Tesla Results Presentation Deck

7

VEHICLE CAPACITY

In Q2, we achieved record production rates across the company. However, we saw a

continuation of manufacturing challenges related to shutdowns, global supply chain

disruptions, labor shortages and logistics and other complications, which limited our

ability to consistently run our factories at full capacity.

US: California and Texas

Our Fremont Factory made a record number of vehicles in Q2. We see opportunities

for further production rate improvements. In Texas, we have added flexibility to

produce vehicles with either a structural battery pack or legacy battery pack. The

next generation of 4680 battery cell machinery has been installed in Texas and is in

the process of commissioning. Factory output in Texas continues to grow.

China: Shanghai

While the Shanghai factory was shut down fully and then partially for the majority of

Q2, we ended the quarter with a record monthly production level. Recent equipment

upgrades will enable us to continue to increase our production rate further.

Europe: Berlin-Brandenburg

Thanks to strong production rate improvement towards the end of Q2, our team in

Germany produced more than 1,000 Model Y vehicles in a single week, using 2170

cells. We expect the production rate to continue improving through the rest of the

year.

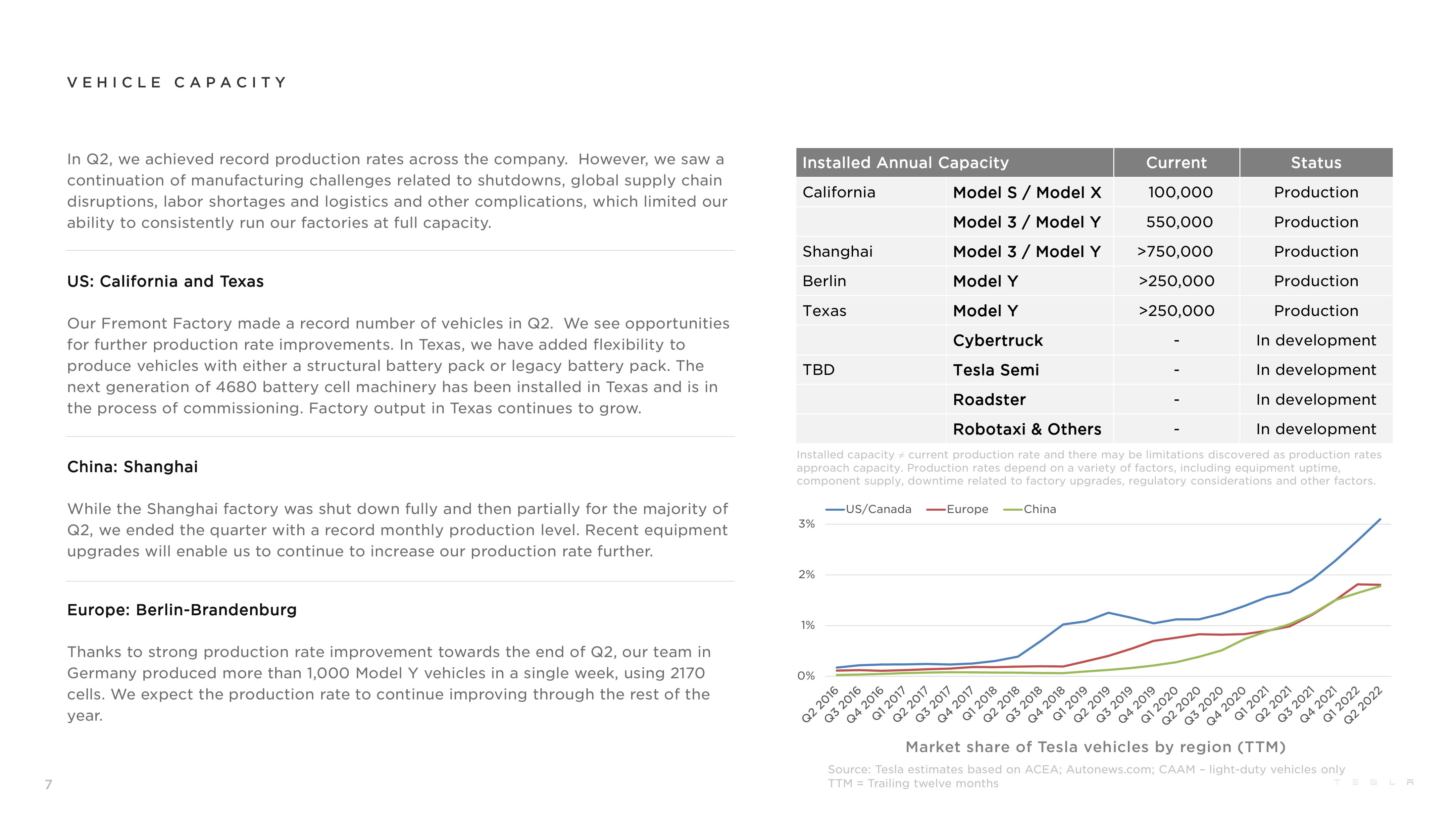

Installed Annual Capacity

California

Status

Production

Model S / Model X

Model 3 / Model Y

Production

Production

Production

Model 3 / Model Y

Model Y

Model Y

Cybertruck

Production

In development

In development

Tesla Semi

Roadster

In development

In development

Robotaxi & Others

Installed capacity current production rate and there may be limitations discovered as production rates

approach capacity. Production rates depend on a variety of factors, including equipment uptime,

component supply, downtime related to factory upgrades, regulatory considerations and other factors.

-US/Canada -Europe -China

Shanghai

Berlin

Texas

TBD

3%

2%

1%

0%

Q2 2016

Q3 2016

Q4 2016

Q1 2017

Q2 2017

Q3 2017

Q4 2017

Q1 2018

Q2 2018

Q4 2018

Q3 2018

Q1 2019

Current

100,000

550,000

>750,000

>250,000

>250,000

Q2 2019

Q3 2019

Q4 2019

Q1 2020

Q2 2020

Q3 2020

Q4 2020

Q1 2021

Q2 2021

Q3 2021

Q4 2021

Q1 2022

Q2 2022

region

(TTM)

Market share of Tesla vehicles by

Tesla estimates based on ACEA; Autonews.com; CAAM - light-duty vehicles only

TTM = Trailing twelve months

Source:

SLAView entire presentation