J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

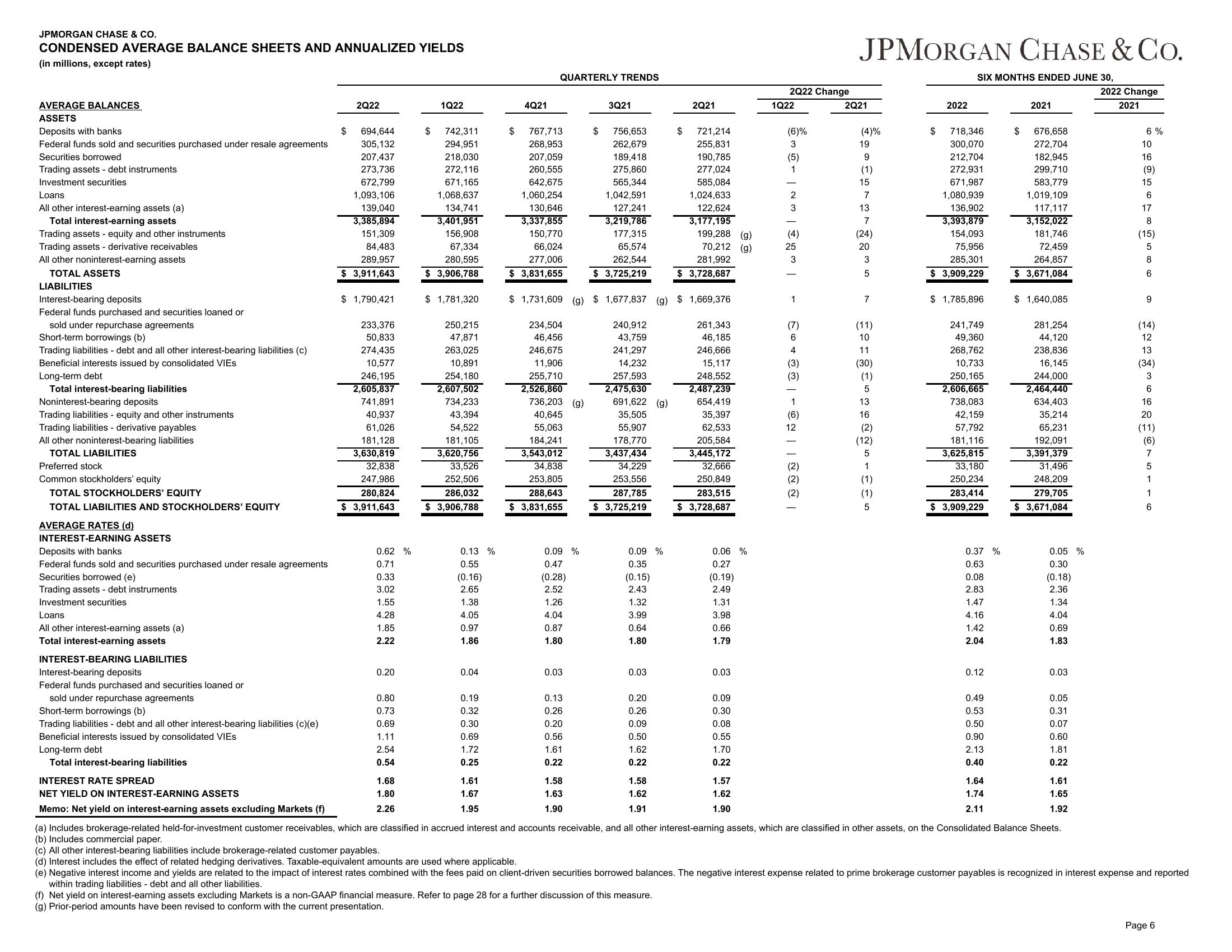

CONDENSED AVERAGE BALANCE SHEETS AND ANNUALIZED YIELDS

(in millions, except rates)

AVERAGE BALANCES

ASSETS

Deposits with banks

Federal funds sold and securities purchased under resale agreements

Securities borrowed

Trading assets - debt instruments

Investment securities

Loans

All other interest-earning assets (a)

Total interest-earning assets

Trading assets - equity and other instruments

Trading assets - derivative receivables

All other noninterest-earning assets

TOTAL ASSETS

LIABILITIES

Interest-bearing deposits

Federal funds purchased and securities loaned or

sold under repurchase agreements

Short-term borrowings (b)

Trading liabilities - debt and all other interest-bearing liabilities (c)

Beneficial interests issued by consolidated VIES

Long-term debt

Total interest-bearing liabilities

Noninterest-bearing deposits

Trading liabilities - equity and other instruments

Trading liabilities - derivative payables

All other noninterest-bearing liabilities

TOTAL LIABILITIES

Preferred stock

Common stockholders' equity

TOTAL STOCKHOLDERS' EQUITY

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

AVERAGE RATES (d)

INTEREST-EARNING ASSETS

Deposits with banks

Federal funds sold and securities purchased under resale agreements

Securities borrowed (e)

Trading assets - debt instruments

Investment securities

Loans

All other interest-earning assets (a)

Total interest-earning assets

INTEREST-BEARING LIABILITIES

Interest-bearing deposits

Federal funds purchased and securities loaned or

sold under repurchase agreements

Short-term borrowings (b)

Trading liabilities - debt and all other interest-bearing liabilities (c)(e)

