MoneyLion SPAC Presentation Deck

FUSION ACQUISITION CORP.

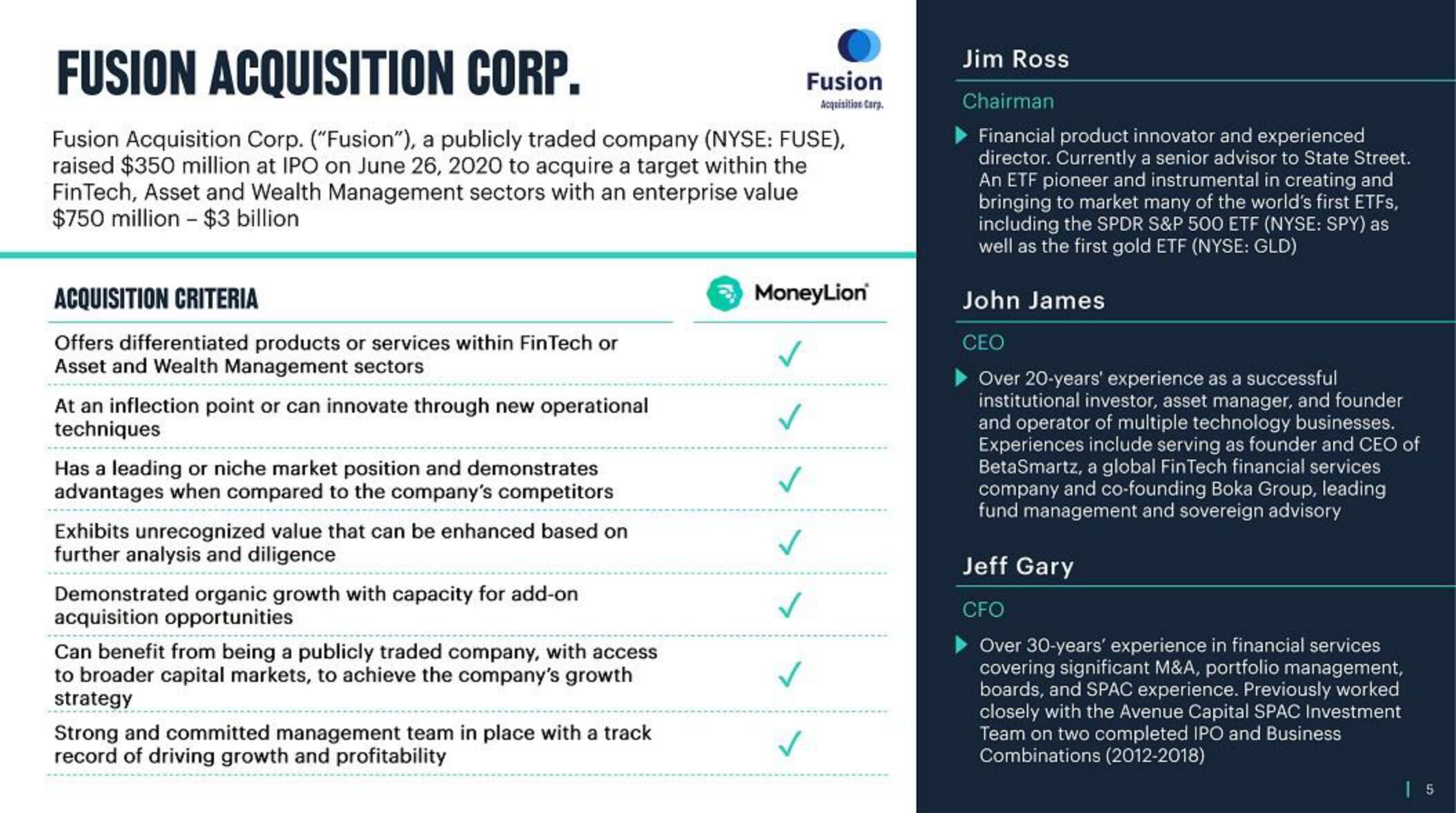

Fusion Acquisition Corp. ("Fusion"), a publicly traded company (NYSE: FUSE),

raised $350 million at IPO on June 26, 2020 to acquire a target within the

FinTech, Asset and Wealth Management sectors with an enterprise value

$750 million $3 billion

ACQUISITION CRITERIA

Offers differentiated products or services within FinTech or

Asset and Wealth Management sectors

At an inflection point or can innovate through new operational

techniques

Has a leading or niche market position and demonstrates

advantages when compared to the company's competitors

Exhibits unrecognized value that can be enhanced based on

further analysis and diligence

Demonstrated organic growth with capacity for add-on

acquisition opportunities

Can benefit from being a publicly traded company, with access

to broader capital markets, to achieve the company's growth

strategy

Strong and committed management team in place with a track

record of driving growth and profitability

MoneyLion

✓

✓

✓

✓

Fusion

Acquisition Corp.

✓

Jim Ross

Chairman

Financial product innovator and experienced

director. Currently a senior advisor to State Street.

An ETF pioneer and instrumental in creating and

bringing to market many of the world's first ETFs,

including the SPDR S&P 500 ETF (NYSE: SPY) as

well as the first gold ETF (NYSE: GLD)

John James

CEO

▸ Over 20-years' experience as a successful

institutional investor, asset manager, and founder

and operator of multiple technology businesses.

Experiences include serving as founder and CEO of

BetaSmartz, a global FinTech financial services

company and co-founding Boka Group, leading

fund management and sovereign advisory

Jeff Gary

CFO

Over 30-years' experience in financial services

covering significant M&A, portfolio management,

boards, and SPAC experience. Previously worked

closely with the Avenue Capital SPAC Investment

Team on two completed IPO and Business

Combinations (2012-2018)

| 5View entire presentation