First Merchants Results Presentation Deck

Nonperforming Assets

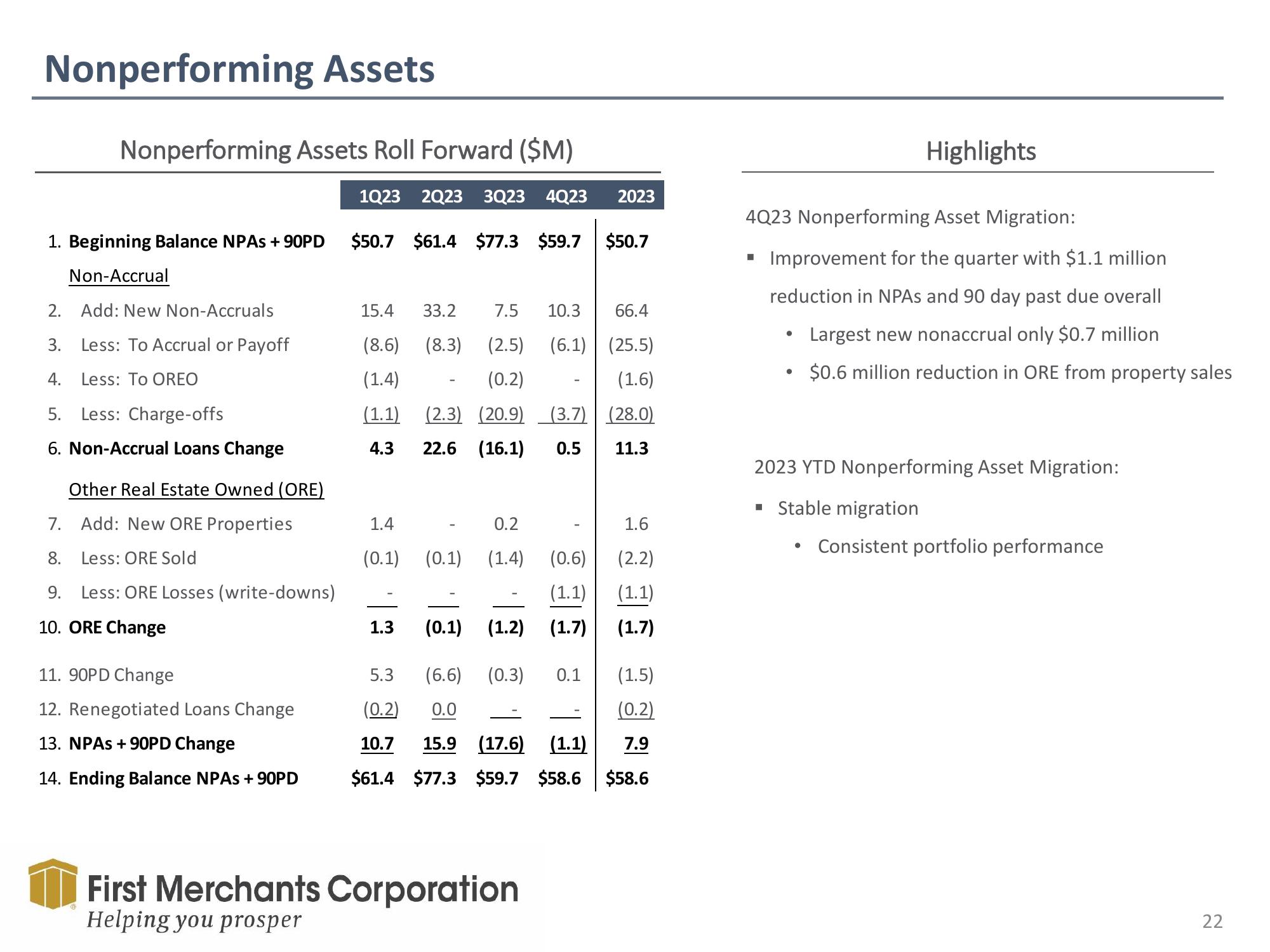

Nonperforming Assets Roll Forward ($M)

1. Beginning Balance NPAs +90PD

Non-Accrual

2. Add: New Non-Accruals

3.

Less: To Accrual or Payoff

4. Less: To OREO

5. Less: Charge-offs

6. Non-Accrual Loans Change

Other Real Estate Owned (ORE)

7. Add: New ORE Properties

8.

Less: ORE Sold

9. Less: ORE Losses (write-downs)

10. ORE Change

11. 90PD Change

12. Renegotiated Loans Change

13. NPAS +90PD Change

14. Ending Balance NPAS + 90PD

1Q23 2Q23 3Q23 4Q23 2023

$50.7 $61.4 $77.3 $59.7 $50.7

15.4

33.2 7.5 10.3 66.4

(8.6) (8.3) (2.5) (6.1) (25.5)

(0.2)

(1.4)

(1.6)

(1.1)

(2.3) (20.9) (3.7)| (28.0)

4.3

22.6 (16.1) 0.5 11.3

1.4

0.2

(0.1) (0.1) (1.4)

1.3

(0.6)

(1.1)

(0.1) (1.2) (1.7)

(6.6) (0.3) 0.1

0.0

1.6

(2.2)

(1.1)

(1.7)

First Merchants Corporation

Helping you prosper

5.3

(0.2)

10.7 15.9 (17.6) (1.1)

$61.4 $77.3 $59.7 $58.6 $58.6

(1.5)

(0.2)

7.9

Highlights

4Q23 Nonperforming Asset Migration:

■ Improvement for the quarter with $1.1 million

reduction in NPAs and 90 day past due overall

Largest new nonaccrual only $0.7 million

• $0.6 million reduction in ORE from property sales

●

2023 YTD Nonperforming Asset Migration:

▪ Stable migration

Consistent portfolio performance

22View entire presentation