Pershing Square Activist Presentation Deck

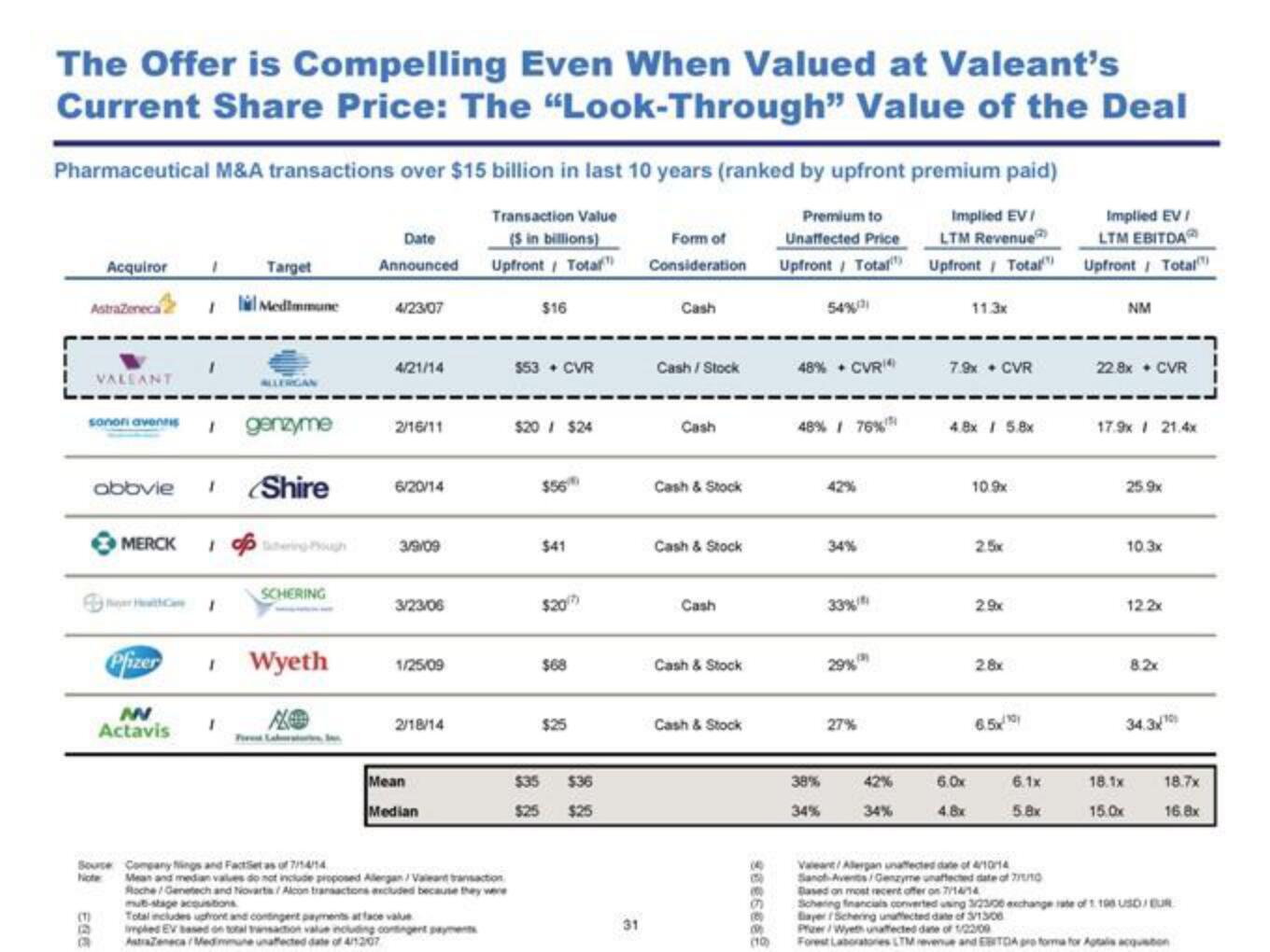

The Offer is Compelling Even When Valued at Valeant's

Current Share Price: The "Look-Through" Value of the Deal

Pharmaceutical M&A transactions over $15 billion in last 10 years (ranked by upfront premium paid)

Acquiror

AstraZeneca

VALEANT

sonori aventis

(T)

3

abbvie

MERCK

Target

Medimmune

ALLERGAN

I genzyme

I

I Shire

opinghough

SCHERING

Pfizer I Wyeth

IN

Actavis

Source Company Nings and FactSet as of 7/14/14

Note

Date

Announced

4/23/07

4/21/14

2/16/11

6/20/14

3/9/09

3/23/06

1/25/09

2/18/14

Mean

Median

Transaction Value

(S in billions)

Upfront / Total

Mean and median values do not include proposed Alergan/Valent transaction

Roche/Genetech and Novarts/Alcon transactions excluded because they were

mub-stage acquisitions

Total includes upfront and contingent payments at face value

impled EV based on total transaction value including contingent payments

AstraZeneca Medimmune unaffected date of 4/12/07

$16

$53 + CVR

$20 / $24

$35

$25

$41

$20

$68

$25

$36

$25

31

Form of

Consideration

Cash

Cash/ Stock

Cash

Cash & Stock

Cash & Stock

Cash

Cash & Stock

Cash & Stock

B

(10)

Premium to

Unaffected Price

Upfront / Total

54%

48% + CVR

48% / 76 %

38%

34%

34%

33%

27%

42%

34%

Implied EVI

LTM Revenue

Upfront / Total

11.3x

7.9x + CVR

4.8x / 5.8x

6.0x

4.8x

10.9x

2.5x

2.9x

28x

6.5x

6.1x

5.8x

Valeant/Allergan unaffected date of 4/10/14

Sanch-Avents/Genzyme unaffected date of 7/10

Implied EV /

LTM EBITDA

Upfront / Total

NM

22.8x + CVR

17.9x / 21.4x

18.1x

15.0x

25.9x

10.3x

12.2x

8.2x

34.30

18.7x

16.8x

Based on most recent offer on 7/14/14

Schering financials converted using 3/23/00 exchange rate of 1.198 USD/EUR

Bayer Schering unaffected date of 3/13/08

Pfizer/Wyeth unaffected date of 1/2209

Forest Laboratories LTM revenue and EBITDA pro forma for Agtas acquistonView entire presentation