Bright Machines SPAC

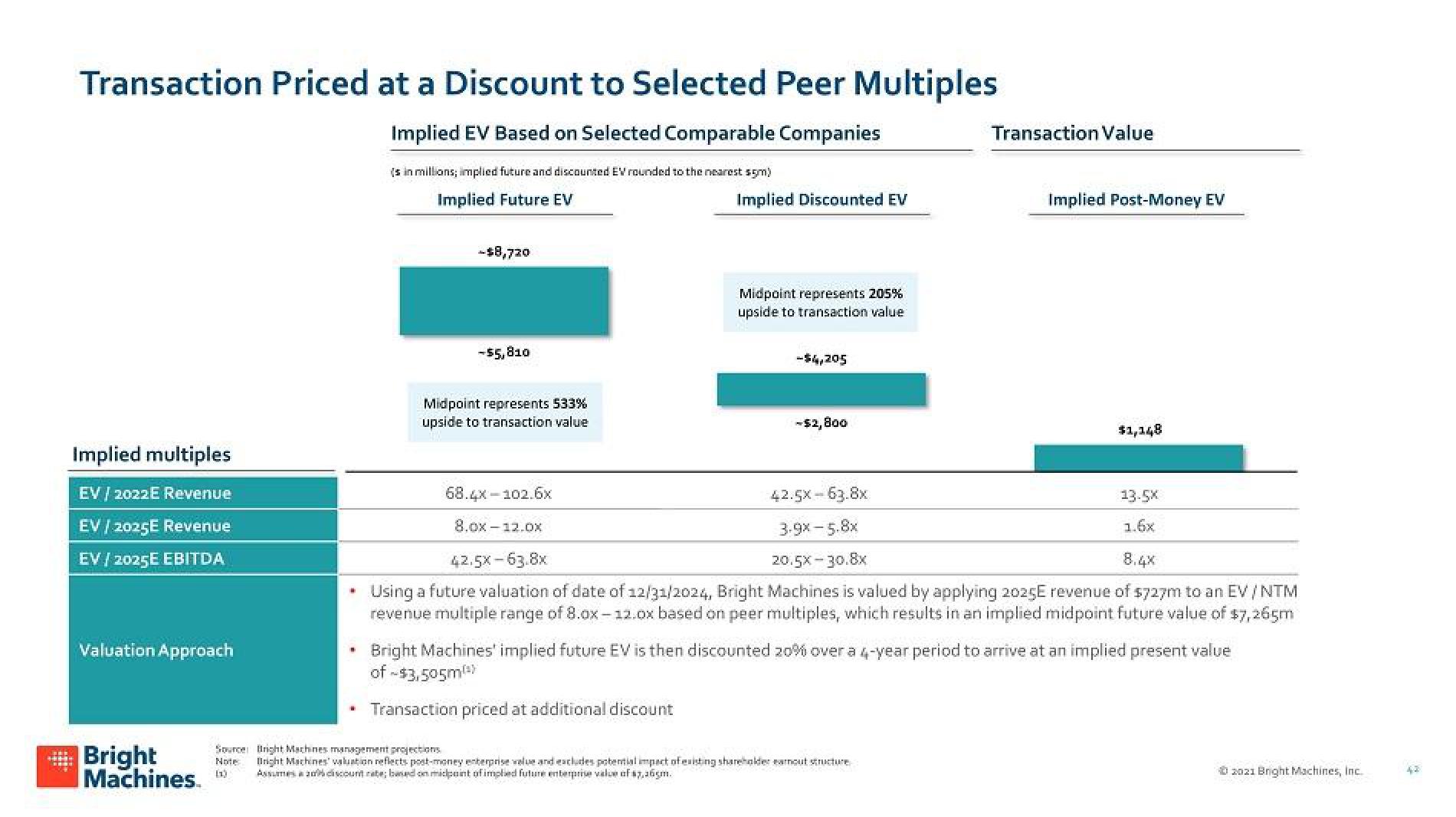

Transaction Priced at a Discount to Selected Peer Multiples

Implied EV Based on Selected Comparable Companies

(s in millions; implied future and discounted EV rounded to the nearest s5m)

Implied Future EV

Implied multiples

EV/ 2022E Revenue

EV/2025E Revenue

EV/2025E EBITDA

Valuation Approach

Bright

Machines.

H

-$8,720

-$5,810

Midpoint represents 533%

upside to transaction value

Implied Discounted EV

68.4x-102.6x

8.ox-12.0x

Midpoint represents 205%

upside to transaction value

-$4,205

-$2,800

Transaction Value

Source Bright Machines management projections

Note

Bright Machines' valuation reflects post-money enterprise value and excludes potential impact of existing shareholder enout structure

Assumes a 20% discount rate; based on midpoint of impled future enterprise value of $7,65m.

Implied Post-Money EV

13.58

42.5X63.8x

3.9x-5.8x

20,5×-30.8x

1.6x

42,5X-63.8x

8.4%

Using a future valuation of date of 12/31/2024, Bright Machines is valued by applying 2025E revenue of $727m to an EV/NTM

revenue multiple range of 8.0x-12.0x based on peer multiples, which results in an implied midpoint future value of $7,265m

Bright Machines' implied future EV is then discounted 20% over a 4-year period to arrive at an implied present value

of -$3,505m²)

Transaction priced at additional discount

$1,148

Ⓒ2021 Bright Machines, Inc.

42View entire presentation