Ares U.S. Real Estate Opportunity Fund IV, L.P. (“AREOF IV”)

Ares U.S. Opportunistic Real Estate Track Record

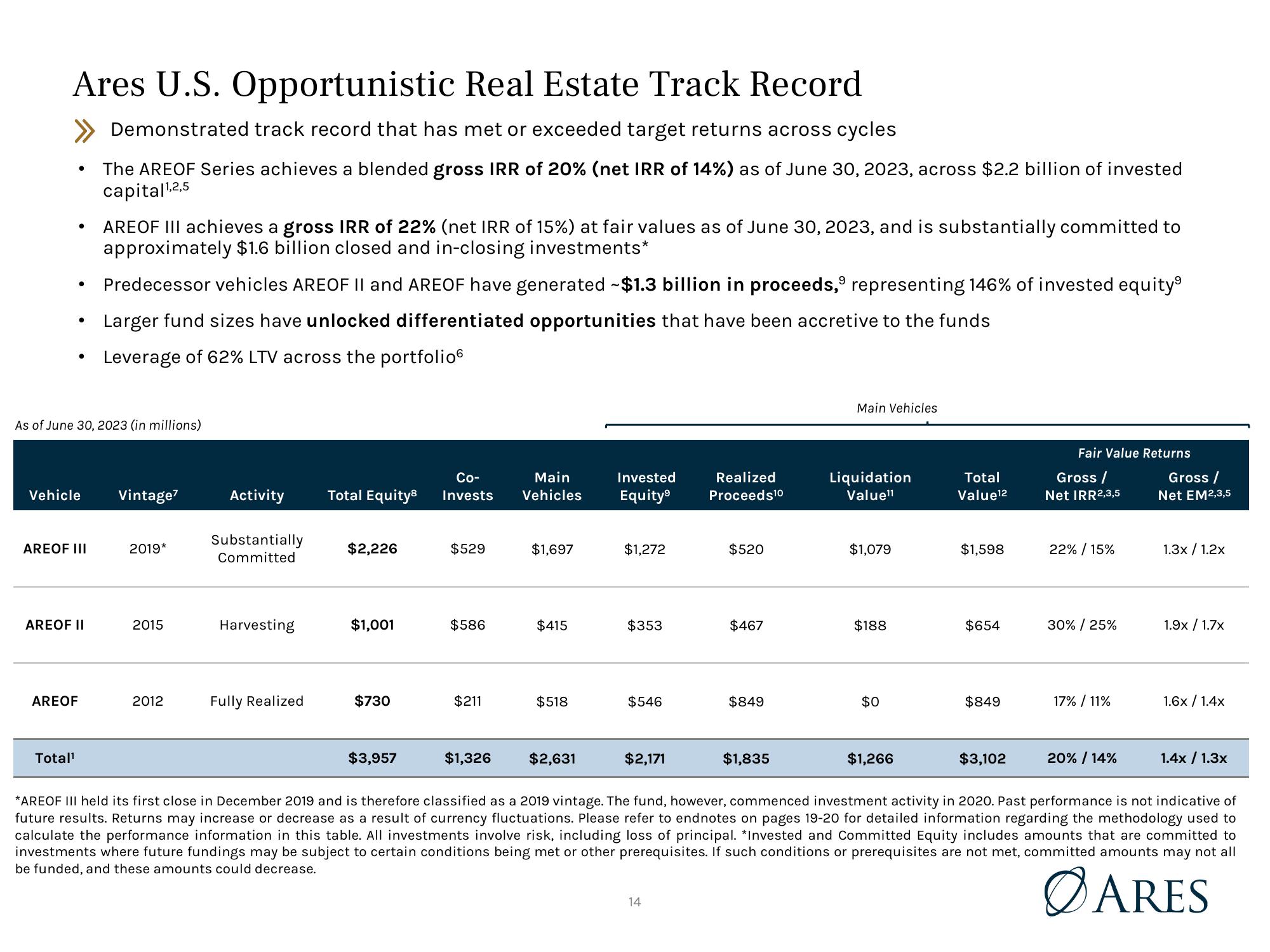

Demonstrated track record that has met or exceeded target returns across cycles

●

●

●

AREOF

●

Vehicle

Total¹

As of June 30, 2023 (in millions)

AREOF III

AREOF II

The AREOF Series achieves a blended gross IRR of 20% (net IRR of 14%) as of June 30, 2023, across $2.2 billion of invested

capital¹,2,5

AREOF III achieves a gross IRR of 22% (net IRR of 15%) at fair values as of June 30, 2023, and is substantially committed to

approximately $1.6 billion closed and in-closing investments*

Predecessor vehicles AREOF II and AREOF have generated -$1.3 billion in proceeds, representing 146% of invested equity

Larger fund sizes have unlocked differentiated opportunities that have been accretive to the funds

Leverage of 62% LTV across the portfolio

Vintage7

2019*

2015

2012

Activity

Substantially

Committed

Harvesting

Fully Realized

Co-

Total Equity Invests

$2,226

$1,001

$730

$3,957

$529

$586

$211

$1,326

Main

Vehicles

$1,697

$415

$518

$2,631

Invested

Equity⁹

$1,272

$353

$546

$2,171

Realized

Proceeds ¹0

14

$520

$467

$849

$1,835

Main Vehicles

Liquidation

Value¹1

$1,079

$188

$0

$1,266

Total

Value¹2

$1,598

$654

$849

$3,102

Fair Value Returns

Gross /

Net IRR2,3,5

22% / 15%

30% / 25%

17% / 11%

20% / 14%

Gross /

Net EM2,3,5

1.3x/ 1.2x

1.9x / 1.7x

1.6x / 1.4x

1.4x / 1.3x

*AREOF III held its first close in December 2019 and is therefore classified as a 2019 vintage. The fund, however, commenced investment activity in 2020. Past performance is not indicative of

future results. Returns may increase or decrease as a result of currency fluctuations. Please refer to endnotes on pages 19-20 for detailed information regarding the methodology used to

calculate the performance information in this table. All investments involve risk, including loss of principal. *Invested and Committed Equity includes amounts that are committed to

investments where future fundings may be subject to certain conditions being met or other prerequisites. If such conditions or prerequisites are not met, committed amounts may not all

be funded, and these amounts could decrease.

ØARESView entire presentation