Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

150

PERFORMANCE

FY19

368

20 | Barclays Q4 2021 Results | 23 February 2022

ASSET QUALITY

FY20

CAPITAL

& LEVERAGE

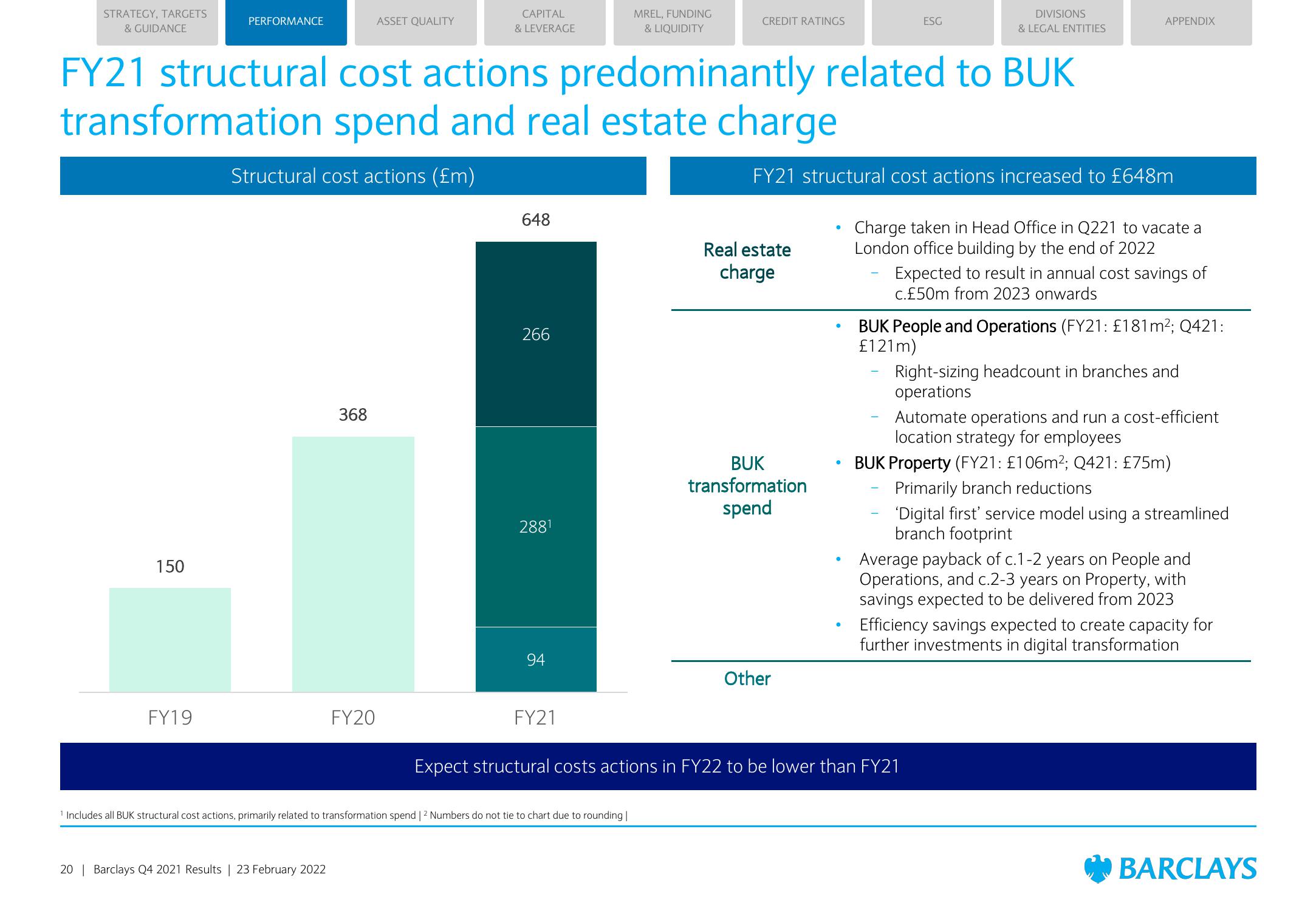

FY21 structural cost actions predominantly related to BUK

transformation spend and real estate charge

Structural cost actions (£m)

FY21 structural cost actions increased to £648m

648

266

288¹

94

FY21

MREL, FUNDING

& LIQUIDITY

¹ Includes all BUK structural cost actions, primarily related to transformation spend | 2 Numbers do not tie to chart due to rounding |

CREDIT RATINGS

Real estate

charge

BUK

transformation

spend

Other

ESG

DIVISIONS

& LEGAL ENTITIES

APPENDIX

Charge taken in Head Office in Q221 to vacate a

London office building by the end of 2022

Expected to result in annual cost savings of

c.£50m from 2023 onwards

BUK People and Operations (FY21: £181m²; Q421:

£121m)

Right-sizing headcount in branches and

operations

Expect structural costs actions in FY22 to be lower than FY21

Automate operations and run a cost-efficient

location strategy for employees

BUK Property (FY21: £106m²; Q421: £75m)

Primarily branch reductions

'Digital first' service model using a streamlined

branch footprint

Average payback of c.1-2 years on People and

Operations, and c.2-3 years on Property, with

savings expected to be delivered from 2023

Efficiency savings expected to create capacity for

further investments in digital transformation

BARCLAYSView entire presentation