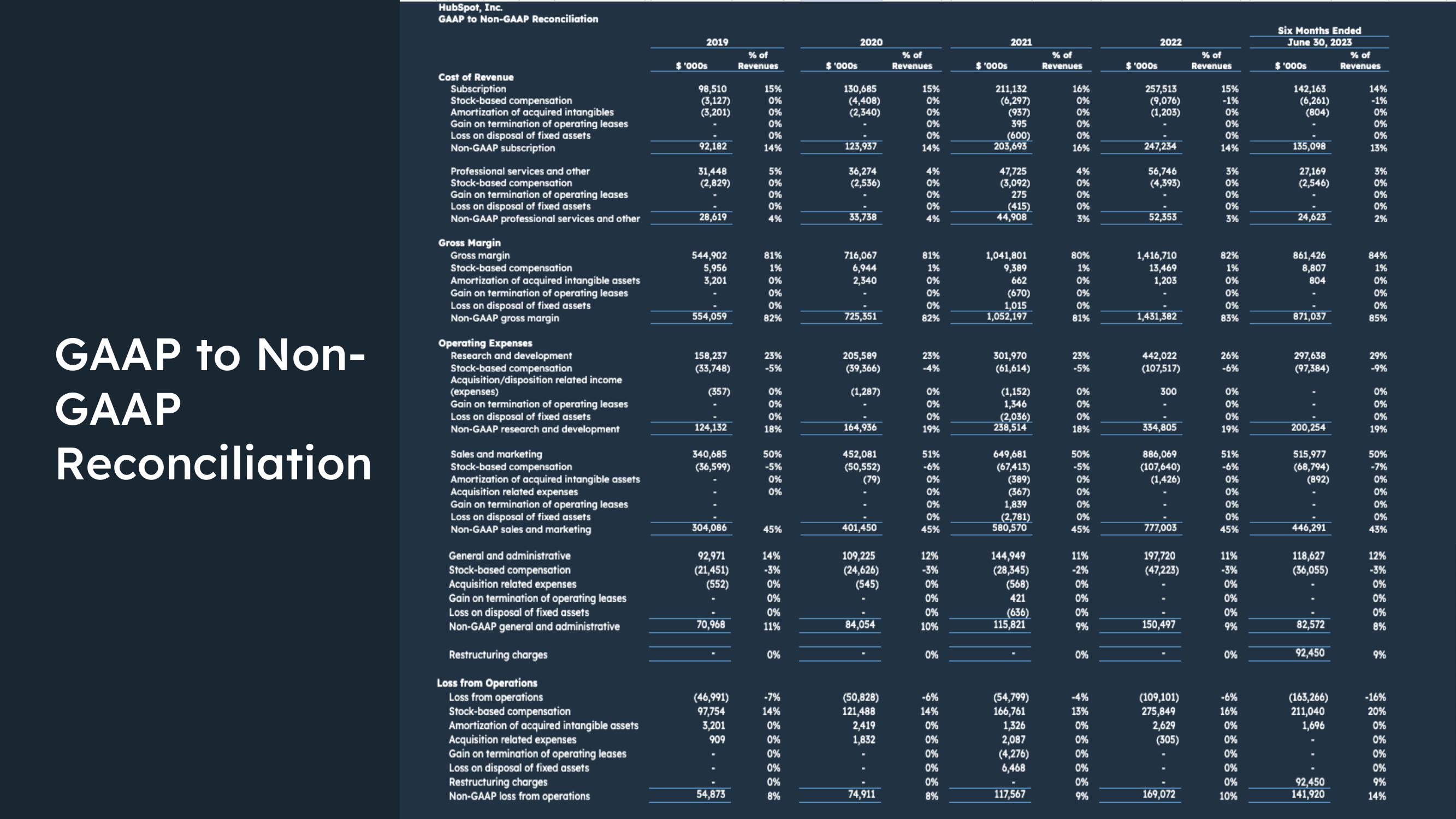

Hubspot Investor Day Presentation Deck

GAAP to Non-

GAAP

Reconciliation

HubSpot, Inc.

