Sweetheart Brands Acquisition

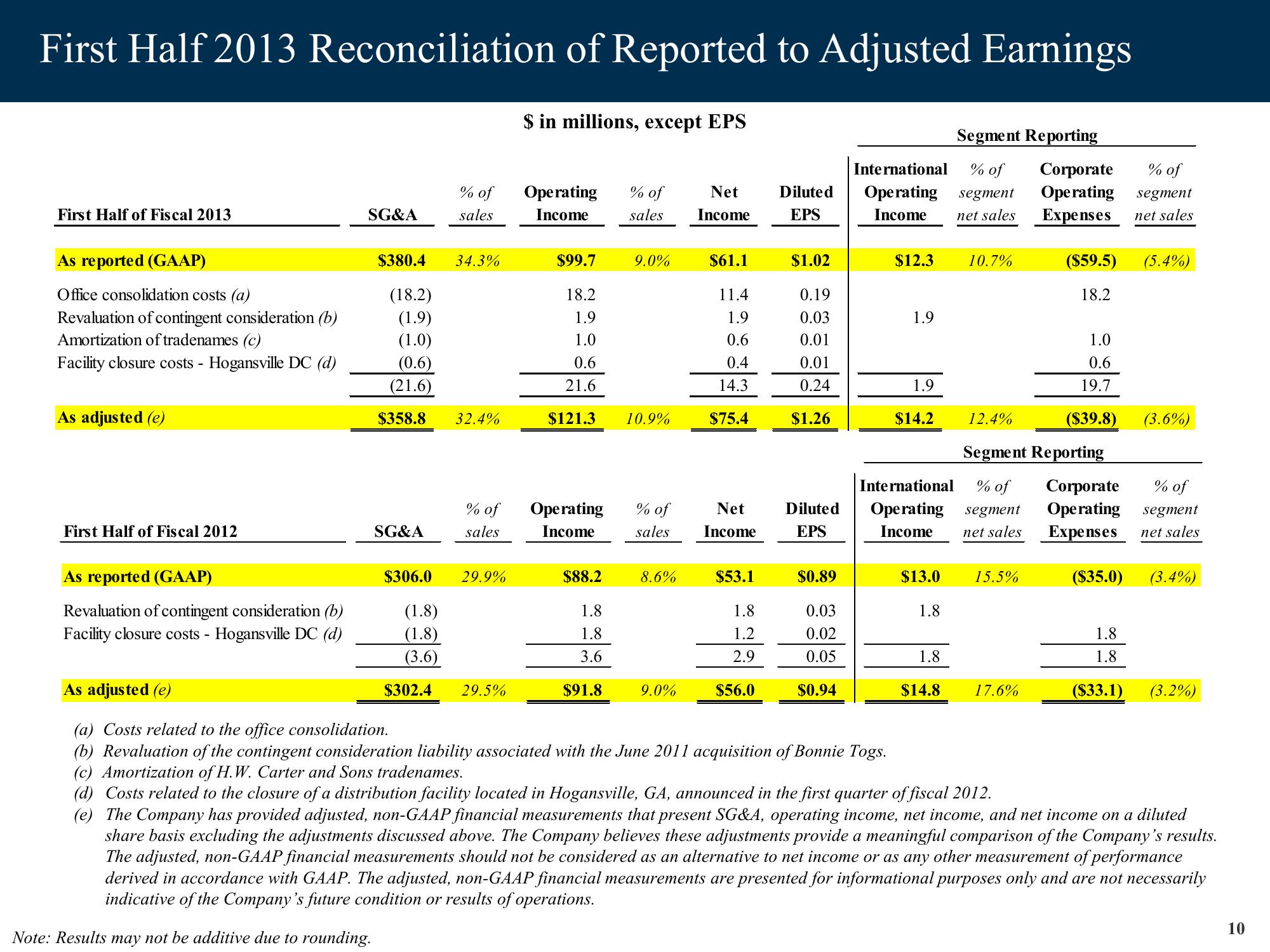

First Half 2013 Reconciliation of Reported to Adjusted Earnings

First Half of Fiscal 2013

As reported (GAAP)

Office consolidation costs (a)

Revaluation of contingent consideration (b)

Amortization of tradenames (c)

Facility closure costs - Hogansville DC (d)

As adjusted (e)

First Half of Fiscal 2012

As reported (GAAP)

Revaluation of contingent consideration (b)

Facility closure costs - Hogansville DC (d)

SG&A

$380.4

(18.2)

(1.9)

(1.0)

(0.6)

(21.6)

$358.8

SG&A

$306.0

% of

sales

34.3%

32.4%

% of

sales

29.9%

(1.8)

(1.8)

(3.6)

$302.4 29.5%

$ in millions, except EPS

Operating

Income

$99.7

18.2

1.9

1.0

0.6

21.6

$121.3

Operating

Income

$88.2

1.8

1.8

3.6

$91.8

% of

sales

9.0%

10.9%

8.6%

Net

Income

% of

Net

sales Income

$61.1

11.4

1.9

0.6

0.4

14.3

$75.4

9.0%

$53.1

1.8

1.2

2.9

Diluted

EPS

$56.0

$1.02

0.19

0.03

0.01

0.01

0.24

$1.26

Diluted

EPS

$0.89

0.03

0.02

0.05

$0.94

Segment Reporting

International % of Corporate

Operating segment Operating

net sales Expenses

Income

As adjusted (e)

(a) Costs related to the office consolidation.

(b) Revaluation of the contingent consideration liability associated with the June 2011 acquisition of Bonnie Togs.

(c) Amortization of H.W. Carter and Sons tradenames.

$12.3

1.9

1.9

$14.2

International % of

Operating segment

Income

net sales

$13.0

1.8

1.8

10.7%

$14.8

12.4%

Segment Reporting

15.5%

($59.5)

18.2

17.6%

1.0

0.6

19.7

($39.8)

Corporate

Operating

Expenses

% of

segment

net sales

(5.4%)

(3.6%)

% of

segment

net sales

($35.0) (3.4%)

1.8

1.8

($33.1) (3.2%)

(d) Costs related to the closure of a distribution facility located in Hogansville, GA, announced in the first quarter of fiscal 2012.

(e) The Company has provided adjusted, non-GAAP financial measurements that present SG&A,

ating income, net income, and net income on a diluted

share basis excluding the adjustments discussed above. The Company believes these adjustments provide a meaningful comparison of the Company's results.

The adjusted, non-GAAP financial measurements should not be considered as an alternative to net income or as any other measurement of performance

derived in accordance with GAAP. The adjusted, non-GAAP financial measurements are presented for informational purposes only and are not necessarily

indicative of the Company's future condition or results of operations.

Note: Results may not be additive due to rounding.

10View entire presentation