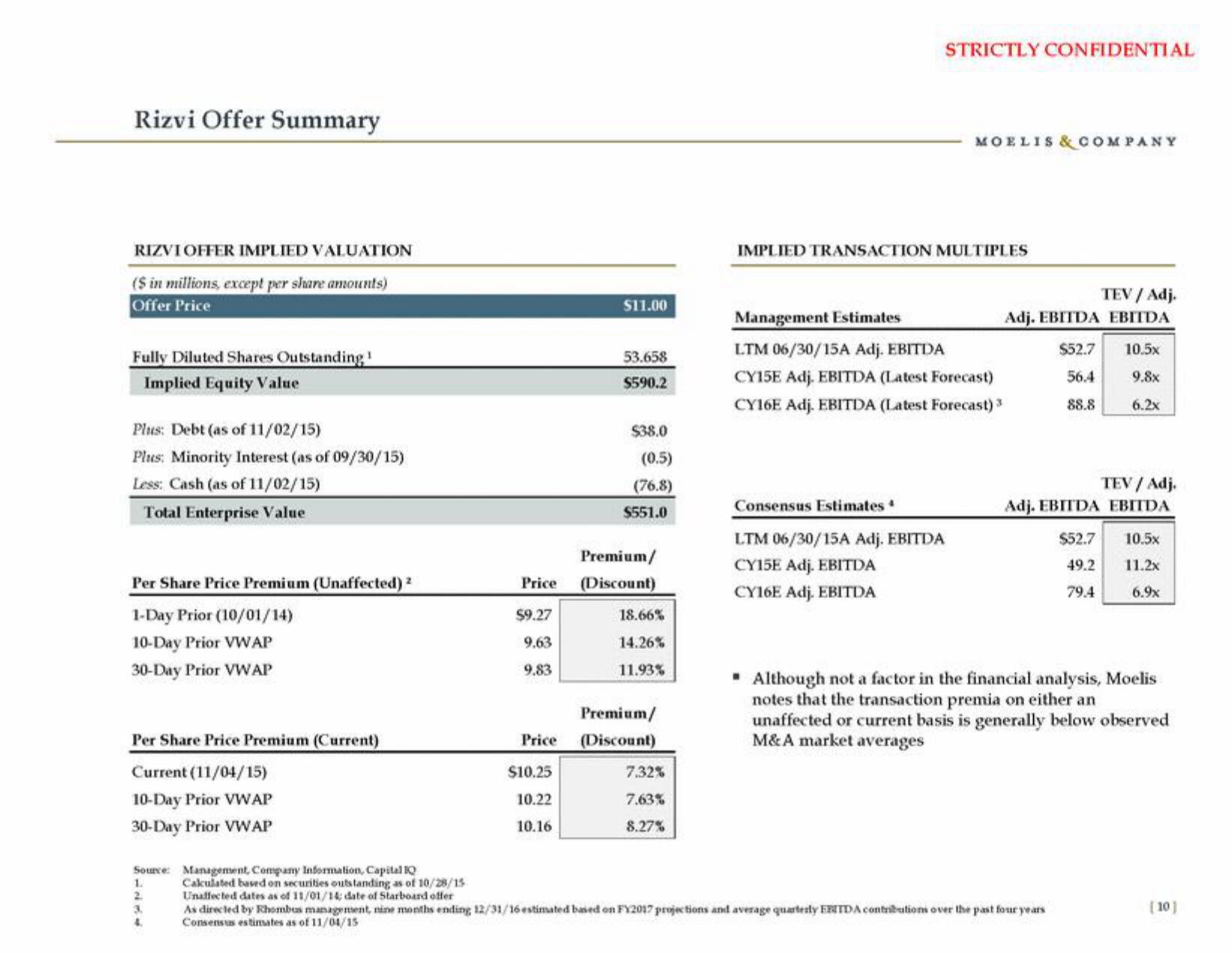

Rizvi Offer Summary

RIZVI OFFER IMPLIED VALUATION

($ in millions, except per share amounts)

Offer Price

Fully Diluted Shares Outstanding ¹

Implied Equity Value

Plus: Debt (as of 11/02/15)

Plus: Minority Interest (as of 09/30/15)

Less: Cash (as of 11/02/15)

Total Enterprise Value

Per Share Price Premium (Unaffected) ²

1-Day Prior (10/01/14)

10-Day Prior VWAP

30-Day Prior VWAP

Per Share Price Premium (Current)

Current (11/04/15)

10-Day Prior VWAP

30-Day Prior VWAP

Source Management, Company Information, Capital IQ

3.

4.

Cakulated based on securities outstanding as of 10/28/15

Unaffected dates as of 11/01/14; date of Starboard offer

$9.27

9.63

9.83

Price

$11.00

Premium/

Price (Discount)

$10.25

10.22

10.16

53.658

$590.2

$38.0

(0.5)

(76.8)

$551.0

18.66%

14.26%

11.93%

Premium/

(Discount)

7.32%

7.63%

8.27%

STRICTLY CONFIDENTIAL

IMPLIED TRANSACTION MULTIPLES

Consensus Estimates 4

MOELIS & COMPANY

Management Estimates

LTM 06/30/15A Adj. EBITDA

CY15E Adj. EBITDA (Latest Forecast)

CY16E Adj. EBITDA (Latest Forecast) 3

LTM 06/30/15A Adj. EBITDA

CY15E Adj. EBITDA

CY16E Adj. EBITDA

TEV / Adj.

Adj. EBITDA EBITDA

$52.7

56.4

88.8

TEV / Adj.

Adj. EBITDA EBITDA

As directed by Rhombus management, nine months ending 12/31/16 estimated based on FY2017 projections and average quarterly FRIDA contributions over the past four years.

Consensus estimates as of 11/04/15

10.5×

9.8x

6.2x

$52.7

49.2

79.4

10.5x

11.2x

6.9x

▪ Although not a factor in the financial analysis, Moelis

notes that the transaction premia on either an

unaffected or current basis is generally below observed

M&A market averages

[10]View entire presentation