Kinnevik Results Presentation Deck

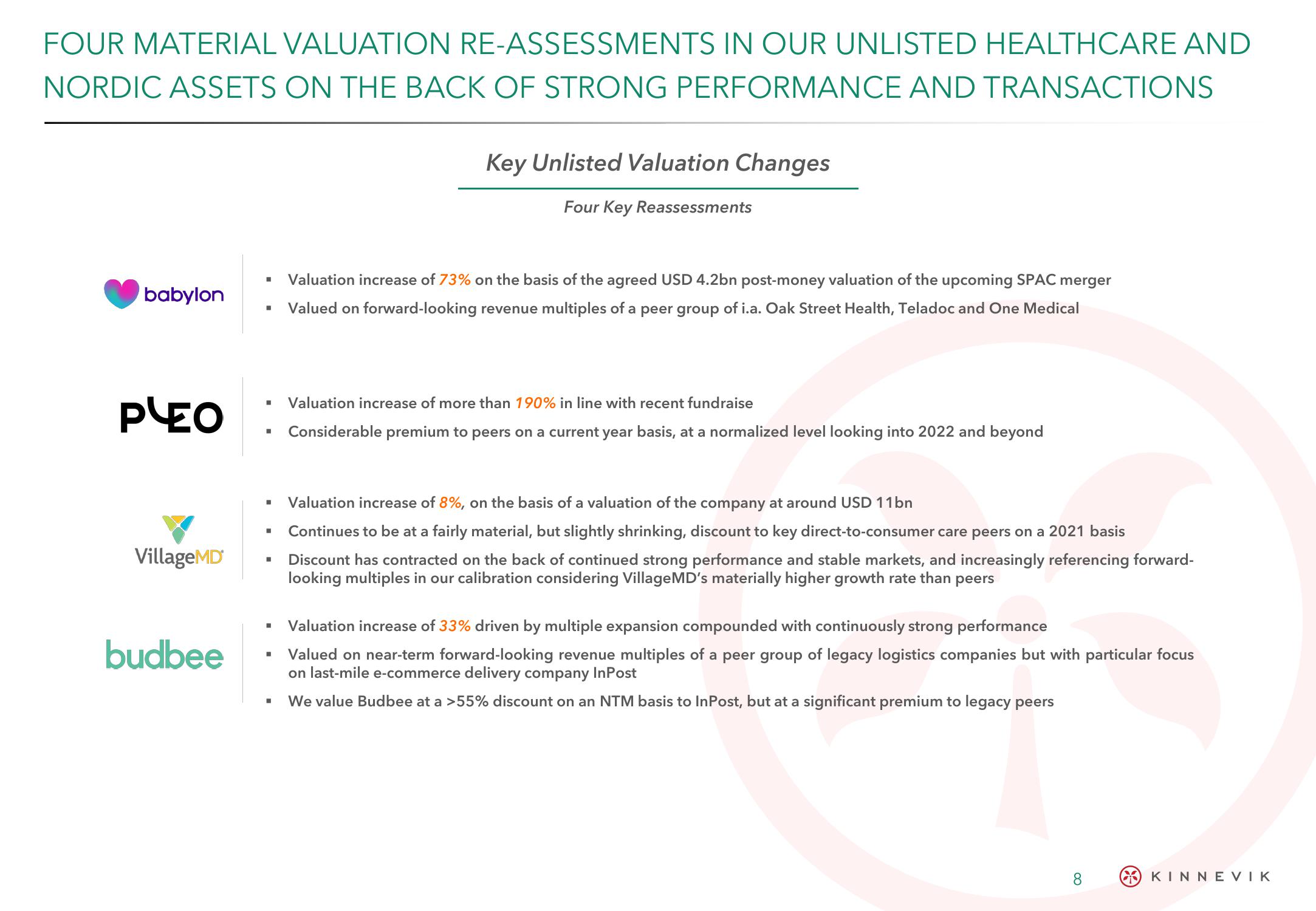

FOUR MATERIAL VALUATION RE-ASSESSMENTS IN OUR UNLISTED HEALTHCARE AND

NORDIC ASSETS ON THE BACK OF STRONG PERFORMANCE AND TRANSACTIONS

babylon

PLEO

VillageMD

budbee

I

■

■ Valuation increase of more than 190% in line with recent fundraise

Considerable premium to peers on a current year basis, at a normalized level looking into 2022 and beyond

■

Key Unlisted Valuation Changes

Four Key Reassessments

■

Valuation increase of 73% on the basis of the agreed USD 4.2bn post-money valuation of the upcoming SPAC merger

Valued on forward-looking revenue multiples of a peer group of i.a. Oak Street Health, Teladoc and One Medical

Valuation increase of 8%, on the basis of a valuation of the company at around USD 11bn

tinues to be at a fairly material, but slightly shrinking, discount to key direct-to-consumer care peers on a 2021 basis

Discount has contracted on the back of continued strong performance and stable markets, and increasingly referencing forward-

looking multiples in our calibration considering Village MD's materially higher growth rate than peers

Valuation increase of 33% driven by multiple expansion compounded with continuously strong performance

Valued on near-term forward-looking revenue multiples of a peer group of legacy logistics companies but with particular focus

on last-mile e-commerce delivery company InPost

We value Budbee at a >55% discount on an NTM basis to InPost, but at a significant premium to legacy peers

8

KINNEVIKView entire presentation