Apollo Global Management Investor Presentation Deck

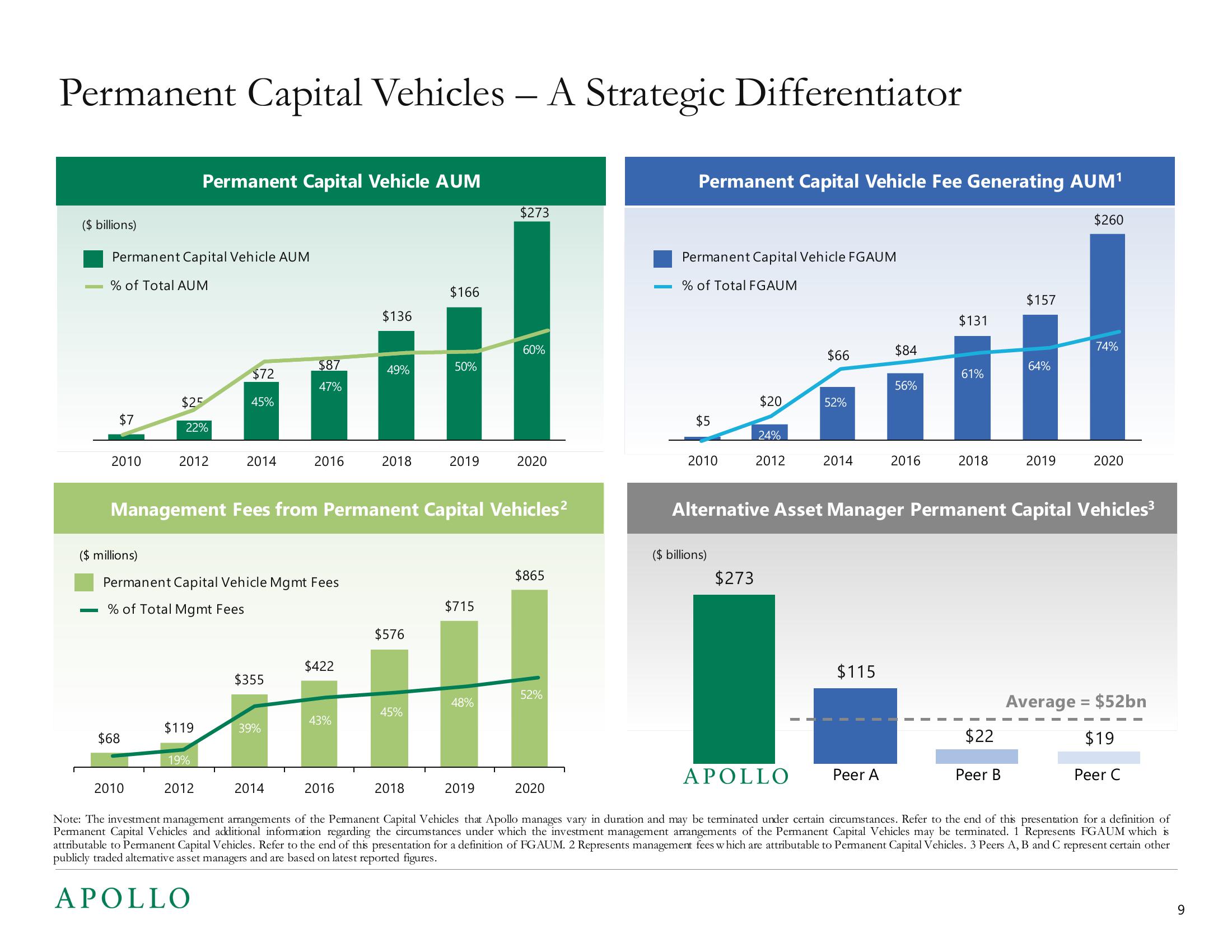

Permanent Capital Vehicles - A Strategic Differentiator

($ billions)

Permanent Capital Vehicle AUM

% of Total AUM

$7

2010

($ millions)

$68

$25

Permanent Capital Vehicle AUM

22%

2010

2012

$119

19%

$72

45%

Permanent Capital Vehicle Mgmt Fees

% of Total Mgmt Fees

2012

2014

$355

$87

47%

39%

2016

Management Fees from Permanent Capital Vehicles²

2014

$422

43%

$136

I

2016

49%

2018

$576

45%

$166

50%

2018

2019

$715

48%

$273

60%

2019

2020

$865

52%

Permanent Capital Vehicle Fee Generating AUM¹

2020

Permanent Capital Vehicle FGAUM

% of Total FGAUM

$5

2010

($ billions)

$20

24%

2012

$273

$66

52%

2014

$115

$84

Peer A

56%

2016

$131

61%

2018

$22

$157

Alternative Asset Manager Permanent Capital Vehicles³

Peer B

64%

2019

APOLLO

Note: The investment management arrangements of the Permanent Capital Vehicles that Apollo manages vary in duration and may be terminated under certain circumstances. Refer to the end of this presentation for a definition of

Permanent Capital Vehicles and additional information regarding the circumstances under which the investment management arrangements of the Permanent Capital Vehicles may be terminated. 1 Represents FGAUM which is

attributable to Permanent Capital Vehicles. Refer to the end of this presentation for a definition of FGAUM. 2 Represents management fees which are attributable to Permanent Capital Vehicles. 3 Peers A, B and C represent certain other

publicly traded alternative asset managers and are based on latest reported figures.

APOLLO

$260

74%

2020

Average = $52bn

$19

Peer C

9View entire presentation