Silicon Valley Bank Results Presentation Deck

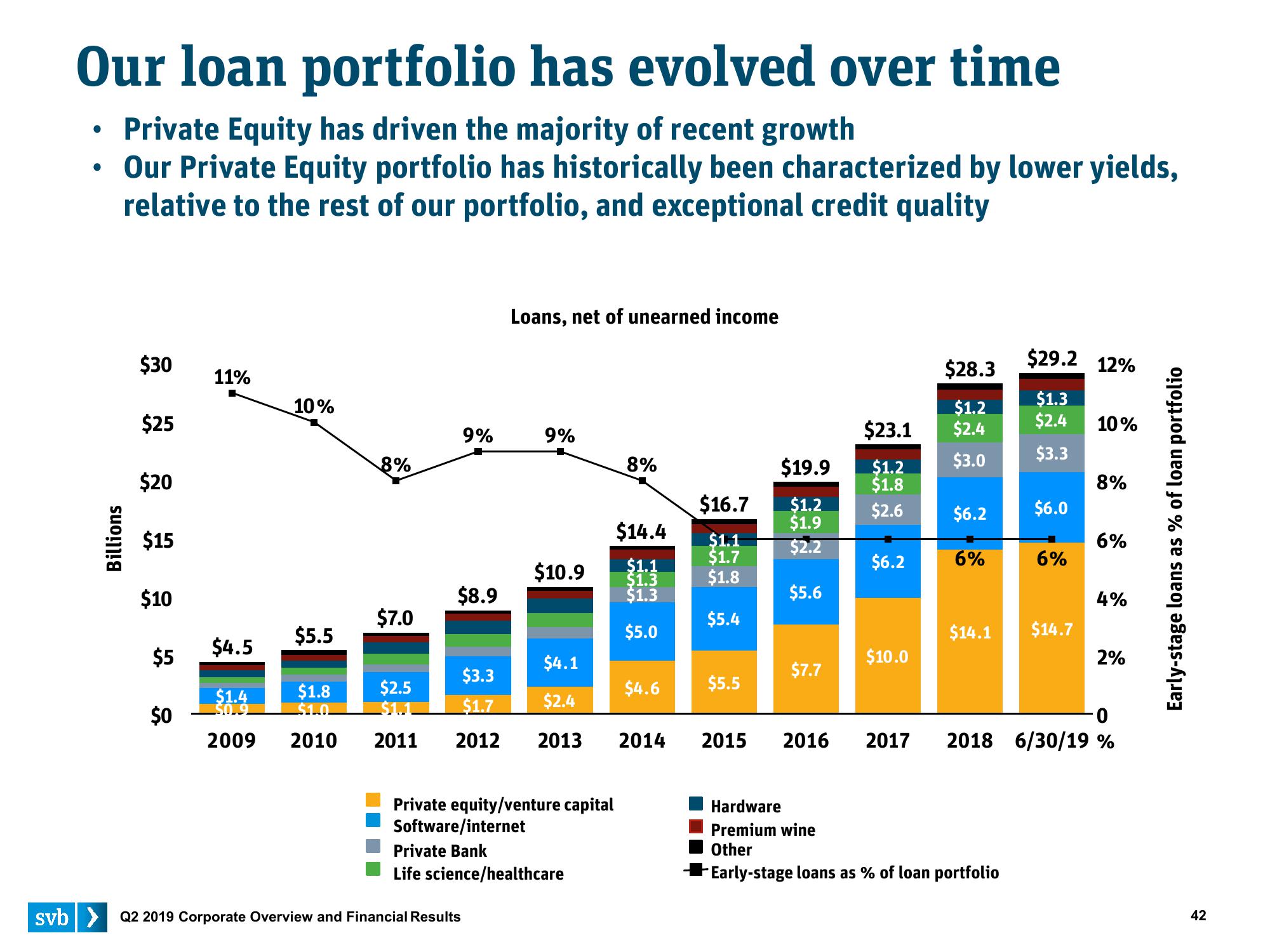

Our loan portfolio has evolved over time

• Private Equity has driven the majority of recent growth

Our Private Equity portfolio has historically been characterized by lower yields,

relative to the rest of our portfolio, and exceptional credit quality

Billions

$30

$25

$20

$15

$10

$5

$0

11%

$4.5

$1.4

$0.9

2009

10%

$5.5

$1.8

$1.0

2010

8%

$7.0

9%

$2.5

$8.9

Loans, net of unearned income

9%

$10.9

svb> Q2 2019 Corporate Overview and Financial Results

$4.1

$3.3

$1.7

$2.4

2011 2012 2013 2014

Private equity/venture capital

Software/internet

Private Bank

Life science/healthcare

8%

$14.4

$1.1

$1.3

$1.3

$5.0

$4.6

$16.7

$1.1

$1.7

$1.8

$5.4

$5.5

2015

$19.9

$1.2

$1.9

$2.2

$5.6

$7.7

$23.1

$1.2

$1.8

$2.6

$6.2

$10.0

2016 2017

$28.3

$1.2

$2.4

$3.0

$6.2

6%

$14.1

$29.2 12%

$1.3

$2.4

$3.3

Hardware

Premium wine

Other

Early-stage loans as % of loan portfolio

$6.0

6%

$14.7

10%

8%

6%

4%

2%

0

2018 6/30/19 %

Early-stage loans as % of loan portfolio

42View entire presentation