TPG Results Presentation Deck

AUM Rollforward

■

■

■

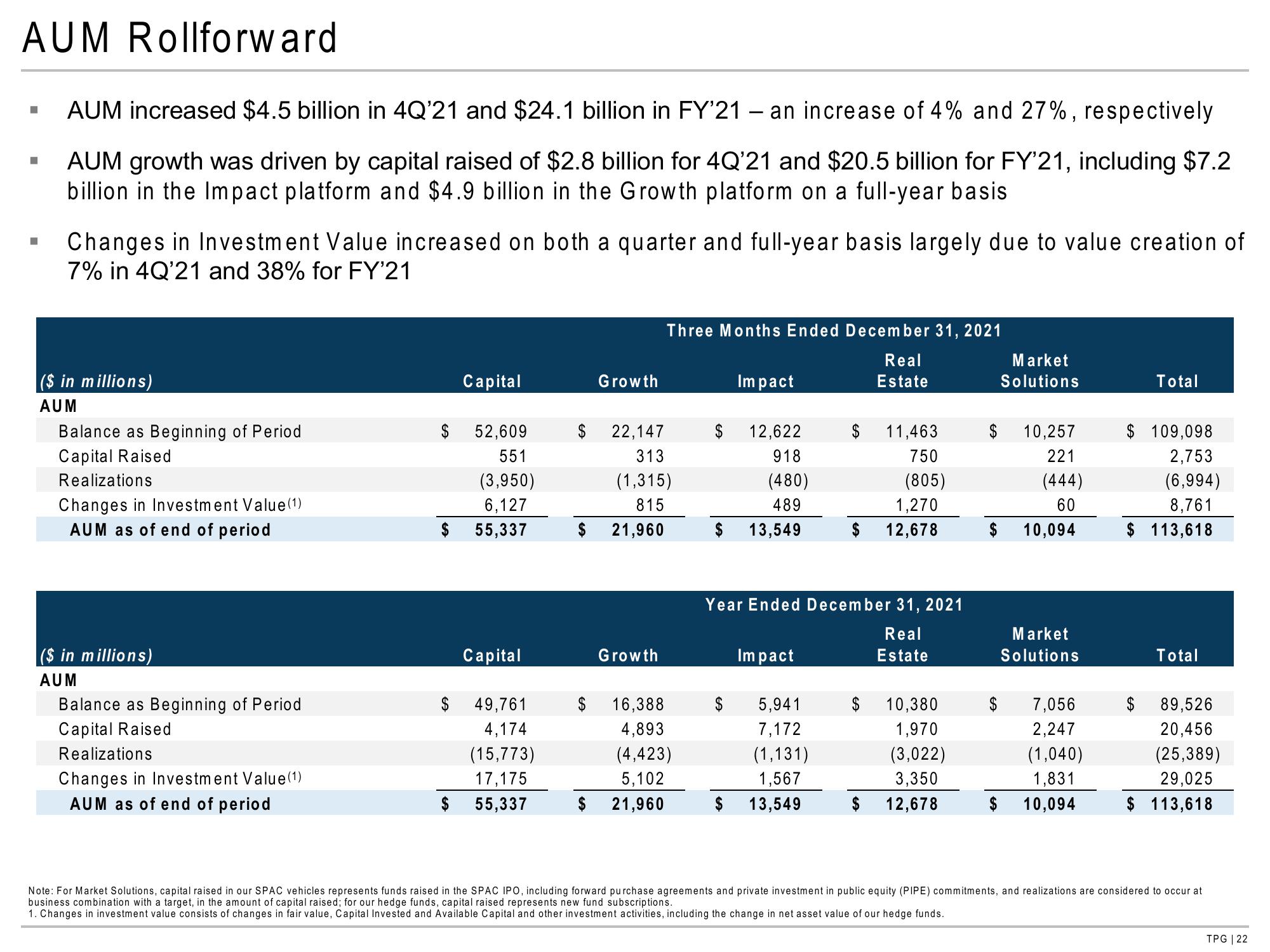

AUM increased $4.5 billion in 4Q'21 and $24.1 billion in FY'21 - an increase of 4% and 27%, respectively

AUM growth was driven by capital raised of $2.8 billion for 4Q'21 and $20.5 billion for FY'21, including $7.2

billion in the Impact platform and $4.9 billion in the Growth platform on a full-year basis

Changes in Investment Value increased on both a quarter and full-year basis largely due to value creation of

7% in 4Q'21 and 38% for FY'21

($ in millions)

AUM

Balance as Beginning of Period

Capital Raised

Realizations

Changes in Investment Value (1)

AUM as of end of period

($ in millions)

AUM

Balance as Beginning of Period

Capital Raised

Realizations

Changes in Investment Value (1)

AUM as of end of period

$

$

Capital

$

52,609

551

(3,950)

6,127

55,337

Capital

$ 49,761

4,174

(15,773)

17,175

55,337

Growth

$ 22,147

313

(1,315)

815

$ 21,960

Growth

Three Months Ended December 31, 2021

Real

Estate

$ 16,388

4,893

(4,423)

5,102

$ 21,960

Impact

12,622

918

(480)

489

13,549

Impact

$ 11,463

750

(805)

Year Ended December 31, 2021

Real

Estate

5,941

7,172

(1,131)

1,567

13,549

1,270

$ 12,678

$ 10,380

1,970

(3,022)

3,350

$ 12,678

Market

Solutions

10,257

221

(444)

60

$ 10,094

Market

Solutions

7,056

2,247

(1,040)

1,831

$ 10,094

Total

$ 109,098

2,753

(6,994)

8,761

$ 113,618

$

Total

89,526

20,456

(25,389)

29,025

$ 113,618

Note: For Market Solutions, capital raised in our SPAC vehicles represents funds raised in the SPAC IPO, including forward purchase agreements and private investment in public equity (PIPE) commitments, and realizations are considered to occur at

business combination with a target, in the amount of capital raised; for our hedge funds, capital raised represents new fund subscriptions.

1. Changes in investment value consists of changes in fair value, Capital Invested and Available Capital and other investment activities, including the change in net asset value of our hedge funds.

TPG | 22View entire presentation