J.P.Morgan 4Q23 Earnings Results

JPMORGAN CHASE & CO.

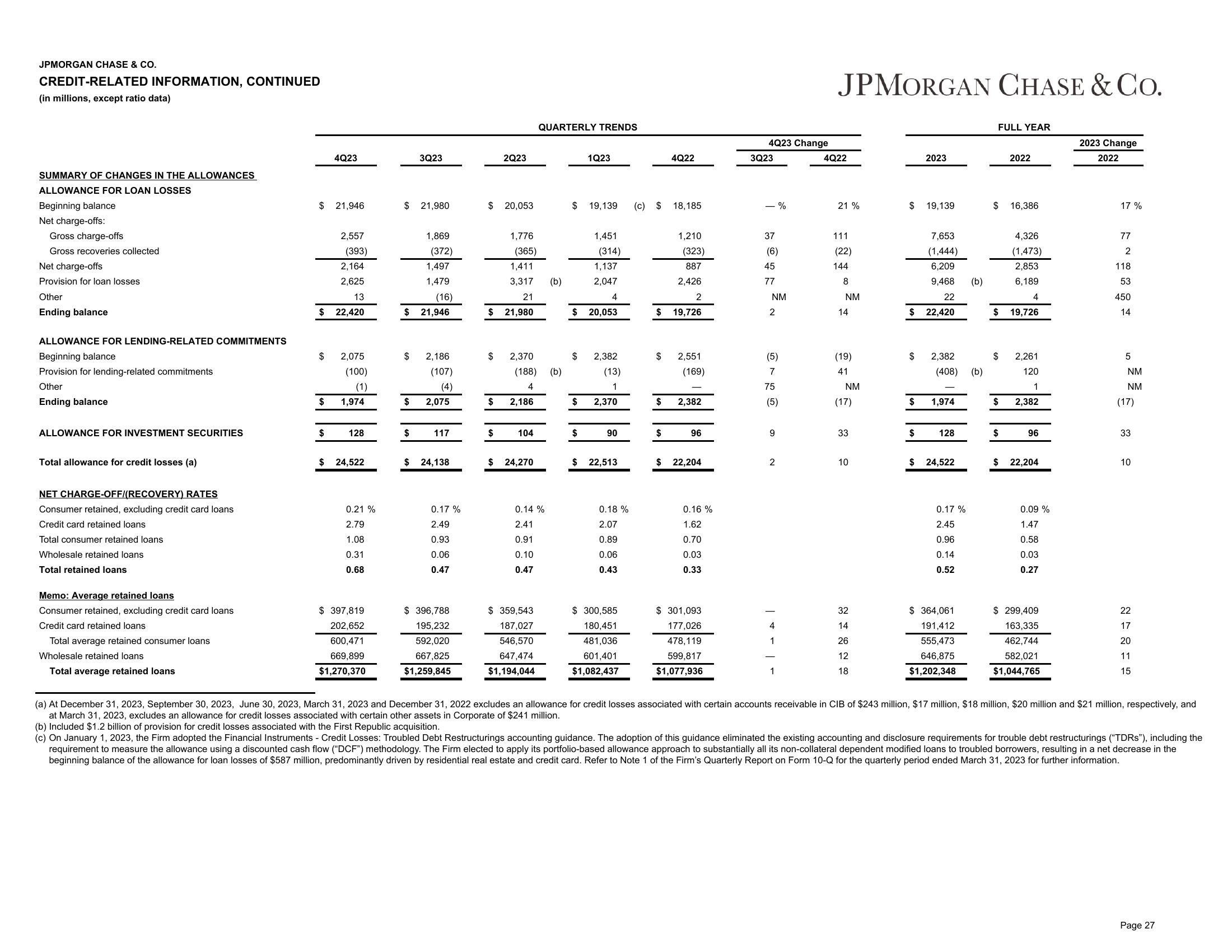

CREDIT-RELATED INFORMATION, CONTINUED

(in millions, except ratio data)

SUMMARY OF CHANGES IN THE ALLOWANCES

ALLOWANCE FOR LOAN LOSSES

Beginning balance

Net charge-offs:

