Commercial Metals Company Results Presentation Deck

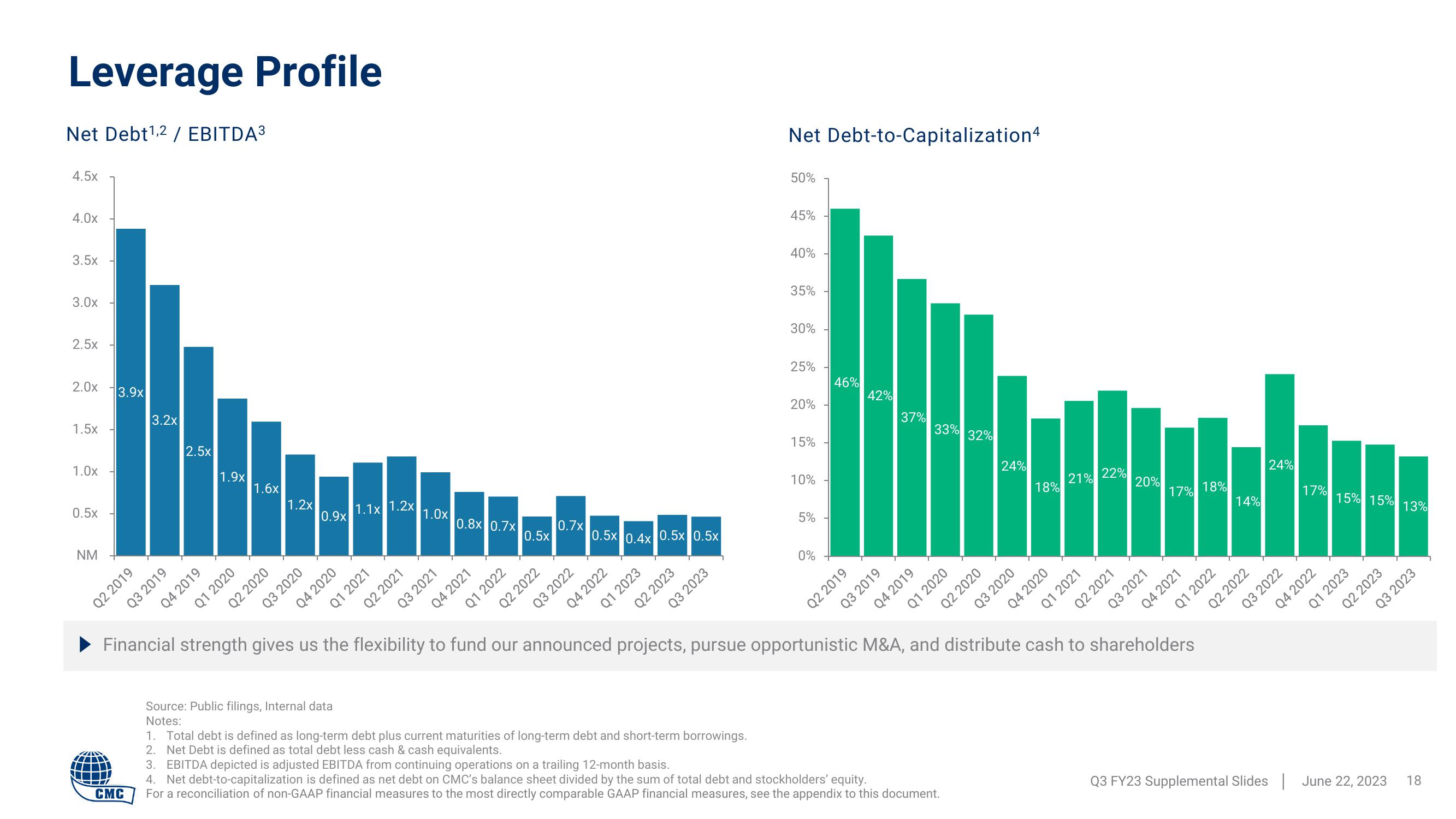

Leverage Profile

Net Debt¹,2 / EBITDA³

4.5x

4.0x

3.5x

3.0x

2.5x

2.0x

1.5x

1.0x

0.5x

NM

13.9x

Q2 2019

CMC

3.2x

Q3 2019

2.5x

Q4 2019

01 2020

1.6x

Q2 2020

1.2x

Q3 2020

0.9x

Q4 2020

1.1x 1.2x

Q1 2021

Source: Public filings, Internal data

Notes:

1.0x

Q2 2021

Q3 2021

0.8x 0.7x

Q4 2021

Q1 2022

0.5x

0.7x

Q2 2022

Q3 2022

0.5x 0.4x 0.5x 0.5x

Q4 2022

Q1 2023

Q2 2023

Q3 2023

Net Debt-to-Capitalization4

1. Total debt is defined as long-term debt plus current maturities of long-term debt and short-term borrowings.

2. Net Debt is defined as total debt less cash & cash equivalents.

50%

45%

40%

35%

30%

25%

20%

15%

10%

5%

0%

T

46%

Q2 2019

42%

Q3 2019

37%

Q4 2019

33% 32%

Q1 2020

Q2 2020

3. EBITDA depicted is adjusted EBITDA from continuing operations on a trailing 12-month basis.

4. Net debt-to-capitalization is defined as net debt on CMC's balance sheet divided by the sum of total debt and stockholders' equity.

For a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document.

24%

Q3 2020

21%

18% 2

04 2020

Q1 2021

22%

Q2 2021

20%

Q3 2021

Financial strength gives us the flexibility to fund our announced projects, pursue opportunistic M&A, and distribute cash to shareholders

17%

Q4 2021

18%

Q1 2022

14%

Q2 2022

24%

Q3 2022

17%

Q4 2022

15% 15% 13%

Q1 2023

Q2 2023

Q3 FY23 Supplemental Slides June 22, 2023

Q3 2023

18View entire presentation