Massachusetts Water Resources Authority (“MWRA”) Employees’ Retirement System

APPENDIX

Representative Investment

ASML Holding (ASML NA) World's dominant producer of semiconductor lithography machines

ASML is the world's dominant producer of semiconductor lithography machines,

which "project" ever-more complex and miniature circuit patterns onto silicon

wafers, thus effectively sustaining Moore's Law (which states that the number of

components and transistors on a chip should double every two years). Free float is

95%.

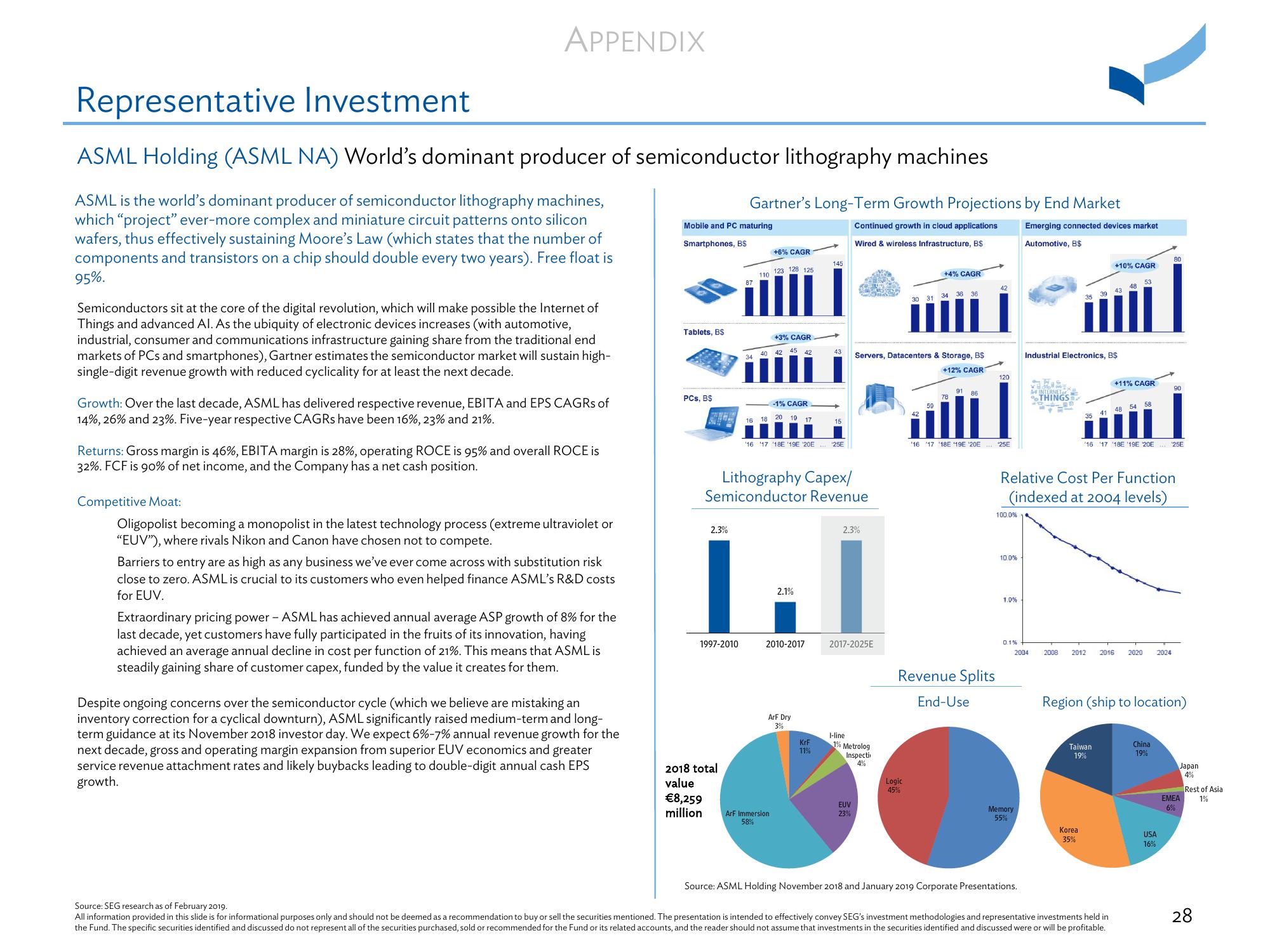

Semiconductors sit at the core of the digital revolution, which will make possible the Internet of