Beneficial interests issued by consolidated VIES

Long-term debt

Total interest-bearing liabilities

INTEREST RATE SPREAD

NET YIELD ON INTEREST-EARNING ASSETS

Memo: Net yield on interest-earning assets excluding Markets (f)

$

2Q22

694,644

305,132

207,437

273,736

672,799

1,093,106

139,040

3,385,894

151,309

84,483

289,957

$ 3,911,643

$ 1,790,421

233,376

50,833

274,435

10,577

246,195

2,605,837

741,891

40,937

61,026

181,128

3,630,819

32,838

247,986

280,824

$ 3,911,643

0.62 %

0.71

0.33

3.02

1.55

4.28

1.85

2.22

0.20

0.80

0.73

0.69

1.11

2.54

0.54

1.68

1.80

2.26

$

1Q22

742,311

294,951

218,030

272,116

671,165

1,068,637

134,741

3,401,951

156,908

67,334

280,595

$ 3,906,788

$ 1,781,320

250,215

47,871

263,025

10,891

254,180

2,607,502

734,233

43,394

54,522

181,105

3,620,756

33,526

252,506

286,032

$ 3,906,788

0.13 %

0.55

(0.16)

2.65

1.38

4.05

0.97

1.86

0.04

0.19

0.32

0.30

0.69

1.72

0.25

1.61

1.67

1.95

4Q21

QUARTERLY TRENDS

$ 767,713

268,953

207,059

260,555

642,675

1,060,254

130,646

3,337,855

150,770

66,024

277,006

$ 3,831,655

234,504

46,456

246,675

11,906

255,710

2,526,860

736,203 (g)

40,645

55,063

184,241

3,543,012

34,838

253,805

288,643

$ 3,831,655

0.09 %

0.47

(0.28)

2.52

1.26

4.04

0.87

1.80

0.03

0.13

0.26

0.20

0.56

1.61

0.22

$

1.58

1.63

1.90

3Q21

$ 1,731,609 (g) $1,677,837 (g) $ 1,669,376

261,343

46,185

246,666

15,117

248,552

2,487,239

654,419

35,397

62,533

205,584

3,445,172

32,666

250,849

283,515

$ 3,728,687

756,653

262,679

189,418

275,860

565,344

1,042,591

127,241

3,219,786

177,315

65,574

262,544

$ 3,725,219

240,912

43,759

241,297

14,232

257,593

2,475,630

691,622 (g)

35,505

55,907

178,770

3,437,434

34,229

253,556

287,785

$ 3,725,219

0.09 %

0.35

(0.15)

2.43

1.32

3.99

0.64

1.80

0.03

0.20

0.26

0.09

0.50

1.62

0.22

2Q21

1.58

1.62

1.91

$ 721,214

255,831

190,785

277,024

585,084

1,024,633

122,624

3,177,195

199,288 (g)

70,212 (g)

281,992

$ 3,728,687

0.06 %

0.27

(0.19)

2.49

1.31

3.98

0.66

1.79

0.03

0.09

0.30

0.08

0.55

1.70

0.22

1.57

1.62

1.90

2Q22 Change

1Q22

(6)%

3

(5)

1

2

3

(4)

I wo

1

Fo+ | | | |

JPMORGAN CHASE & CO.

SIX MONTHS ENDED JUNE 30,

2Q21

(4)%

19

(1)

15

13

(24)

20

✓

(11)

10

11

(30)

(1)

5

13

16

(2)

(12)

5

1

(1)

(1)

5

$

2022

718,346

300,070

212,704

272,931

671,987

1,080,939

136,902

3,393,879

154,093

75,956

285,301

$ 3,909,229

$ 1,785,896

241,749

49,360

268,762

10,733

250,165

2,606,665

738,083

42,159

57,792

181,116

3,625,815

33,180

250,234

283,414

$ 3,909,229

0.37 %

0.63

0.08

2.83

1.47

4.16

1.42

2.04

0.12

0.49

0.53

0.50

0.90

2.13

0.40

1.64

1.74

2.11

$

2021

676,658

272,704

182,945

299,710

583,779

1,019,109

117,117

3,152,022

181,746

72,459

264,857

$ 3,671,084

$ 1,640,085

281,254

44,120

238,836

16,145

244,000

2,464,440

634,403

35,214

65,231

192,091

3,391,379

31,496

248,209

279,705

$ 3,671,084

0.05 %

0.30

(0.18)

2.36

1.34

4.04

0.69

1.83

0.03

0.05

0.31

0.07

0.60

1.81

0.22

1.61

1.65

1.92

(a) Includes brokerage-related held-for-investment customer receivables, which are classified in accrued interest and accounts receivable, and all other interest-earning assets, which are classified in other assets, on the Consolidated Balance Sheets.

(b) Includes commercial paper.

2022 Change

2021

6%

10

16

(9)

15

ܗ ܐ ܣ ܟ ܗ ܣ ܗ

(15)

9

(14)

12

13

(34)

16

20

(11)

(6)

TATTO

(c) All other interest-bearing liabilities include brokerage-related customer payables.

(d) Interest includes the effect of related hedging derivatives. Taxable-equivalent amounts are used where applicable.

(e) Negative interest income and yields are related to the impact of interest rates combined with the fees paid on client-driven securities borrowed balances. The negative interest expense related to prime brokerage customer payables is recognized in interest expense and reported

within trading liabilities - debt and all other liabilities.

(f) Net yield on interest-earning assets excluding Markets is a non-GAAP financial measure. Refer to page 28 for a further discussion of this measure.

(g) Prior-period amounts have been revised to conform with the current presentation.

Page 6View entire presentation