Uber Results Presentation Deck

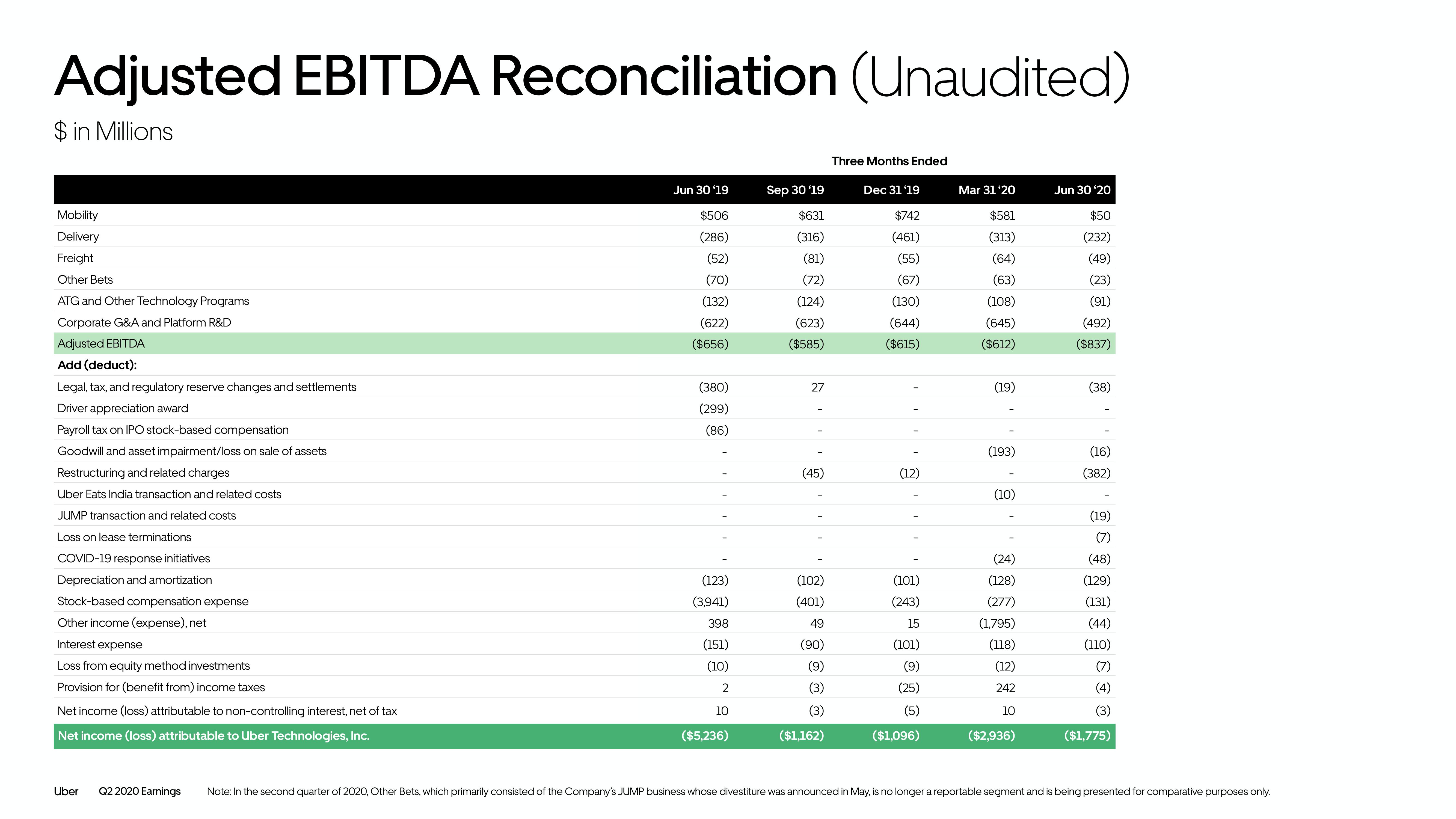

Adjusted EBITDA Reconciliation (Unaudited)

$ in Millions

Mobility

Delivery

Freight

Other Bets

ATG and Other Technology Programs

Corporate G&A and Platform R&D

Adjusted EBITDA

Add (deduct):

Legal, tax, and regulatory reserve changes and settlements

Driver appreciation award

Payroll tax on IPO stock-based compensation

Goodwill and asset impairment/loss on sale of assets

Restructuring and related charges

Uber Eats India transaction and related costs

JUMP transaction and related costs

Loss on lease terminations

COVID-19 response initiatives

Depreciation and amortization

Stock-based compensation expense

Other income (expense), net

Interest expense

Loss from equity method investments

Provision for (benefit from) income taxes

Net income (loss) attributable to non-controlling interest, net of tax

Net income (loss) attributable to Uber Technologies, Inc.

Uber Q2 2020 Earnings

Jun 30 '19

$506

(286)

(52)

(70)

(132)

(622)

($656)

(380)

(299)

(86)

(123)

(3,941)

398

(151)

(10)

2

10

($5,236)

Sep 30 '19

$631

(316)

(81)

(72)

(124)

(623)

($585)

27

(45)

(102)

(401)

49

(90)

(9)

(3)

(3)

($1,162)

Three Months Ended

Dec 31 '19

$742

(461)

(55)

(67)

(130)

(644)

($615)

(12)

(101)

(243)

15

(101)

(9)

(25)

(5)

($1,096)

Mar 31 '20

$581

(313)

(64)

(63)

(108)

(645)

($612)

(19)

(193)

(10)

(24)

(128)

(277)

(1,795)

(118)

(12)

242

10

($2,936)

Jun 30'20

$50

(232)

(49)

(23)

(91)

(492)

($837)

(38)

(16)

(382)

(19)

(7)

(48)

(129)

(131)

(44)

(110)

(7)

(4)

(3)

($1,775)

Note: In the second quarter of 2020, Other Bets, which primarily consisted of the Company's JUMP business whose divestiture was announced in May, is no longer a reportable segment and is being presented for comparative purposes only.View entire presentation