KKR Real Estate Finance Trust Investor Presentation Deck

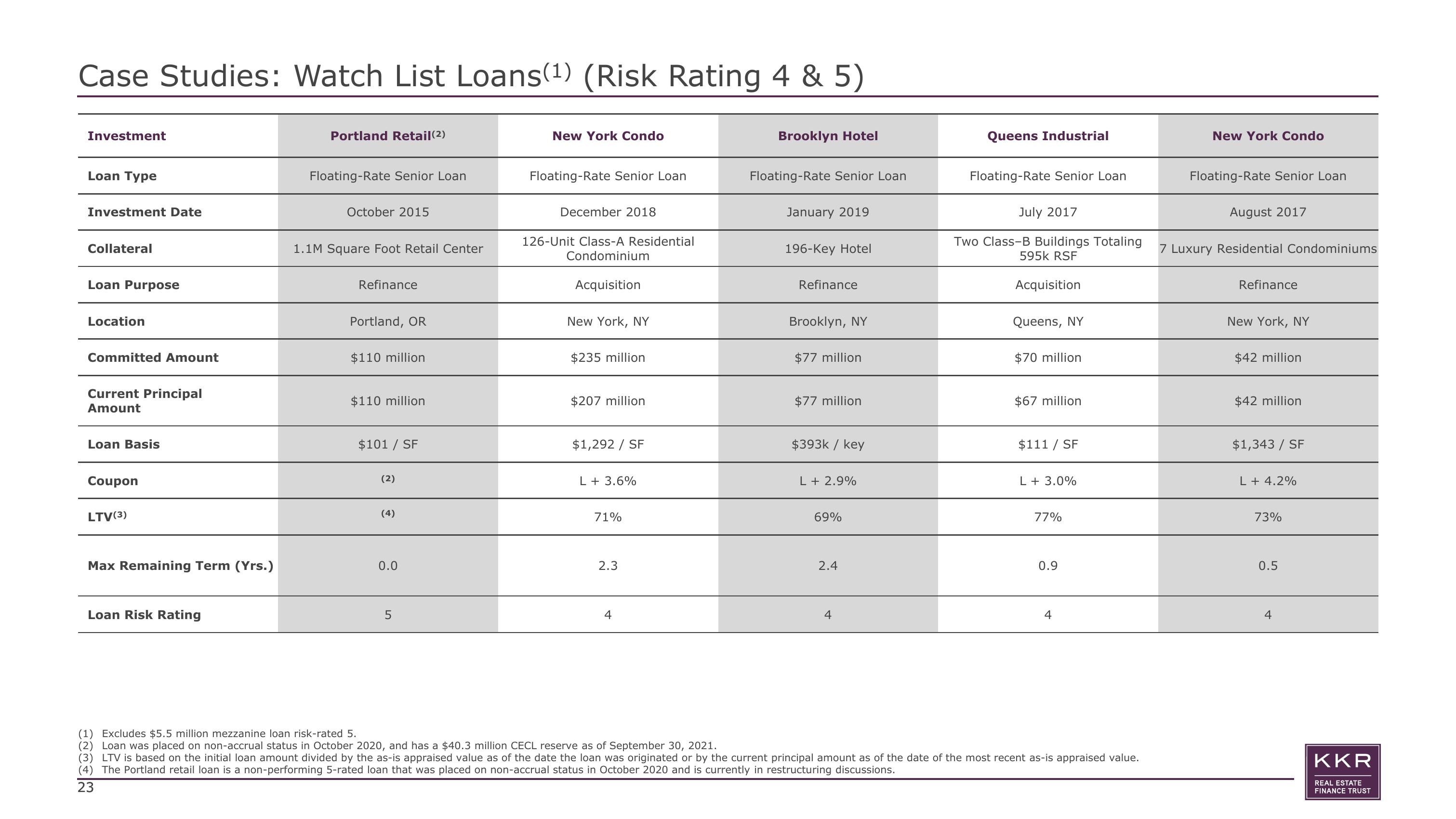

Case Studies: Watch List Loans(¹) (Risk Rating 4 & 5)

Investment

Loan Type

Investment Date

Collateral

Loan Purpose

Location

Committed Amount

Current Principal

Amount

Loan Basis

Coupon

LTV(3)

Max Remaining Term (Yrs.)

Loan Risk Rating

Portland Retail (2)

Floating-Rate Senior Loan

October 2015

1.1M Square Foot Retail Center

Refinance

Portland, OR

$110 million

$110 million

$101 / SF

(2)

(4)

0.0

5

New York Condo

Floating-Rate Senior Loan

December 2018

126-Unit Class-A Residential

Condominium

Acquisition

New York, NY

$235 million

$207 million

$1,292 / SF

L + 3.6%

71%

2.3

4

Brooklyn Hotel

Floating-Rate Senior Loan

January 2019

196-Key Hotel

Refinance

Brooklyn, NY

$77 million

$77 million

$393k / key

L + 2.9%

69%

2.4

4

Queens Industrial

Floating-Rate Senior Loan

July 2017

Two Class-B Buildings Totaling

595k RSF

Acquisition

Queens, NY

$70 million

$67 million

$111 / SF

L + 3.0%

77%

0.9

4

(1) Excludes $5.5 million mezzanine loan risk-rated 5.

(2) Loan was placed on non-accrual status in October 2020, and has a $40.3 million CECL reserve as of September 30, 2021.

(3) LTV is based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated or by the current principal amount as of the date of the most recent as-is appraised value.

(4) The Portland retail loan is a non-performing 5-rated loan that was placed on non-accrual status in October 2020 and is currently in restructuring discussions.

23

New York Condo

Floating-Rate Senior Loan

August 2017

7 Luxury Residential Condominiums

Refinance

New York, NY

$42 million

$42 million

$1,343 / SF

L + 4.2%

73%

0.5

4

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation