Benson Hill SPAC Presentation Deck

BENSON HILL

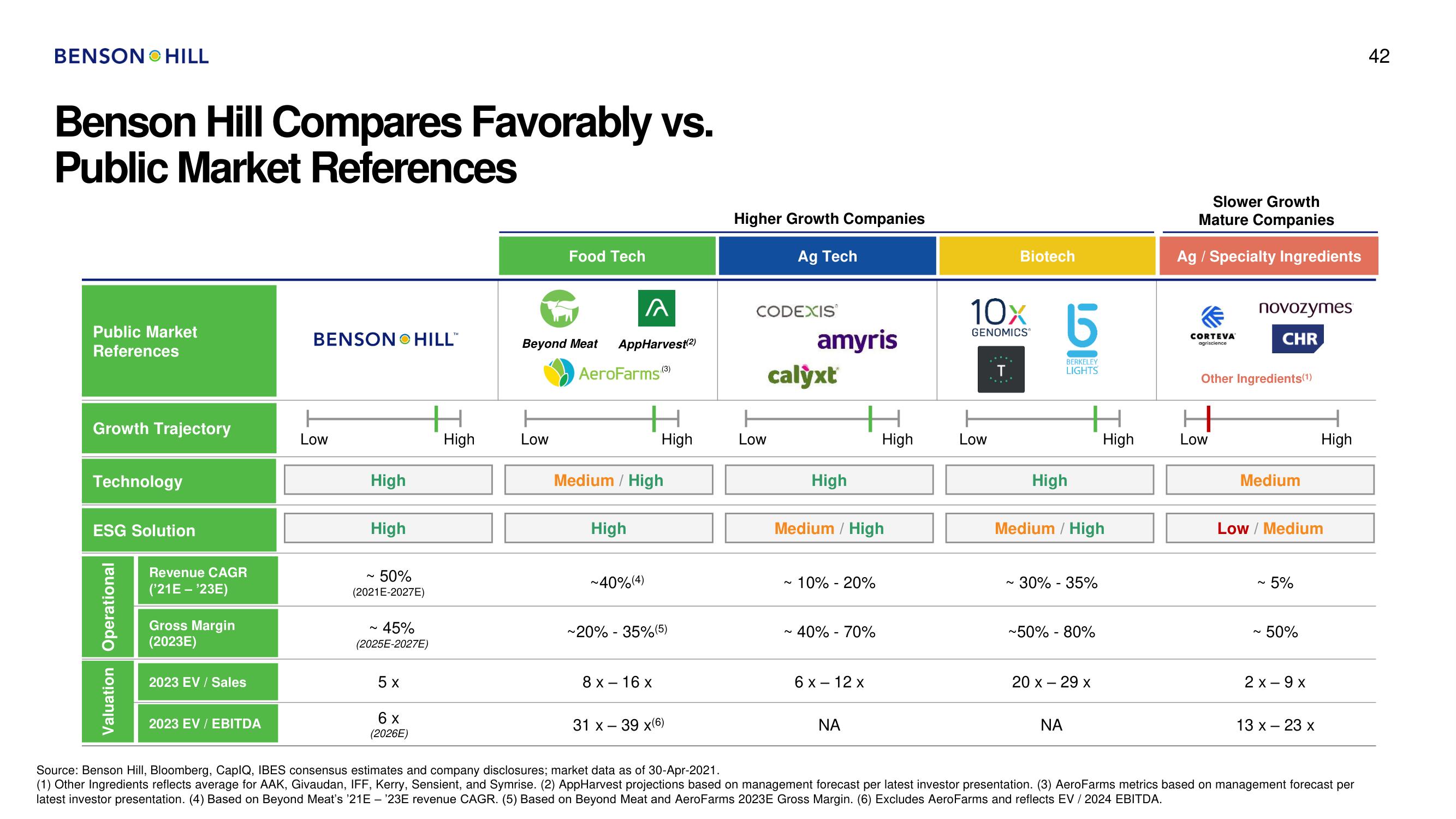

Benson Hill Compares Favorably vs.

Public Market References

Public Market

References

Growth Trajectory

Technology

ESG Solution

Valuation Operational

Revenue CAGR

('21E - '23E)

Gross Margin

(2023E)

2023 EV / Sales

2023 EV / EBITDA

BENSON HILL™

ㅏ

Low

High

High

~ 50%

(2021E-2027E)

~ 45%

(2025E-2027E)

5 x

6 x

(2026E)

High

Food Tech

A

Beyond Meat AppHarvest(2)

AeroFarms (3)

Low

Medium / High

High

~40%(4)

High

~20% -35%(5)

8 x 16 x

31 x 39 x(6)

Higher Growth Companies

Ag Tech

CODEXIS

Low

amyris

calyxt

High

Medium / High

~ 10% - 20%

- 40% - 70%

6 x - 12 x

High

ΝΑ

10x

GENOMICS"

Low

Biotech

T

6

BERKELEY

LIGHTS

High

Medium / High

~ 30% -35%

~50% - 80%

20 x 29 x

ΝΑ

High

Slower Growth

Mature Companies

Ag / Specialty Ingredients

CORTEVA

agriscience

novozymes

CHR

Other Ingredients (1)

Low

Medium

Low / Medium

~ 5%

~ 50%

2x-9x

1

High

13 x 23 x

Source: Benson Hill, Bloomberg, CapIQ, IBES consensus estimates and company disclosures; market data as of 30-Apr-2021.

(1) Other Ingredients reflects average for AAK, Givaudan, IFF, Kerry, Sensient, and Symrise. (2) AppHarvest projections based on management forecast per latest investor presentation. (3) AeroFarms metrics based on management forecast per

latest investor presentation. (4) Based on Beyond Meat's '21E - '23E revenue CAGR. (5) Based on Beyond Meat and AeroFarms 2023E Gross Margin. (6) Excludes AeroFarms and reflects EV / 2024 EBITDA.

42View entire presentation