Confluent IPO Presentation Deck

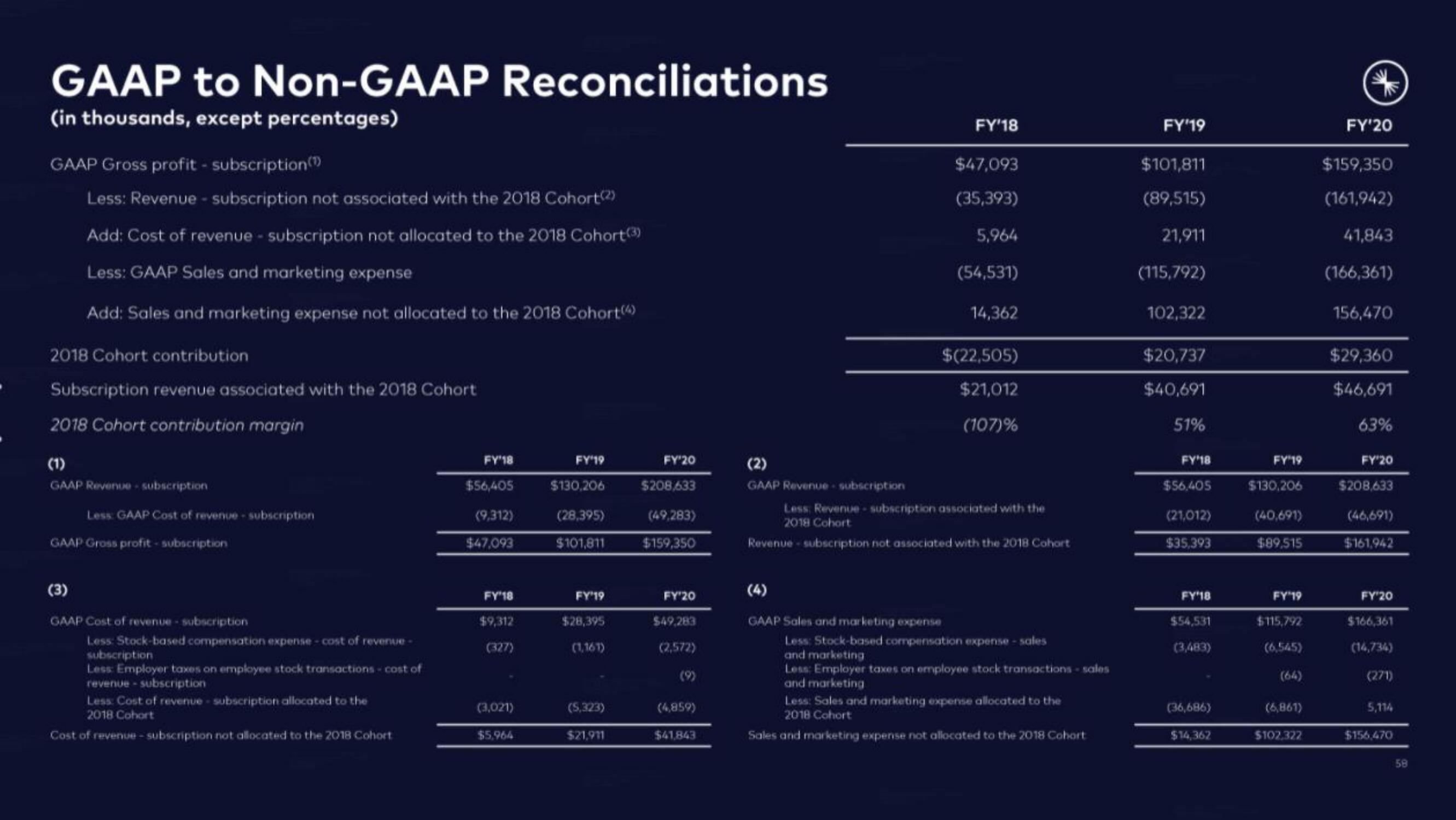

GAAP to Non-GAAP Reconciliations

(in thousands, except percentages)

GAAP Gross profit - subscription()

Less: Revenue - subscription not associated with the 2018 Cohort(2)

Add: Cost of revenue subscription not allocated to the 2018 Cohort (3)

Less: GAAP Sales and marketing expense

Add: Sales and marketing expense not allocated to the 2018 Cohort(4)

2018 Cohort contribution

Subscription revenue associated with the 2018 Cohort

2018 Cohort contribution margin

GAAP Revenue- subscription

Less: GAAP Cost of revenue -subscription

GAAP Gross profit-subscription

(3)

GAAP Cost of revenue- subscription

Less: Stock-based compensation expense-cost of revenue-

subscription

Less: Employer taxes on employee stock transactions - cost of

revenue -subscription

Less: Cost of revenue- subscription allocated to the

2018 Cohort

Cost of revenue -subscription not allocated to the 2018 Cohort

FY'18

$56,405

(9,312)

$47,093

FY'18

$9,312

(327)

(3,021)

$5,964

FY'19

$130,206

(28,395)

$101,811

FY'19

$28,395

(1,167)

(5,323)

$21,911

FY'20

$208,633

(49,283)

$159,350

FY'20

$49,283

(2,572)

(4,859)

$41,843

(2)

GAAP Revenue subscription

FY'18

$47,093

(35,393)

5,964

(54,531)

GAAP Sales and marketing expense

14,362

$(22,505)

$21,012

(107)%

Less: Revenue -subscription associated with the

2018 Cohort

Revenue subscription not associated with the 2018 Cohort

Less: Stock-based compensation expense - sales

and marketing

Less: Employer taxes on employee stock transactions - sales

and marketing

Less: Sales and marketing expense allocated to the

2018 Cohort

Sales and marketing expense not allocated to the 2018 Cohort

FY'19

$101,811

(89,515)

21,911

(115,792)

102,322

$20,737

$40,691

51%

FY'18

$56,405

(21,012)

$35,393

FY'18

$54,531

(3,483)

(36,686)

$14,362

FY'19

$130,206

(40,691)

$89.515

FY'19

$115,792

(6,545)

(6,861)

$102,322

FY'20

$159,350

(161,942)

41,843

(166,361)

156,470

$29,360

$46,691

63%

FY'20

$208,633

(46,691)

$161,942

FY'20

$166,361

(14,734)

(271)

5,114

$156,470

58View entire presentation