Antero Midstream Partners Mergers and Acquisitions Presentation Deck

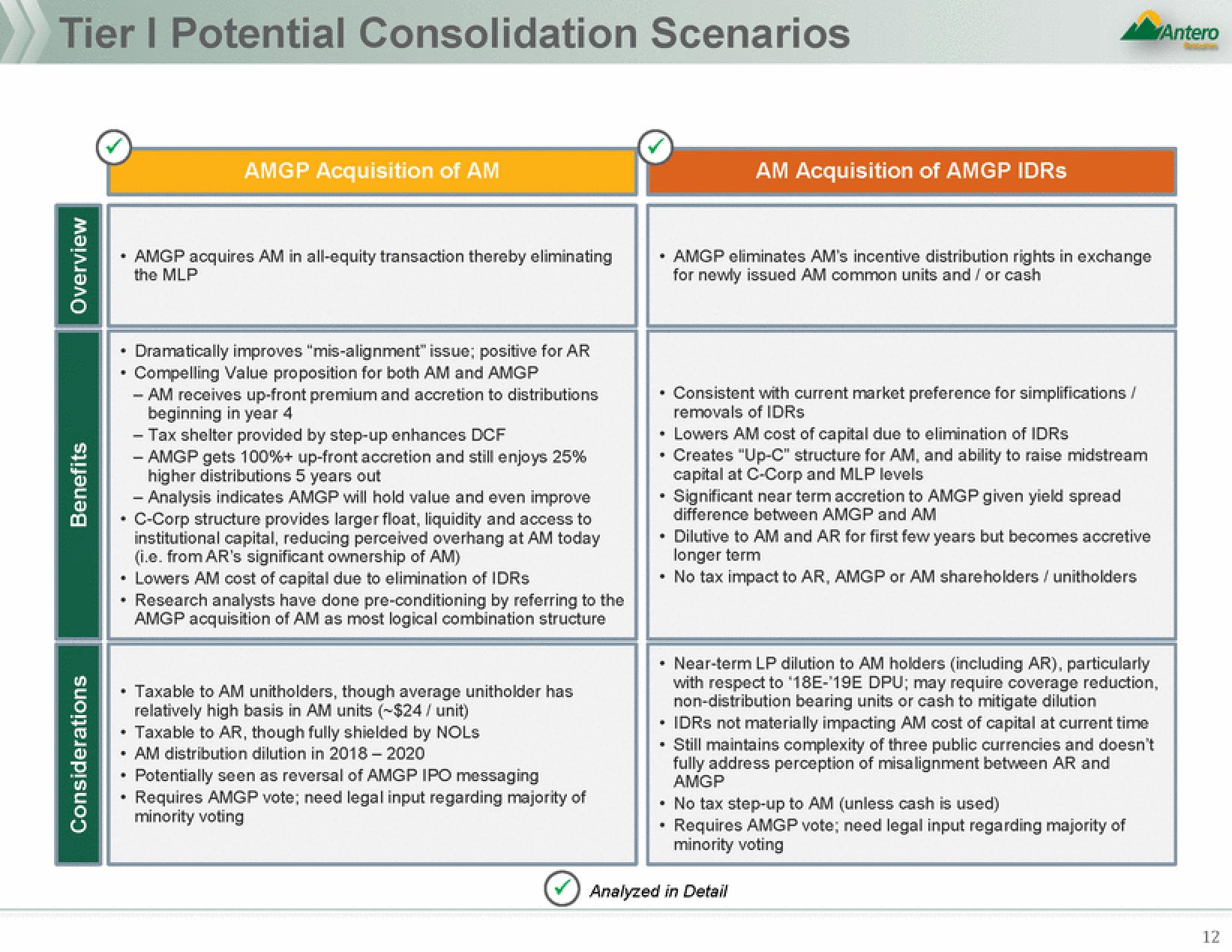

Tier I Potential Consolidation Scenarios

Overview

Benefits

Considerations

♥

.

AMGP Acquisition of AM

AMGP acquires AM in all-equity transaction thereby eliminating

the MLP

.

Dramatically improves "mis-alignment" issue; positive for AR

Compelling Value proposition for both AM and AMGP

- Analysis indicates AMGP will hold value and even improve

C-Corp structure provides larger float, liquidity and access to

institutional capital, reducing perceived overhang at AM today

(i.e. from AR's significant ownership of AM)

* Lowers AM cost of capital due to elimination of IDRs

Research analysts have done pre-conditioning by referring to the

AMGP acquisition of AM as most logical combination structure

■

- AM receives up-front premium and accretion to distributions

beginning in year 4

- Tax shelter provided by step-up enhances DCF

- AMGP gets 100%+ up-front accretion and still enjoys 25%

higher distributions 5 years out

• Taxable to AM unitholders, though average unitholder has

relatively high basis in AM units (-$24/ unit)

Taxable to AR, though fully shielded by NOLS

* AM distribution dilution in 2018-2020

Potentially seen as reversal of AMGP IPO messaging

Requires AMGP vote; need legal input regarding majority of

minority voting

. AMGP eliminates AM's incentive distribution rights in exchange

for newly issued AM common units and / or cash

* Consistent with current market preference for simplifications /

removals of IDRs

-

+

+

AM Acquisition of AMGP IDRS

+

Lowers AM cost of capital due to elimination of IDRs

Creates "Up-C" structure for AM, and ability to raise midstream

capital at C-Corp and MLP levels

Significant near term accretion to AMGP given yield spread

difference between AMGP and AM

Dilutive to AM and AR for first few years but becomes accretive

longer term

* No tax impact to AR, AMGP or AM shareholders / unitholders

* Near-term LP dilution to AM holders (including AR), particularly

with respect to "18E-19E DPU; may require coverage reduction,

non-distribution bearing units or cash to mitigate dilution

* IDRs not materially impacting AM cost of capital at current time

* Still maintains complexity of three public currencies and doesn't

fully address perception of misalignment between AR and

AMGP

* No tax step-up to AM (unless cash is used)

.

Requires AMGP vote; need legal input regarding majority of

minority voting

Analyzed in Detail

Antero

12View entire presentation