Ares US Real Estate Opportunity Fund III

Hotel Experiencing Short-Term Distress With Longer-Term Recovery

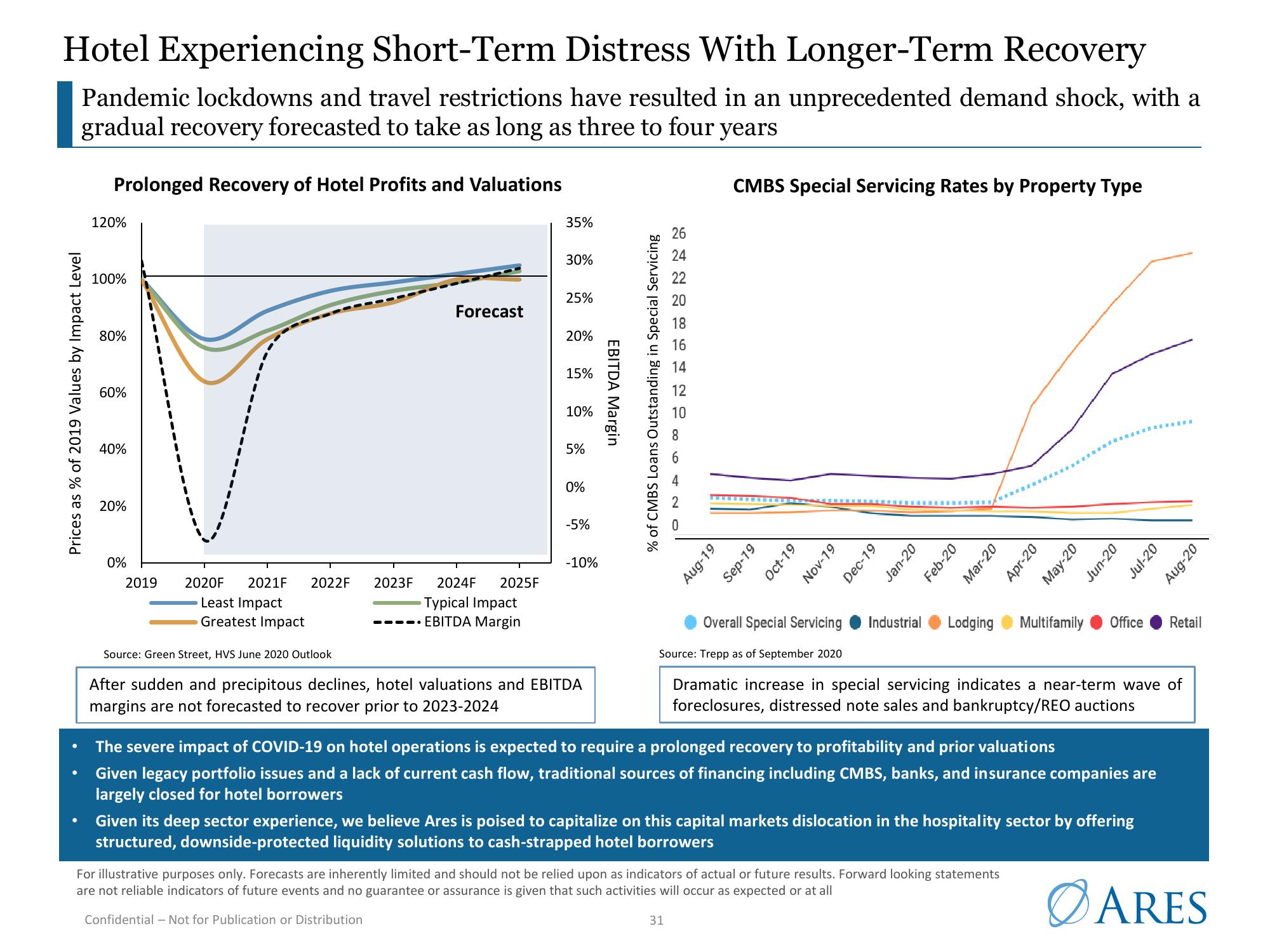

Pandemic lockdowns and travel restrictions have resulted in an unprecedented demand shock, with a

gradual recovery forecasted to take as long as three to four years

Prolonged Recovery of Hotel Profits and Valuations

Prices as % of 2019 Values by Impact Level

●

120%

100%

80%

60%

40%

20%

0%

2019

2020F 2021F

Least Impact

Greatest Impact

2022F 2023F

Source: Green Street, HVS June 2020 Outlook

Forecast

2024F 2025F

Typical Impact

EBITDA Margin

35%

30%

25%

20%

15%

10%

5%

0%

-5%

-10%

After sudden and precipitous declines, hotel valuations and EBITDA

margins are not forecasted to recover prior to 2023-2024

EBITDA Margin

% of CMBS Loans Outstanding in Special Servicing

22228ENND

26

24

20

31

18

16

14

12

Aug-19

CMBS Special Servicing Rates by Property Type

Overall

Sep-19

Oct-19

Nov-19

Special Servicing

Dec-19

Jan-20

Feb-20

Mar-20

Apr-20

May-20

Jun-20

For illustrative purposes only. Forecasts are inherently limited and should not be relied upon as indicators of actual or future results. Forward looking statements

are not reliable indicators of future events and no guarantee or assurance is given that such activities will occur as expected or at all

Confidential - Not for Publication or Distribution

******

Jul-20

Source: Trepp as of September 2020

Dramatic increase in special servicing indicates a near-term wave of

foreclosures, distressed note sales and bankruptcy/REO auctions

Industrial Lodging Multifamily Office Retail

The severe impact of COVID-19 on hotel operations is expected to require a prolonged recovery to profitability and prior valuations

Given legacy portfolio issues and a lack of current cash flow, traditional sources of financing including CMBS, banks, and insurance companies are

largely closed for hotel borrowers

Aug-20

Given its deep sector experience, we believe Ares is poised to capitalize on this capital markets dislocation in the hospitality sector by offering

structured, downside-protected liquidity solutions to cash-strapped hotel borrowers

ARESView entire presentation