Centrica Results Presentation Deck

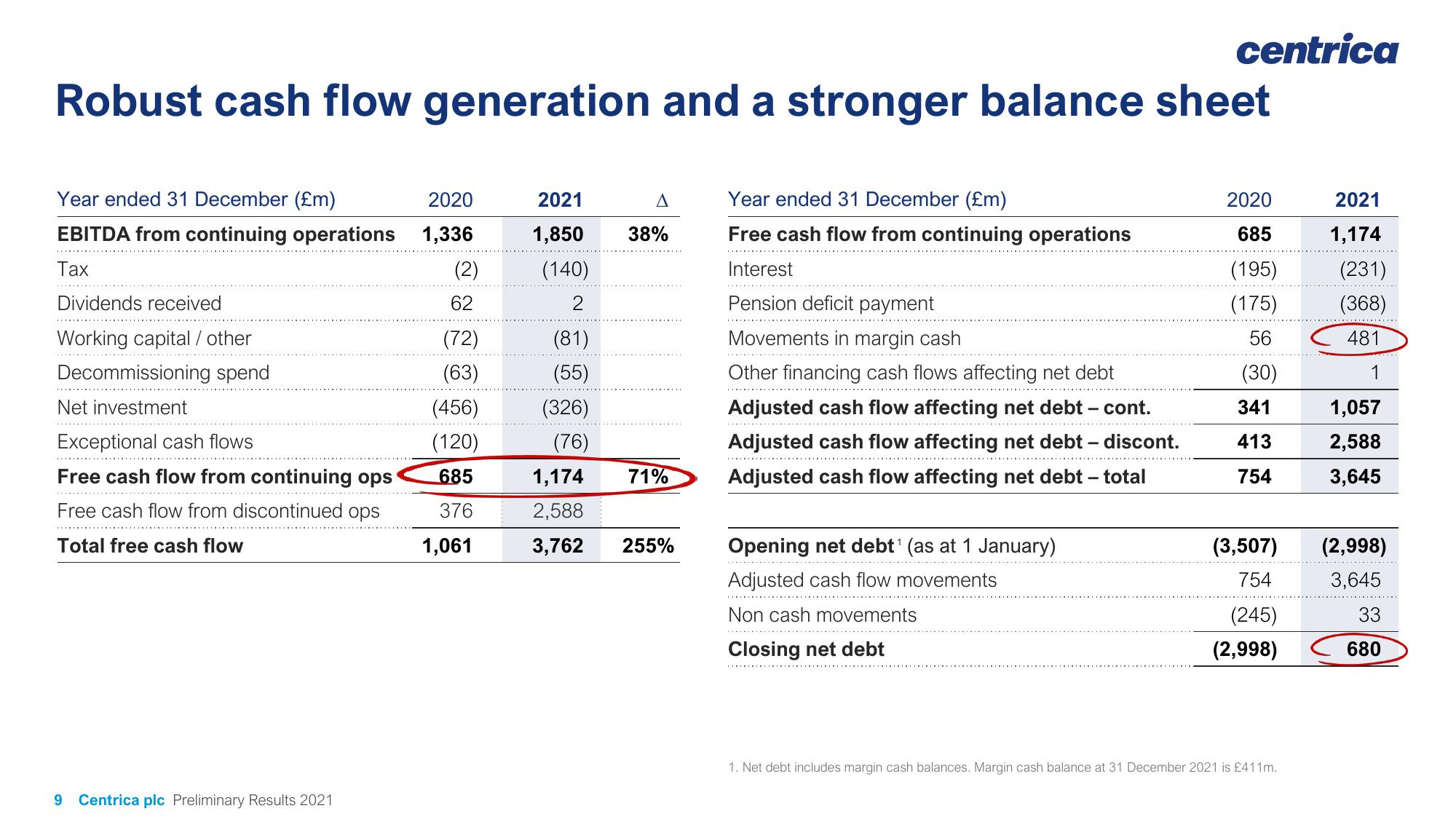

Robust cash flow generation and a stronger balance sheet

Year ended 31 December (£m)

EBITDA from continuing operations

Tax

Dividends received

Working capital / other

Decommissioning spend

Net investment

Exceptional cash flows

Free cash flow from continuing ops

Free cash flow from discontinued ops

Total free cash flow

9 Centrica plc Preliminary Results 2021

2020

1,336

(2)

62

(72)

(63)

(456)

(120)

685

376

1,061

2021

1,850

(140)

2

(81)

(55)

(326)

(76)

1,174

2,588

3,762

A

38%

71%

255%

Year ended 31 December (£m)

Free cash flow from continuing operations

Interest

Pension deficit payment

Movements in margin cash

Other financing cash flows affecting net debt

Adjusted cash flow affecting net debt - cont.

Adjusted cash flow affecting net debt - discont.

Adjusted cash flow affecting net debt - total

centrica

Opening net debt ¹ (as at 1 January)

Adjusted cash flow movements

Non cash movements

Closing net debt

2020

685

(195)

(175)

56

(30)

341

413

754

(3,507)

754

(245)

(2,998)

1. Net debt includes margin cash balances. Margin cash balance at 31 December 2021 is £411m.

2021

1,174

(231)

(368)

481

1

1,057

2,588

3,645

(2,998)

3,645

33

680View entire presentation