Cerberus Global NPL Fund, L.P.

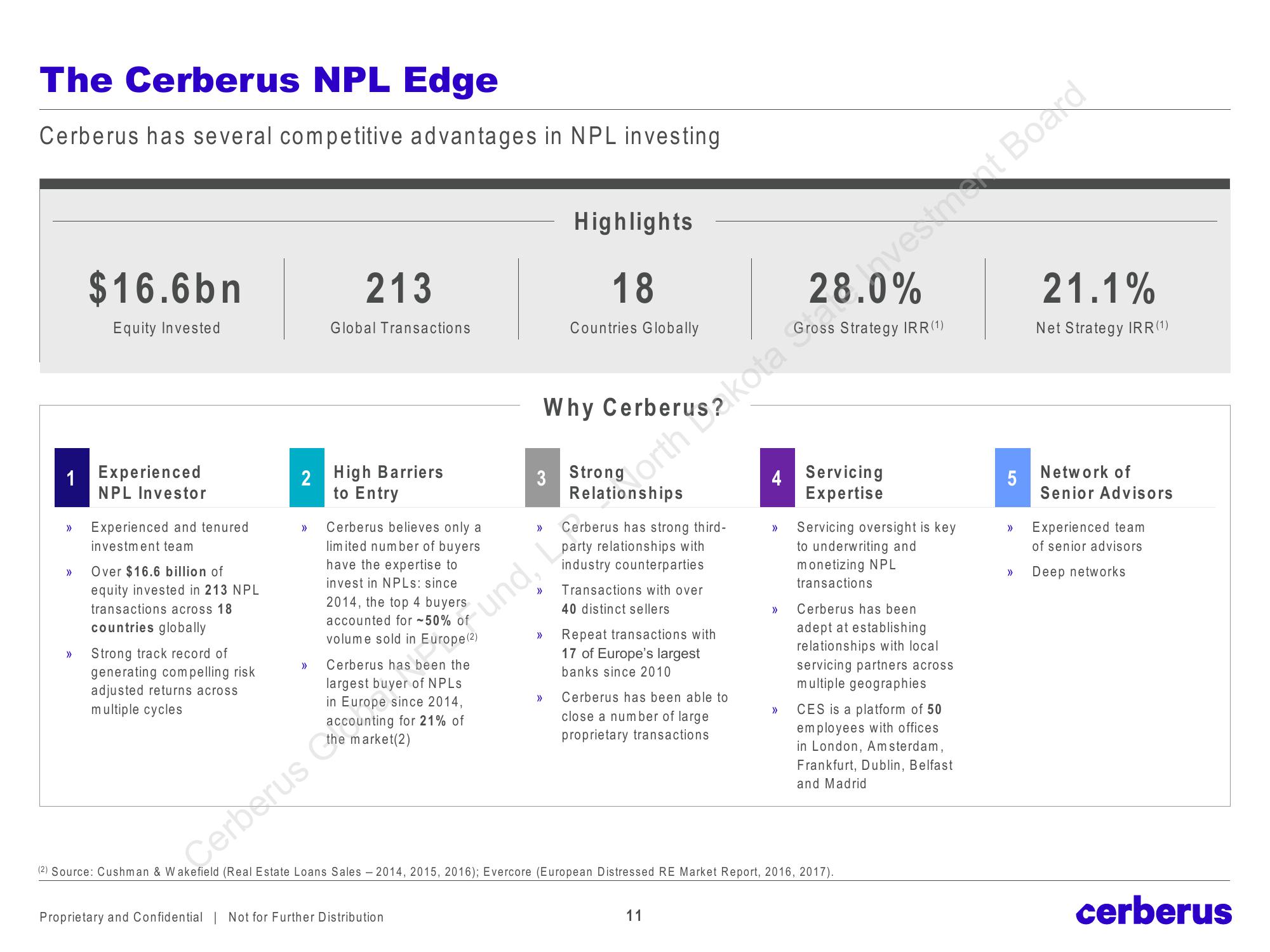

The Cerberus NPL Edge

Cerberus has several competitive advantages in NPL investing

1

>>

$16.6bn

Equity Invested

>>> Experienced and tenured

investment team

>>>

Experienced

NPL Investor

Over $16.6 billion of

equity invested in 213 NPL

transactions across 18.

countries globally

Strong track record of

generating compelling risk

adjusted returns across

multiple cycles

>>>

2 High Barriers

to Entry

>>>

213

Global Transactions

Cerberus believes only a

limited number of buyers

have the expertise to

invest in NPLs: since

2014, the top 4 buyers

accounted for ~50% of

volume sold in Europe (2)

Cerberus has been the

largest buyer of NPLs

in Europe since 2014,

accounting for 21% of

the market (2)

A Cerberus

Proprietary and Confidential | Not for Further Distribution

Highlights

18

Countries Globally

und, orth

>>

whyota vestment Board

Cerberus has strong third-

party relationships with

industry counterparties

Transactions with over

40 distinct sellers

Repeat transactions with

17 of Europe's largest

banks since 2010

>> Cerberus has been able to

close a number of large

proprietary transactions

4

11

Strategy IRR (1)

>>>

Servicing

Expertise

>>> Servicing oversight is key

to underwriting and

monetizing NPL

transactions

(2) Source: Cushman & Wakefield (Real Estate Loans Sales - 2014, 2015, 2016); Evercore (European Distressed RE Market Report, 2016, 2017).

Cerberus has been

adept at establishing

relationships with local

servicing partners across

multiple geographies

CES is a platform of 50

employees with offices

in London, Amsterdam,

Frankfurt, Dublin, Belfast

and Madrid

21.1%

Net Strategy IRR (1)

5

Network of

Senior Advisors

>>> Experienced team

of senior advisors

Deep networks

cerberusView entire presentation