Bank of America Investment Banking Pitch Book

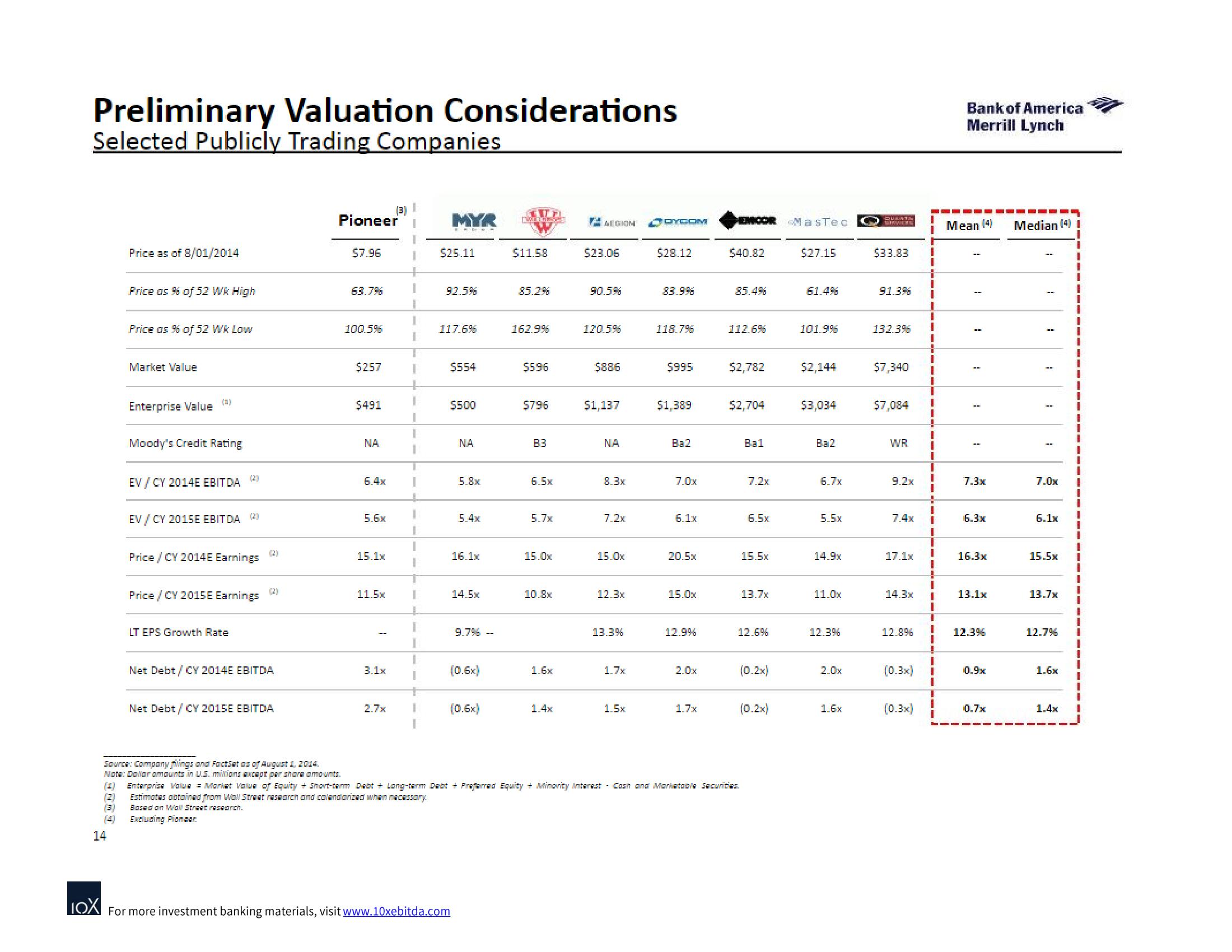

Preliminary Valuation Considerations

Selected Publicly Trading Companies

(1)

(2)

(3)

Price as of 8/01/2014

14

Price as 96 of 52 Wk High

Price as % of 52 Wk Low

Market Value

Enterprise Value

(4)

Moody's Credit Rating

EV / CY 2014E EBITDA

(2)

EV / CY 2015E EBITDA (2)

Price/CY 2014E Earnings

Price / CY 2015 E Earnings

LT EPS Growth Rate

(2)

(2)

Net Debt / CY 2014E EBITDA

Net Debt / CY 2015E EBITDA

Source: Company filings and FactSet as of August 1, 2014.

Note: Dollar amounts in U.S. milions except par shore amounts.

Pioneer

$7.96

63.7%

100.5%

$257

$491

NA

6.4x

5.6x

15.1x

11.5

3.1x

2.7x

1

MYR

$25.11

92.5%

117.6%

IOX For more investment banking materials, visit www.10xebitda.com

$554

$5.00

NA

5.8x

5.4x

16.1x

14.5x

9.7% --

(0.6x)

(0.6x)

GUA

$11.58

85.2%

162.9%

$596

$796

83

6.5x

5.7x

15.0x

10.8x

1.6x

1.4x

AEGION

$23.06

90.5%

120.5%

$886

$1,137

NA

8.3x

7.2x

15.0x

12.3x

13.3%

1.7x

1.5x

DYCOM

$28.12

83.996

118.7%

$995

$1,389

Ba2

7.0x

6.1x

20.5x

15.0x

12.9%

2.0x

1.7x

EMCOR MasTec

$40.82

85.4%

112.6%

$2,782

$2,704

Bal

7.2x

Enterprise Value = Market Value of Equity + Short-tarm Diabt + Long-term Debt + Preferred Equity + Minority Interest Cash and Morlatobla Sacurities.

Estimates obtained from Wall Street research and colendorized when necessary

Based on Wall Street research.

Excluding Pionear.

6.5x

15.Ex

13.7x

12.6%

(0.2x)

(0.2x)

$27.15

61.4%

101.9%

$2,144

$3,034

Ba2

6.7x

5.5x

14.9x

11.0x

12.3%

1.6x

DULITE

SERVIERE

$33.83

91.3% 1

1

132.3%

$7,340

$7,084

WR

9.2x

7.4x

17.1x

14.3x

12.8%

(0.3x)

(0.3x)

1

H

I

1

1

1

!

I

1

1

I

1

I

Bank of America

Merrill Lynch

Mean (4)

1

7.3x

6.3x

16.3x

13.1x

12.3%

0.9x

0.7x

Median (4) I

1

7.0x

6.1x

15.5x

13.7x

12.7%

1.6x

1.4x

1

1View entire presentation