Morgan Stanley Investment Banking Pitch Book

.

●

Project Roosevelt

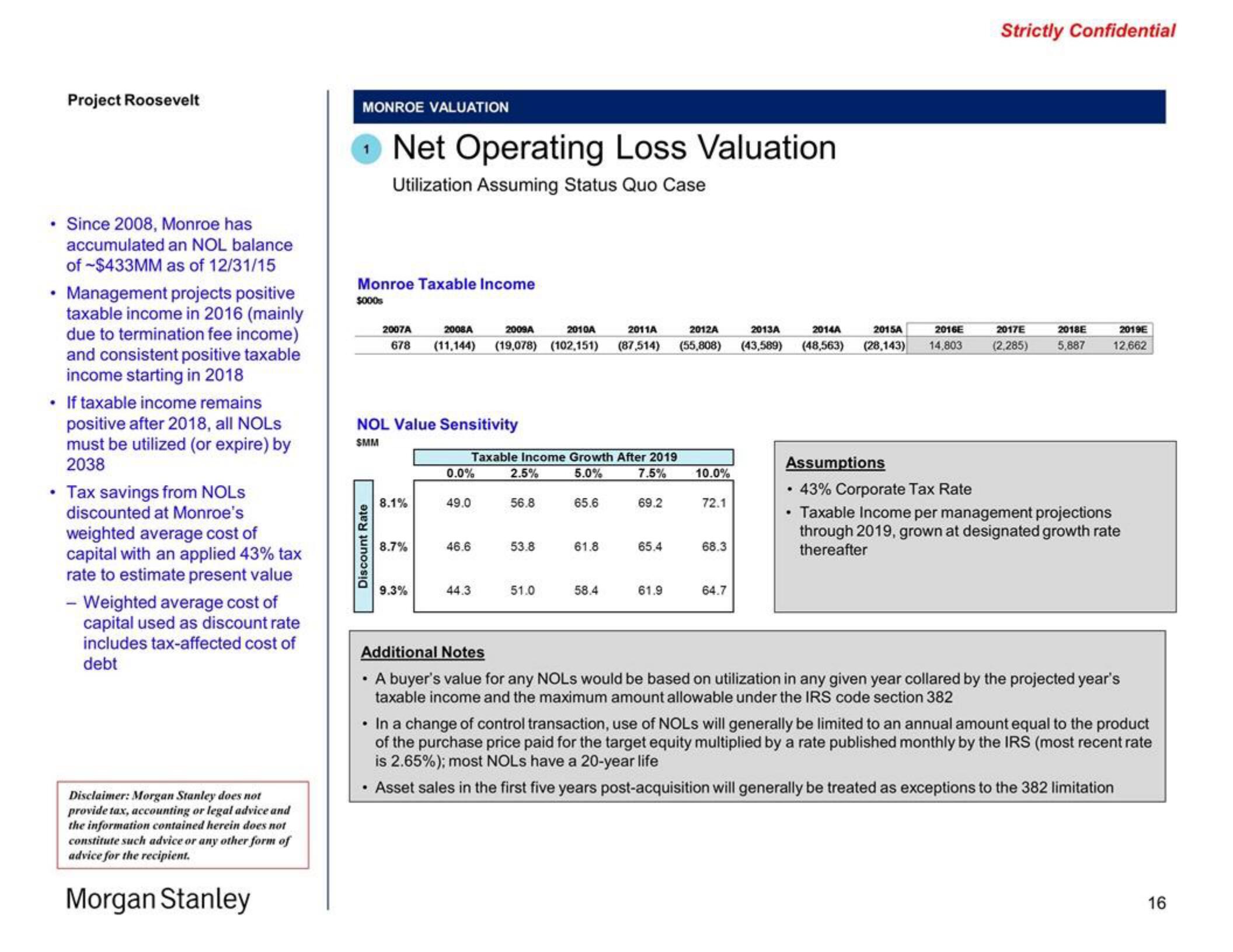

Since 2008, Monroe has

accumulated an NOL balance

of -$433MM as of 12/31/15

Management projects positive

taxable income in 2016 (mainly

due to termination fee income)

and consistent positive taxable

income starting in 2018

• If taxable income remains

positive after 2018, all NOLS

must be utilized (or expire) by

2038

• Tax savings from NOLS

discounted at Monroe's

weighted average cost of

capital with an applied 43% tax

rate to estimate present value

- Weighted average cost of

capital used as discount rate

includes tax-affected cost of

debt

Disclaimer: Morgan Stanley does not

provide tax, accounting or legal advice and

the information contained herein does not

constitute such advice or any other form of

advice for the recipient.

Morgan Stanley

MONROE VALUATION

Net Operating Loss Valuation

Utilization Assuming Status Quo Case

Monroe Taxable Income

$000s

Discount Rate

NOL Value Sensitivity

SMM

2007A

2008.A

2009A

2010A

2011A

2012A

2013A

2014A

2015A

2016E

2017E

2018E

2019E

678 (11,144) (19,078) (102,151) (87,514) (55,808) (43,589) (48,563) (28,143) 14,803 (2,285) 5,887 12,662

8.1%

8.7%

9.3%

0.0%

Taxable Income Growth After 2019

2.5%

5.0%

7.5%

49.0

46.6

44.3

56.8

53.8

51.0

65.6

61.8

58.4

69.2

65.4

61.9

10.0%

72.1

68.3

64.7

Strictly Confidential

Assumptions

43% Corporate Tax Rate

Taxable Income per management projections

through 2019, grown at designated growth rate

thereafter

.

.

Additional Notes

A buyer's value for any NOLS would be based on utilization in any given year collared by the projected year's

taxable income and the maximum amount allowable under the IRS code section 382

●

In a change of control transaction, use of NOLS will generally be limited to an annual amount equal to the product

of the purchase price paid for the target equity multiplied by a rate published monthly by the IRS (most recent rate

is 2.65%); most NOLS have a 20-year life

Asset sales in the first five years post-acquisition will generally be treated as exceptions to the 382 limitation

16View entire presentation