Investor Presentation

Our Strategy

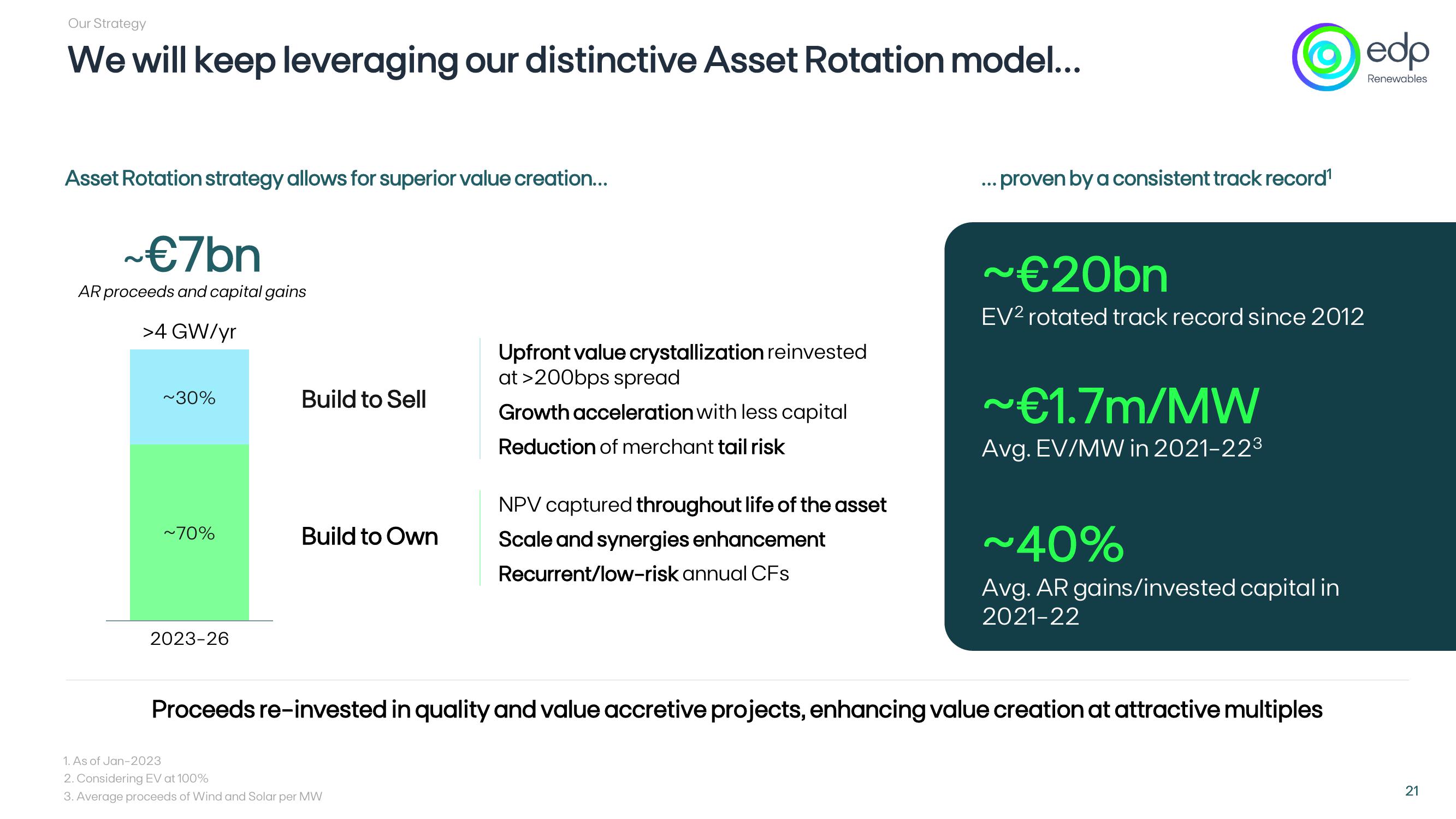

We will keep leveraging our distinctive Asset Rotation model...

Asset Rotation strategy allows for superior value creation...

~€7bn

AR proceeds and capital gains

>4 GW/yr

~30%

Build to Sell

... proven by a consistent track record¹

Upfront value crystallization reinvested

at >200bps spread

Growth acceleration with less capital

Reduction of merchant tail risk

~€20bn

EV² rotated track record since 2012

~€1.7m/MW

Avg. EV/MW in 2021-223

~70%

Build to Own

NPV captured throughout life of the asset

Scale and synergies enhancement

Recurrent/low-risk annual CFs

2023-26

~40%

Avg. AR gains/invested capital in

2021-22

Proceeds re-invested in quality and value accretive projects, enhancing value creation at attractive multiples

1. As of Jan-2023

2. Considering EV at 100%

3. Average proceeds of Wind and Solar per MW

edp

Renewables

21View entire presentation