Apollo Global Management Investor Day Presentation Deck

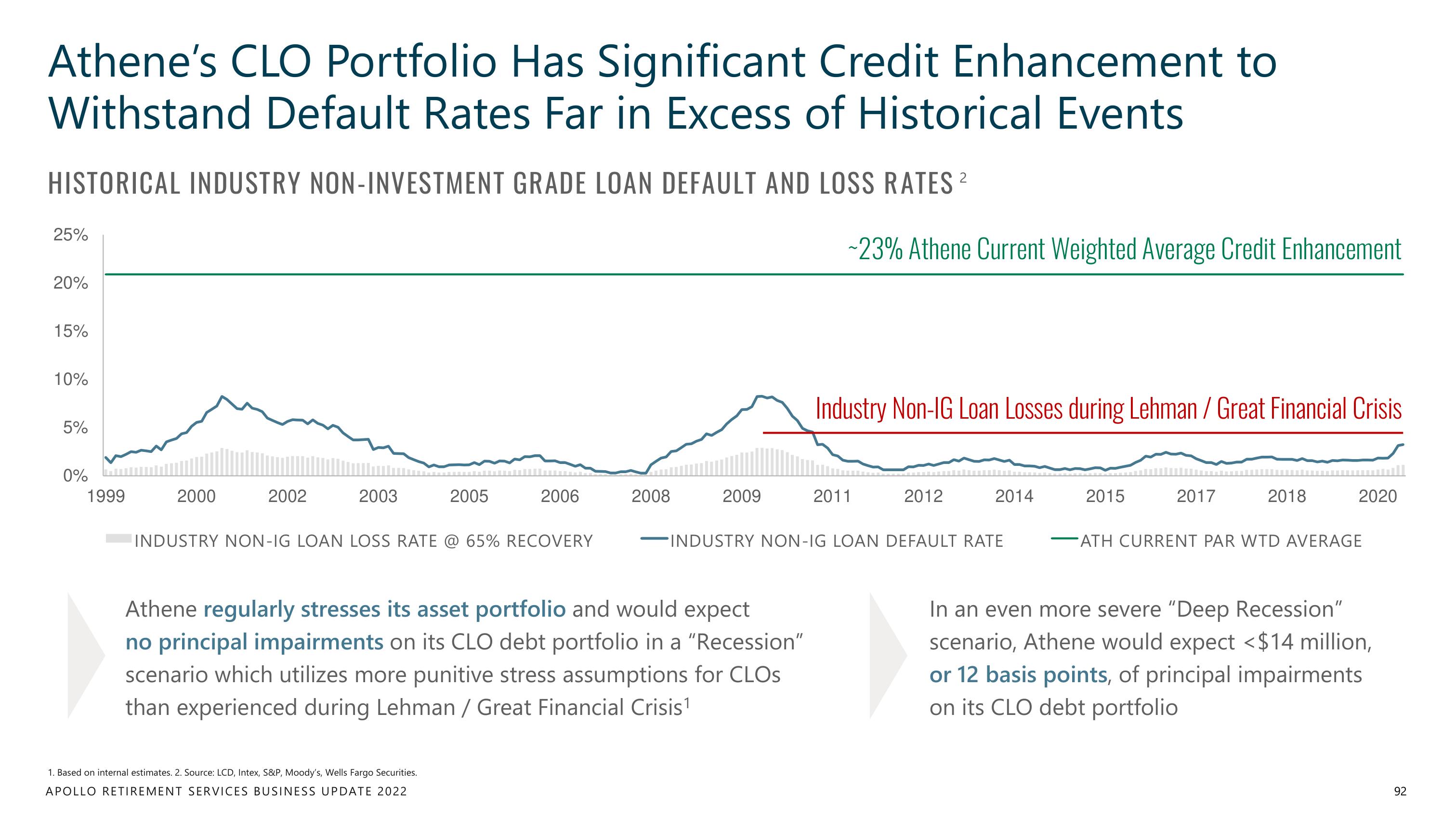

Athene's CLO Portfolio Has Significant Credit Enhancement to

Withstand Default Rates Far in Excess of Historical Events

HISTORICAL INDUSTRY NON-INVESTMENT GRADE LOAN DEFAULT AND LOSS RATES

25%

20%

15%

10%

5%

0%

1999

2000

2002

2003

2005

2006

INDUSTRY NON-IG LOAN LOSS RATE @ 65% RECOVERY

1. Based on internal estimates. 2. Source: LCD, Intex, S&P, Moody's, Wells Fargo Securities.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

2008

2009

Athene regularly stresses its asset portfolio and would expect

no principal impairments on its CLO debt portfolio in a "Recession"

scenario which utilizes more punitive stress assumptions for CLOS

than experienced during Lehman / Great Financial Crisis¹

~23% Athene Current Weighted Average Credit Enhancement

Industry Non-IG Loan Losses during Lehman / Great Financial Crisis

2011

2012

2014

INDUSTRY NON-IG LOAN DEFAULT RATE

2015

2017

2018

2020

ATH CURRENT PAR WTD AVERAGE

In an even more severe "Deep Recession"

scenario, Athene would expect <$14 million,

or 12 basis points, of principal impairments

on its CLO debt portfolio

92View entire presentation