Things and advanced Al. As the ubiquity of electronic devices increases (with automotive,

industrial, consumer and communications infrastructure gaining share from the traditional end

markets of PCs and smartphones), Gartner estimates the semiconductor market will sustain high-

single-digit revenue growth with reduced cyclicality for at least the next decade.

Growth: Over the last decade, ASML has delivered respective revenue, EBITA and EPS CAGRs of

14%, 26% and 23%. Five-year respective CAGRs have been 16%, 23% and 21%.

Returns: Gross margin is 46%, EBITA margin is 28%, operating ROCE is 95% and overall ROCE is

32%. FCF is 90% of net income, and the Company has a net cash position.

Competitive Moat:

Oligopolist becoming a monopolist in the latest technology process (extreme ultraviolet or

"EUV"), where rivals Nikon and Canon have chosen not to compete.

Barriers to entry are as high as any business we've ever come across with substitution risk

close to zero. ASML is crucial to its customers who even helped finance ASML's R&D costs

for EUV.

Extraordinary pricing power - ASML has achieved annual average ASP growth of 8% for the

last decade, yet customers have fully participated in the fruits of its innovation, having

achieved an average annual decline in cost per function of 21%. This means that ASML is

steadily gaining share of customer capex, funded by the value it creates for them.

Despite ongoing concerns over the semiconductor cycle (which we believe are mistaking an

inventory correction for a cyclical downturn), ASML significantly raised medium-term and long-

term guidance at its November 2018 investor day. We expect 6%-7% annual revenue growth for the

next decade, gross and operating margin expansion from superior EUV economics and greater

service revenue attachment rates and likely buybacks leading to double-digit annual cash EPS

growth.

Mobile and PC maturing

Smartphones, B$

Tablets, BS

PCs, B$

FI-2

2.3%

Gartner's Long-Term Growth Projections by End Market

Continued growth in cloud applications

Wired & wireless Infrastructure, B$

1997-2010

2018 total

value

€8,259

million

87

+6% CAGR

110 123 128 125

16 18

+3% CAGR

42 45 42

-1% CAGR

20 19

ArF Immersion

58%

Lithography Capex/

Semiconductor Revenue

2.1%

2010-2017

17

16 17 18E 19E '20E ¹25E

ArF Dry

3%

145

43

KrF

11%

15

2.3%

2017-2025E

I-line

1% Metrolog

Inspecti

4%

EUV

23%

Servers, Datacenters & Storage, B$

+12% CAGR

30 31

+4% CAGR

Logic

45%

34

36

78

91 86

42

Revenue Splits

End-Use

120

16 17 18E 19E '20E 25E

100.0%

10.0%

1.0%

0.1%

Emerging connected devices market

Automotive, B$

Memory

55%

2004

Source: ASML Holding November 2018 and January 2019 Corporate Presentations.

Industrial Electronics, B$

INTERNET

THINGS

Relative Cost Per Function

(indexed at 2004 levels)

35 41

+10% CAGR

53

43 48

Korea

35%

Taiwan

19%

+11% CAGR

48 54 58

16 17 18E 19E 20E ¹25E

2008 2012 2016 2:02:0 2024

Source: SEG research as of February 2019.

All information provided in this slide is for informational purposes only and should not be deemed as a recommendation to buy or sell the securities mentioned. The presentation is intended to effectively convey SEG's investment methodologies and representative investments held in

the Fund. The specific securities identified and discussed do not represent all of the securities purchased, sold or recommended for the Fund or its related accounts, and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Region (ship to location)

90

China

19%

USA

16%

Japan

4%

EMEA

6%

Rest of Asia

1%

28View entire presentation