Gross charge-offs

Gross recoveries collected

Net charge-offs

Provision for loan losses

Other

Ending balance

ALLOWANCE FOR LENDING-RELATED COMMITMENTS

Beginning balance

Provision for lending-related commitments

Other

Ending balance

ALLOWANCE FOR INVESTMENT SECURITIES

Total allowance for credit losses (a)

NET CHARGE-OFF/(RECOVERY) RATES

Consumer retained, excluding credit card loans

Credit card retained loans

Total consumer retained loans

Wholesale retained loans

Total retained loans

Memo: Average retained loans

Consumer retained, excluding credit card loans

Credit card retained loans

Total average retained consumer loans

Wholesale retained loans

Total average retained loans

$ 21,946

$

4Q23

$

2,557

(393)

2,164

2,625

13

22,420

$ 2,075

(100)

(1)

$ 1,974

128

$ 24,522

0.21%

2.79

1.08

0.31

0.68

$397,819

202,652

600,471

669,899

$1,270,370

3Q23

$ 21,980

1,869

$

(372)

1,497

1,479

(16)

$ 21,946

$ 2,186

(107)

(4)

$ 2,075

117

$ 24,138

0.17%

2.49

0.93

0.06

0.47

$ 396,788

195,232

592,020

667,825

$1,259,845

$ 20,053

$

$

$

2Q23

$

1,776

(365)

1,411

3,317

21

21,980

104

2,370

(188) (b)

4

2,186

$ 24,270

QUARTERLY TRENDS

0.14%

2.41

0.91

0.10

0.47

$ 359,543

187,027

546,570

647,474

$1,194,044

(b)

$

1Q23

$

19,139 (c) $

$

1,451

1,137

2,047

4

$ 20,053

(314)

$ 2,382

(13)

1

2,370

90

$ 22,513

0.18%

2.07

0.89

0.06

0.43

$ 300,585

180,451

481,036

601,401

$1,082,437

$

$

$

4Q22

18,185

1,210

(323)

887

2,426

2

19,726

2,551

(169)

2,382

96

$ 22,204

0.16%

1.62

0.70

0.03

0.33

$ 301,093

177,026

478,119

599,817

$1,077,936

4Q23 Change

3Q23

- %

37

(6)

45

77

NM

2

(5)

7

75

(5)

9

2

4

1

1

JPMORGAN CHASE & Co.

4Q22

21%

111

(22)

144

8

NM

14

(19)

41

NM

(17)

33

10

32

14

26

12

18

$ 19,139

$

2023

6,209

9,468

22

$ 22,420

$

$

7,653

(1,444)

2,382

(408) (b)

1,974

128

$ 24,522

0.17%

2.45

0.96

0.14

0.52

(b)

$364,061

191,412

555,473

646,875

$1,202,348

FULL YEAR

$

$

$

$

$

$

2022

16,386

4,326

(1,473)

2,853

6,189

4

19,726

2,261

120

1

2,382

96

22,204

0.09 %

1.47

0.58

0.03

0.27

$299,409

163,335

462,744

582,021

$1,044,765

2023 Change

2022

17%

77

2

118

53

450

14

5

NM

NM

(17)

33

10

22

17

20

11

15

(a) At December 31, 2023, September 30, 2023, June 30, 2023, March 31, 2023 and December 31, 2022 excludes an allowance for credit losses associated with certain accounts receivable in CIB of $243 million, $17 million, $18 million, $20 million and $21 million, respectively, and

at March 31, 2023, excludes an allowance for credit losses associated with certain other assets in Corporate of $241 million.

(b) Included $1.2 billion of provision for credit losses associated with the First Republic acquisition.

(c) On January 1, 2023, the Firm adopted the Financial Instruments - Credit Losses: Troubled Debt Restructurings accounting guidance. The adoption of this guidance eliminated the existing accounting and disclosure requirements for trouble debt restructurings ("TDRs"), including the

requirement to measure the allowance using a discounted cash flow ("DCF") methodology. The Firm elected to apply its portfolio-based allowance approach to substantially all its non-collateral dependent modified loans to troubled borrowers, resulting in a net decrease in the

beginning balance of the allowance for loan losses of $587 million, predominantly driven by residential real estate and credit card. Refer to Note 1 of the Firm's Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2023 for further information.

Page 27View entire presentation