Evercore Investment Banking Pitch Book

Valuation Analyses

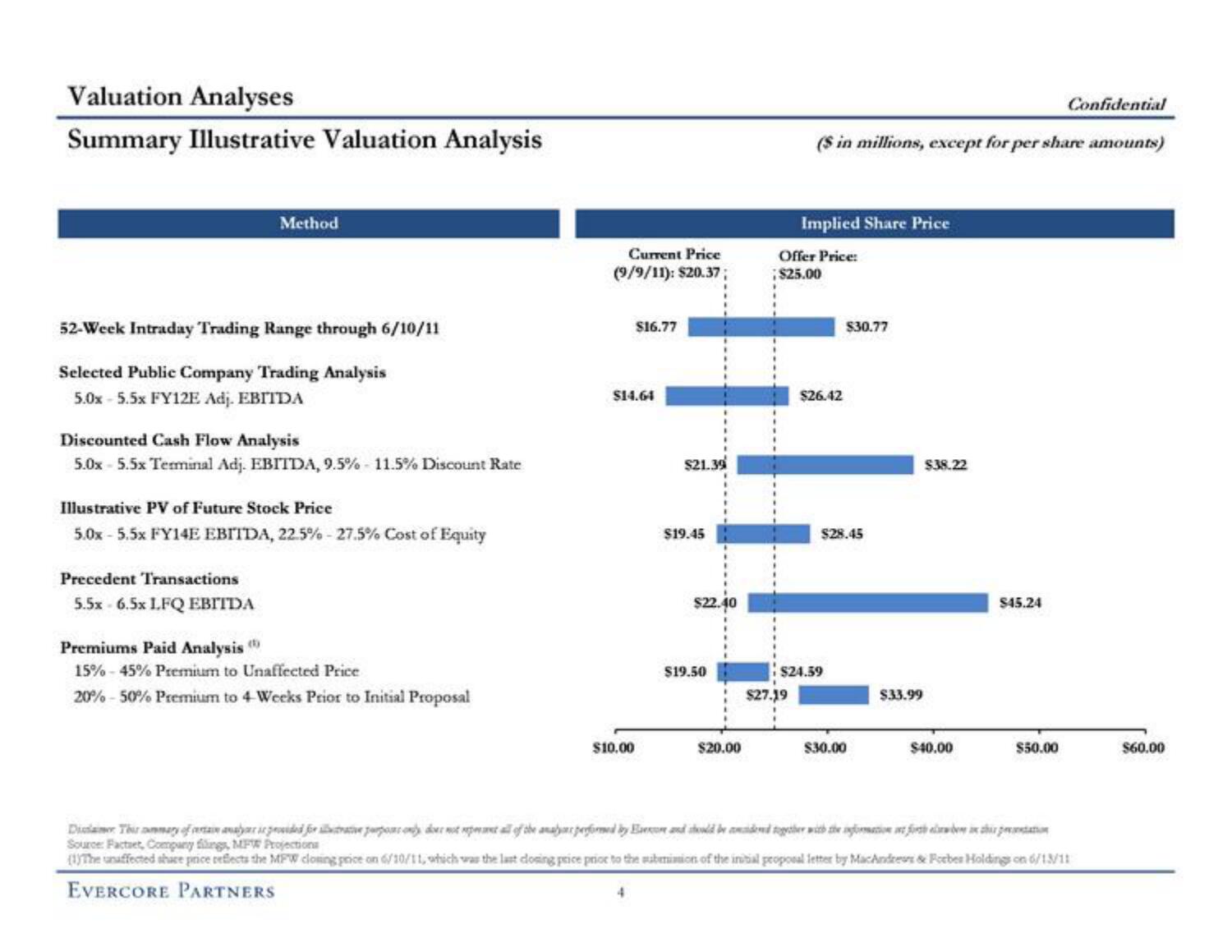

Summary Illustrative Valuation Analysis

Method

52-Week Intraday Trading Range through 6/10/11

Selected Public Company Trading Analysis

5.0x-5.5x FY12E Adj. EBITDA

Discounted Cash Flow Analysis

5.0x-5.5x Terminal Adj. EBITDA, 9.5% -11.5% Discount Rate

Illustrative PV of Future Stock Price

5.0x- 5.5x FY14E EBITDA, 22.5% - 27.5% Cost of Equity

Precedent Transactions

5.5x6.5x LFQ EBITDA

Premium Paid Analysis (

15% -45% Premium to Unaffected Price

20% -50% Premium to 4-Weeks Prior to Initial Proposal

Current Price

(9/9/11): $20.37;

$16.77

$14.64

$10.00

$21.39

$19.45

$22.40

$19.50

$20.00

Confidential

($ in millions, except for per share amounts)

Implied Share Price

Offer Price:

$25.00

$27.19

$26.42

$24.59

$30.77

$28.45

$30.00

$33.99

$38.22

$40.00

$45.24

$50.00

Dua Thurmmary of certain analyour se provided for auctrative purpose only do not put all of the analy performed by Bar and should be add together with the information at forth bench prtation

Source: Factaet, Company filings, MFW Projections

(1)The unaffected share price reflects the MFW closing price on 6/10/11, which was the last closing price prior to the submission of the initial proposal letter by MacAndrews & Forbes Holdings on 6/13/11

EVERCORE PARTNERS

$60.00View entire presentation