GAAP to Non-GAAP Reconciliation

Cost of Revenue

Subscription

Stock-based compensation

Amortization of acquired intangibles

Gain on termination of operating leases

Loss on disposal of fixed assets

Non-GAAP subscription

Professional services and other

Stock-based compensation

Gain on termination of operating leases

Loss on disposal of fixed assets

Non-GAAP professional services and other

Gross Margin

Gross margin

Stock-based compensation

Amortization of acquired intangible assets

Gain on termination of operating leases

Loss on disposal of fixed assets

Non-GAAP gross margin

Operating Expenses

Research and development

Stock-based compensation

Acquisition/disposition related income

(expenses)

Gain on termination of operating leases

Loss on disposal of fixed assets

Non-GAAP research and development

Sales and marketing

Stock-based compensation

Amortization of acquired intangible assets

Acquisition related expenses

Gain on termination of operating leases

Loss on disposal of fixed assets

Non-GAAP sales and marketing

General and administrative

Stock-based compensation

Acquisition related expenses

Gain on termination of operating leases

Loss on disposal of fixed assets

Non-GAAP general and administrative

Restructuring charges

Loss from Operations

Loss from operations

Stock-based compensation

Amortization of acquired intangible assets

Acquisition related expenses

Gain on termination of operating leases

Loss on disposal of fixed assets

Restructuring charges

Non-GAAP loss from operations

2019

$'000s

98,510

(3,127)

(3,201)

92,182

31,448

(2,829)

28,619

544,902

5,956

3,201

554,059

158,237

(33,748)

(357)

124,132

340,685

(36,599)

304,086

92,971

(21,451)

(552)

70,968

(46,991)

97,754

3,201

909

54,873

% of

Revenues

15%

0%

0%

0%

0%

14%

5%

0%

0%

0%

4%

81%

1%

0%

0%

0%

82%

23%

-5%

0%

0%

0%

18%

50%

-5%

0%

0%

45%

14%

-3%

0%

0%

0%

11%

0%

-7%

14%

0%

0%

0%

0%

0%

8%

$'000s

2020

130,685

(4,408)

(2,340)

123,937

36,274

(2,536)

33,738

716,067

6,944

2,340

725,351

205,589

(39,366)

(1,287)

164,936

452,081

(50,552)

(79)

401,450

109,225

(24,626)

(545)

84,054

(50,828)

121,488

2,419

1,832

74,911

% of

Revenues

15%

0%

0%

0%

0%

14%

4%

0%

0%

0%

4%

81%

1%

0%

0%

0%

82%

23%

-4%

0%

0%

0%

19%

51%

-6%

0%

0%

0%

0%

45%

12%

-3%

0%

0%

0%

10%

0%

-6%

14%

0%

0%

0%

0%

0%

8%

$'000s

2021

211,132

(6,297)

(937)

395

(600)

203,693

47,725

(3,092)

275

(415)

44,908

1,041,801

9,389

662

(670)

1,015

1,052,197

301,970

(61,614)

(1,152)

1,346

(2,036)

238,514

649,681

(67,413)

(389)

(367)

1,839

(2,781)

580,570

144,949

(28,345)

(568)

421

(636)

115,821

(54,799)

166,761

1,326

2,087

(4,276)

6,468

117,567

% of

Revenues

16%

0%

0%

0%

0%

16%

4%

0%

0%

0%

3%

80%

1%

0%

0%

0%

81%

23%

-5%

0%

0%

0%

18%

50%

-5%

0%

0%

0%

0%

45%

11%

-2%

0%

0%

0%

9%

0%

-4%

13%

0%

0%

0%

0%

0%

9%

$ '000s

2022

257,513

(9,076)

(1,203)

247,234

56,746

(4,393)

52,353

1,416,710

13,469

1,203

1,431,382

442,022

(107,517)

300

334,805

886,069

(107,640)

(1,426)

777,003

197,720

(47,223)

150,497

(109,101)

275,849

2,629

(305)

169,072

% of

Revenues

15%

-1%

0%

0%

0%

14%

3%

0%

0%

0%

3%

82%

1%

0%

0%

0%

83%

26%

-6%

0%

0%

0%

19%

51%

-6%

0%

0%

0%

0%

45%

11%

-3%

0%

0%

0%

9%

0%

-6%

16%

0%

0%

0%

0%

0%

10%

Six Months Ended

June 30, 2023

$'000s

142,163

(6,261)

(804)

135,098

27,169

(2,546)

24,623

861,426

8,807

804

871,037

297,638

(97,384)

200,254

515,977

(68,794)

(892)

446,291

118,627

(36,055)

82,572

92,450

(163,266)

211,040

1,696

92,450

141,920

% of

Revenues

14%

-1%

0%

0%

0%

13%

3%

0%

0%

0%

2%

84%

1%

0%

0%

0%

85%

29%

-9%

0%

0%

0%

19%

50%

-7%

0%

0%

0%

0%

43%

12%

-3%

0%

0%

0%

8%

9%

-16%

20%

0%

0%

0%

0%

9%

14%View entire presentation