First Busey Results Presentation Deck

2Q23 Earnings Investor Presentation

First Busey Corporation | Ticker: BUSE

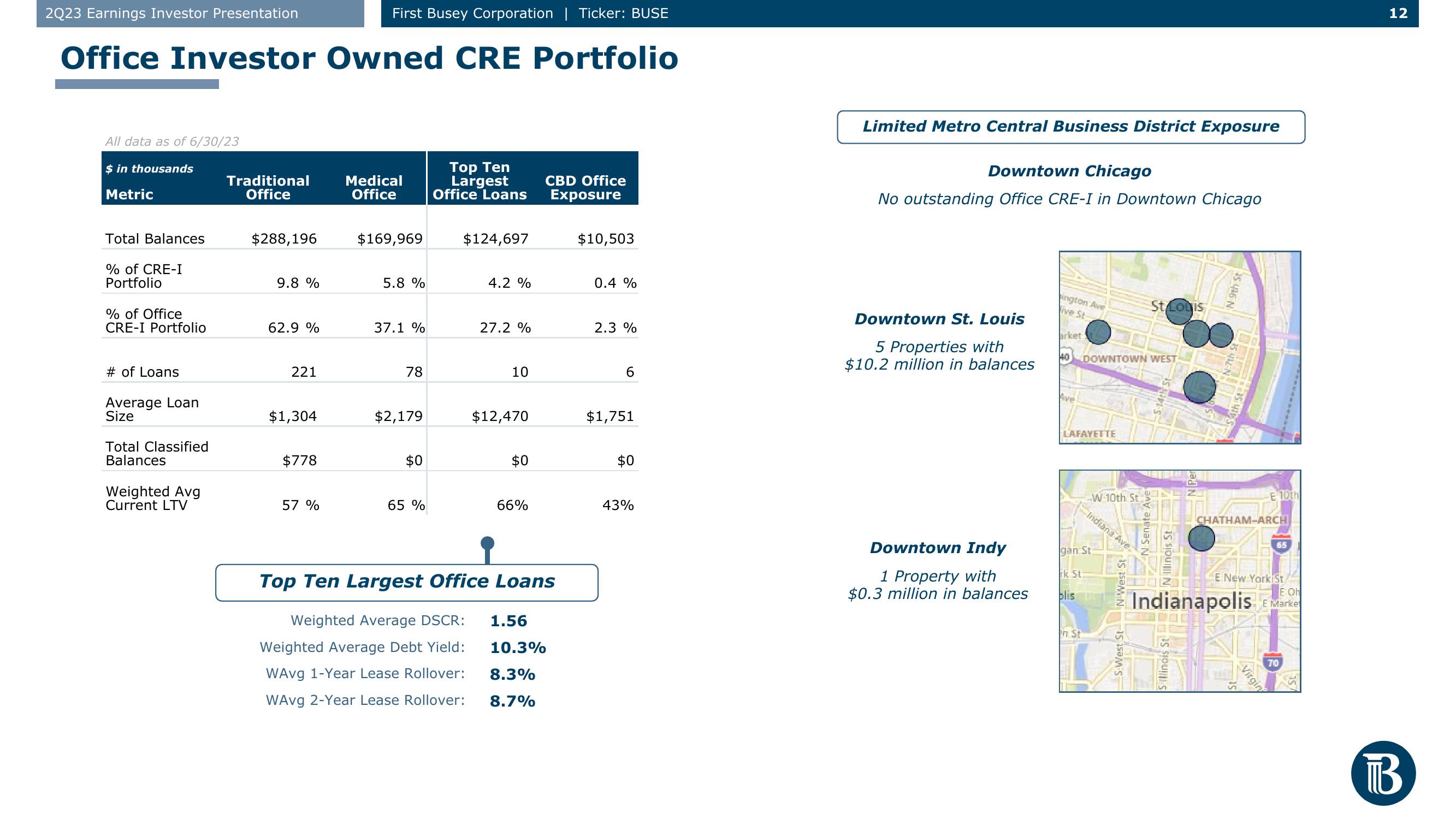

Office Investor Owned CRE Portfolio

All data as of 6/30/23

$ in thousands

Metric

Total Balances

% of CRE-I

Portfolio

% of Office

CRE-I Portfolio

# of Loans

Average Loan

Size

Total Classified

Balances

Weighted Avg

Current LTV

Traditional

Office

$288,196

9.8 %

62.9 %

221

$1,304

$778

57 %

Medical

Office

$169,969

5.8 %

37.1 %

78

$2,179

$0

65 %

Top Ten

Largest

Office Loans

$124,697

4.2 %

Weighted Average Debt Yield:

WAvg 1-Year Lease Rollover:

WAvg 2-Year Lease Rollover:

27.2 %

10

$12,470

$0

66%

CBD Office

Exposure

Top Ten Largest Office Loans

Weighted Average DSCR: 1.56

10.3%

8.3%

8.7%

$10,503

0.4 %

2.3 %

6

$1,751

$0

43%

Limited Metro Central Business District Exposure

Downtown Chicago

No outstanding Office CRE-I in Downtown Chicago

Downtown St. Louis

5 Properties with

$10.2 million in balances

Downtown Indy

1 Property with

$0.3 million in balances

ington Ave

Vive St-

arket

40 DOWNTOWN WEST

Ave

LAFAYETTE

W 10th St

In St

gan St

rk St.

blis p

Indiana Ave.

IN Senate Ave

S-West St N West St

St Louis

N'Illinois St

SIllinois St

N 9th St

CHATHAM-ARCH

E 10th

CALEY

E New York St

E:Oh

Indianapolis Marke

KA

Virgin

710

12

BView entire presentation