Nepc Private Markets Investment Due Diligence Report

Penwood Select Industrial Partners VII

Non-Core Real Estate

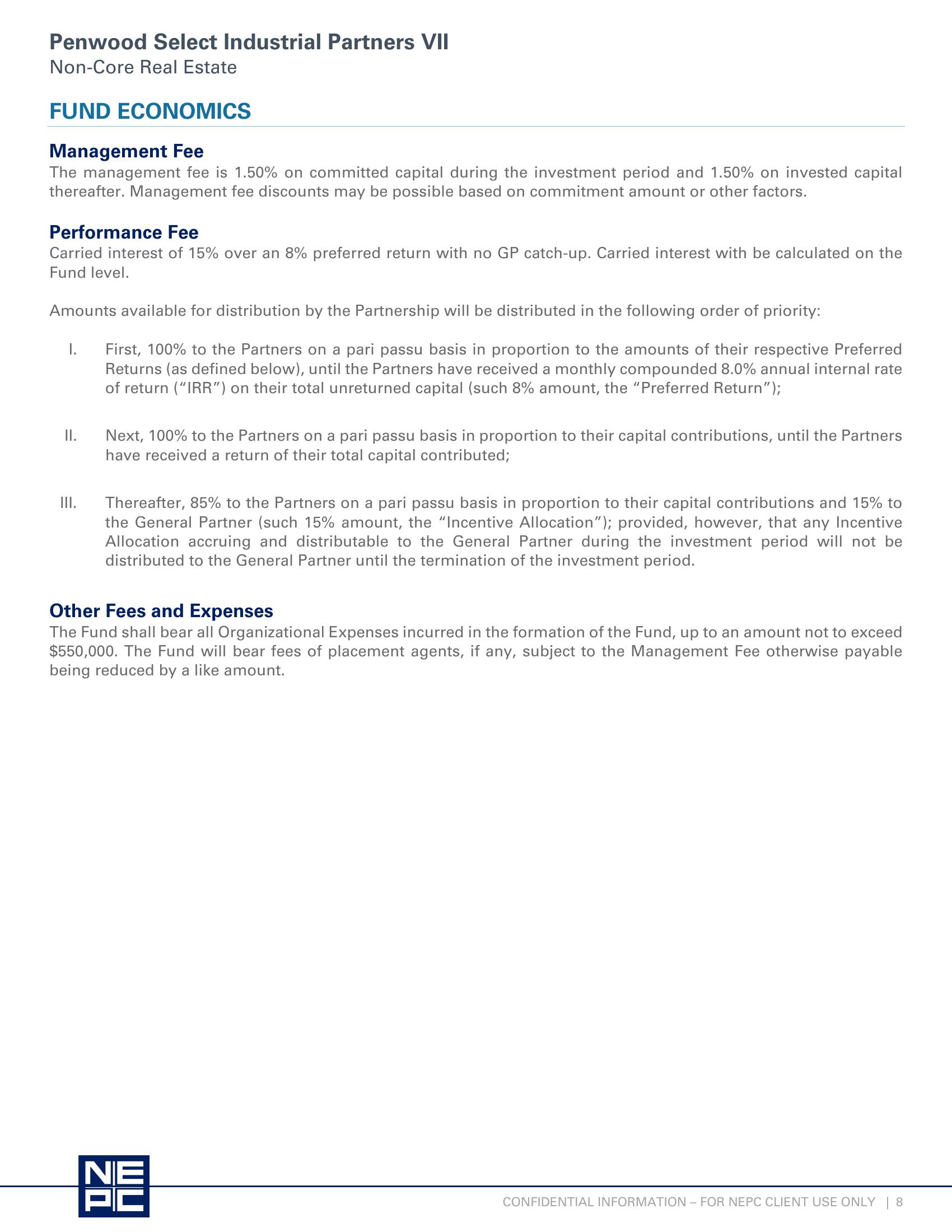

FUND ECONOMICS

Management Fee

The management fee is 1.50% on committed capital during the investment period and 1.50% on invested capital

thereafter. Management fee discounts may be possible based on commitment amount or other factors.

Performance Fee

Carried interest of 15% over an 8% preferred return with no GP catch-up. Carried interest with be calculated on the

Fund level.

Amounts available for distribution by the Partnership will be distributed in the following order of priority:

First, 100% to the Partners on a pari passu basis in proportion to the amounts of their respective Preferred

Returns (as defined below), until the Partners have received a monthly compounded 8.0% annual internal rate

of return ("IRR") on their total unreturned capital (such 8% amount, the "Preferred Return");

I.

II.

III.

Next, 100% to the Partners on a pari passu basis in proportion to their capital contributions, until the Partners

have received a return of their total capital contributed;

Thereafter, 85% to the Partners on a pari passu basis in proportion to their capital contributions and 15% to

the General Partner (such 15% amount, the "Incentive Allocation"); provided, however, that any Incentive

Allocation accruing and distributable to the General Partner during the investment period will not be

distributed to the General Partner until the termination of the investment period.

Other Fees and Expenses

The Fund shall bear all Organizational Expenses incurred in the formation of the Fund, up to an amount not to exceed

$550,000. The Fund will bear fees of placement agents, if any, subject to the Management Fee otherwise payable

being reduced by a like amount.

NE

PC

CONFIDENTIAL INFORMATION - FOR NEPC CLIENT USE ONLY 8View entire presentation