First Busey Results Presentation Deck

4Q23 Earnings Investor Presentation

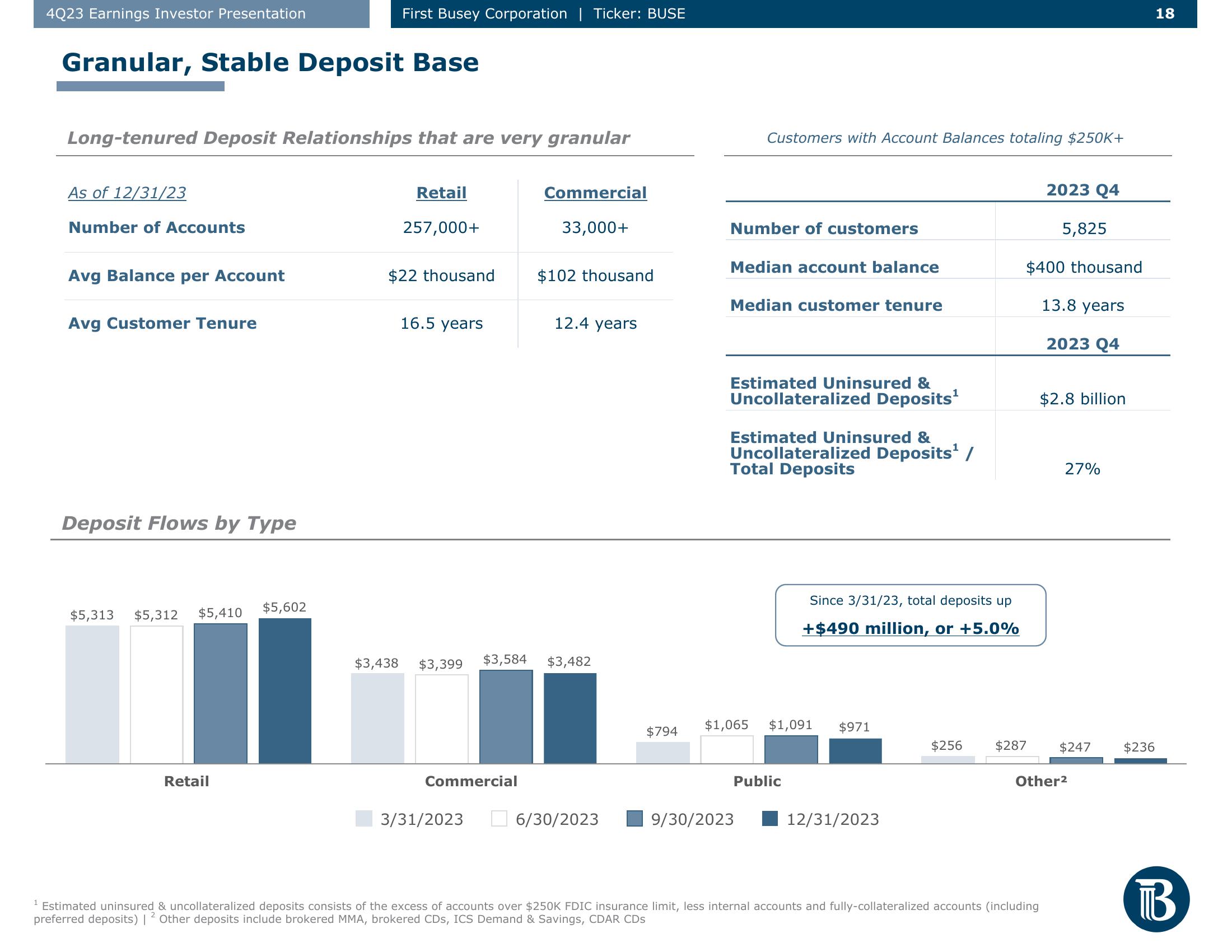

Granular, Stable Deposit Base

Long-tenured Deposit Relationships that are very granular

As of 12/31/23

Number of Accounts

Avg Balance per Account

Avg Customer Tenure

Deposit Flows by Type

$5,313 $5,312 $5,410

First Busey Corporation | Ticker: BUSE

Retail

$5,602

Retail

257,000+

$22 thousand

16.5 years

$3,438 $3,399 $3,584

Commercial

3/31/2023

Commercial

33,000+

$102 thousand

12.4 years

$3,482

6/30/2023

$794

Customers with Account Balances totaling $250K+

Number of customers

Median account balance

Median customer tenure

Estimated Uninsured &

Uncollateralized Deposits¹

Estimated Uninsured &

Uncollateralized Deposits¹ /

Total Deposits

$1,065 $1,091

Public

9/30/2023

Since 3/31/23, total deposits up

+$490 million, or +5.0%

1

$971

12/31/2023

2023 Q4

5,825

$400 thousand

Estimated uninsured & uncollateralized deposits consists of the excess of accounts over $250K FDIC insurance limit, less internal accounts and fully-collateralized accounts (including

preferred deposits) | Other deposits include brokered MMA, brokered CDs, ICS Demand & Savings, CDAR CDs

13.8 years

2023 Q4

$2.8 billion

27%

$256 $287 $247

Other²

$236

18

BView entire presentation