Origin SPAC Presentation Deck

Operational

Valuation

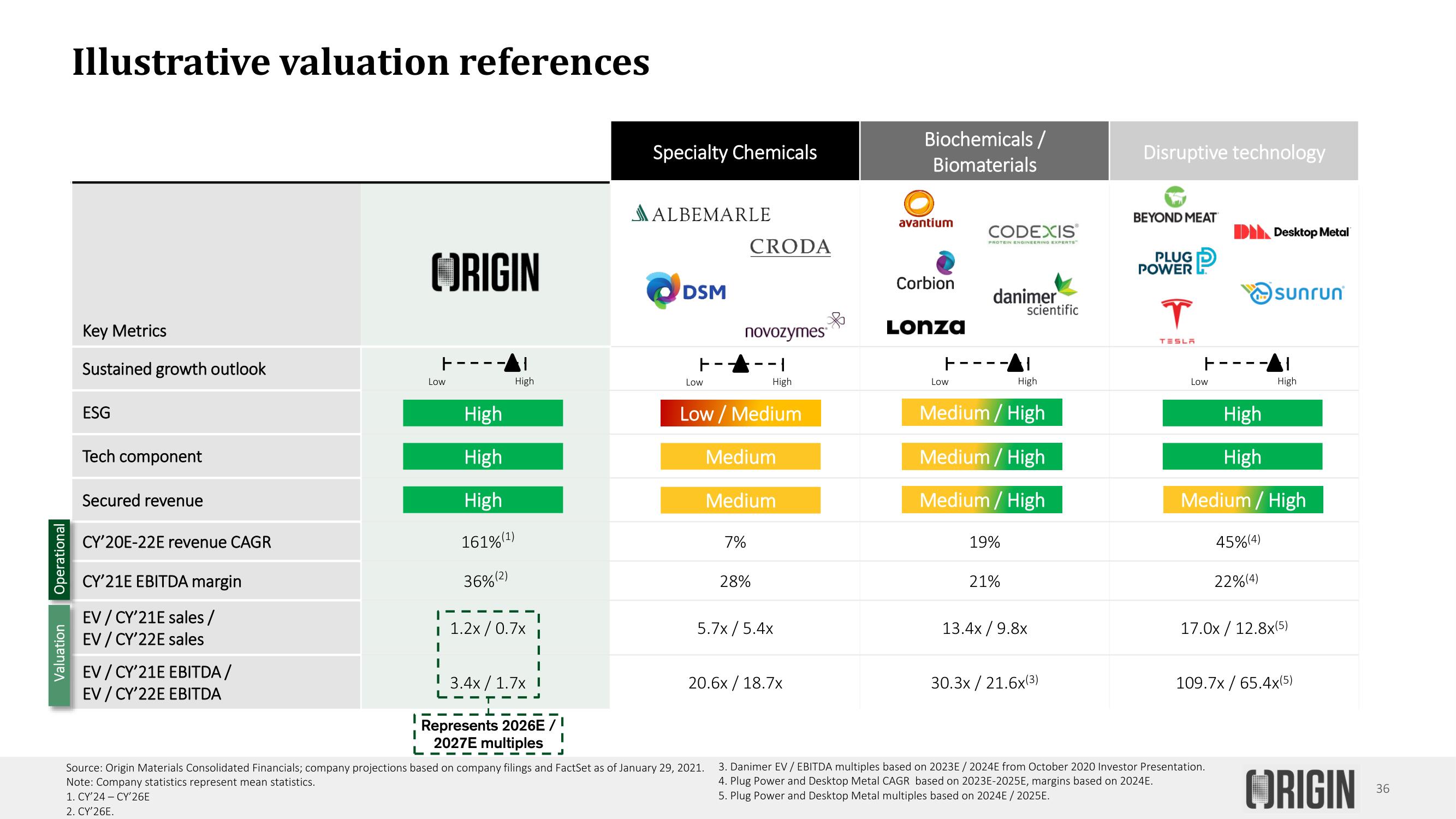

Illustrative valuation references

Key Metrics

Sustained growth outlook

ESG

Tech component

Secured revenue

CY'20E-22E revenue CAGR

CY'21E EBITDA margin

EV/CY'21E sales/

EV/CY'22E sales

EV/CY'21E EBITDA/

EV/CY'22E EBITDA

ORIGIN

I

L

Low

High

High

High

161% (¹)

36% (2)

High

I

I 1.2x/0.7x

I

13.4x / 1.7x

Represents 2026E/

2027E multiples

Specialty Chemicals

AALBEMARLE

DSM

Low

novozymes

-1

High

Low / Medium

CRODA

--L

Source: Origin Materials Consolidated Financials; company projections based on company filings and FactSet as of January 29, 2021.

Note: Company statistics represent mean statistics.

1. CY'24-CY'26E

2. CY'26E.

Medium

Medium

7%

28%

5.7x/5.4x

20.6x/18.7x

Biochemicals/

Biomaterials

avantium

Corbion

Lonza

7--

Low

CODEXIS

PROTEIN ENGINEERING EXPERTS

danimer

19%

scientific

Medium / High

Medium / High

Medium / High

21%

High

13.4x/9.8x

30.3x/ 21.6x(3)

Disruptive technology

BEYOND MEAT

PLUG

POWER

T

TESLA

Low

D Desktop Metal

High

High

Medium / High

45%(4)

3. Danimer EV / EBITDA multiples based on 2023E / 2024E from October 2020 Investor Presentation.

4. Plug Power and Desktop Metal CAGR based on 2023E-2025E, margins based on 2024E.

5. Plug Power and Desktop Metal multiples based on 2024E / 2025E.

sunrun

22%(4)

High

17.0x/ 12.8x(5)

109.7x/65.4x(5)

ORIGIN

36View entire presentation